Rising Three Methods: A Comprehensive Guide

If you are a stock market enthusiast, then you may have heard about Rising Three Methods. Rising three methods is a bullish candlestick pattern that signals a potential continuation in an uptrend. It is a continuation pattern that consists of five candles, with the middle three candles forming an ascending channel. In this blog post, we will explore the rising three methods pattern, how to identify it, and how to trade it.

What is the Rising Three Methods Pattern?

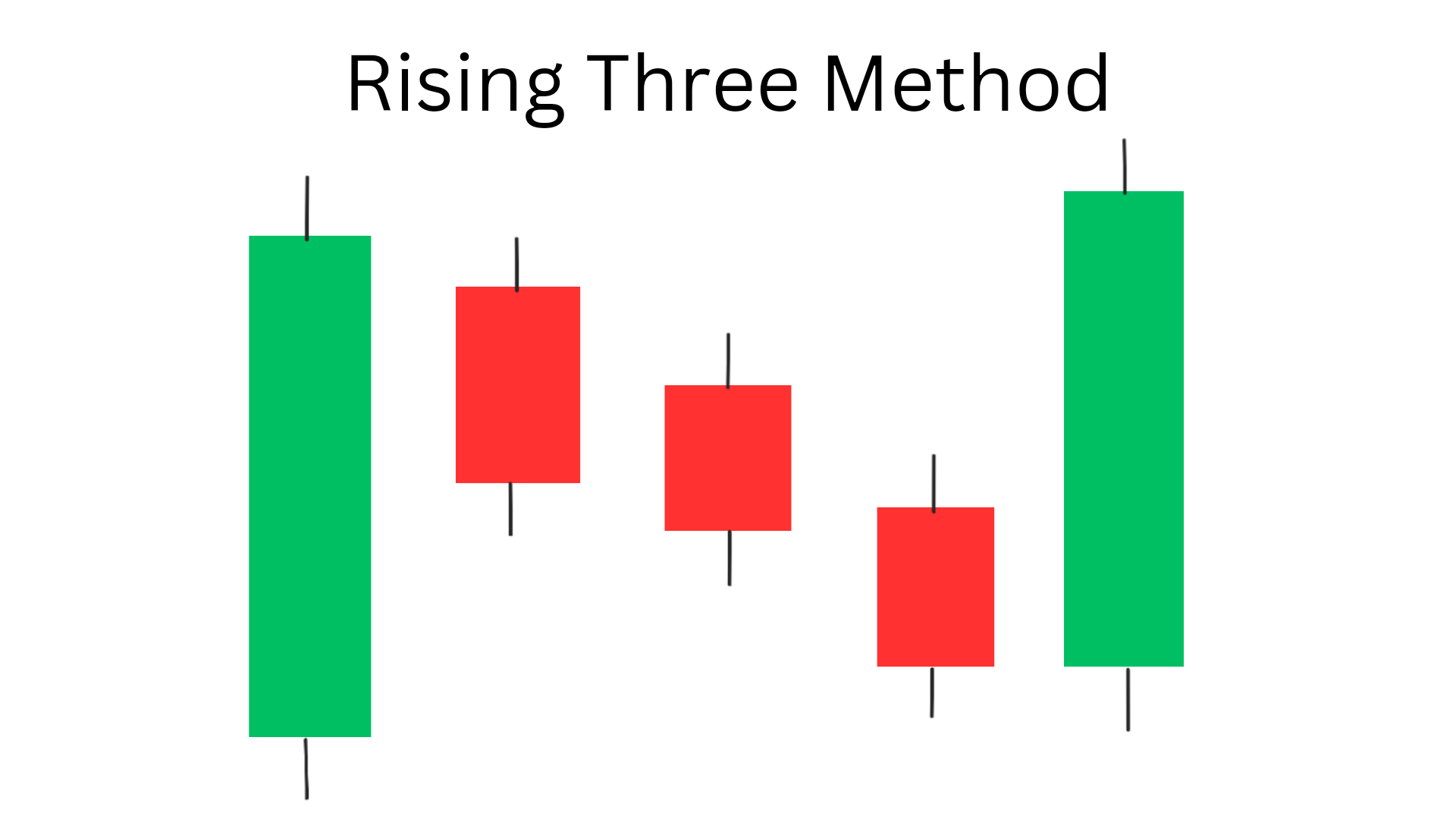

The rising three methods pattern is a five candlestick bullish continuation pattern that occurs during an uptrend. It is formed by five candles, with the middle three candles forming an ascending channel. The 1st candle is a long bullish candle, followed by three small bearish candles that trade within the range of the first candle and then fifth candle is a long bullish candle that closes above the high of the first candle.

The pattern is called “rising three methods” because the middle three candles resemble rising steps or stairs. The pattern indicates that the bulls are in control of the market, and the uptrend may continue.

How to Identify the Rising Three Methods Candlestick Pattern?

To identify the rising three methods pattern, you need to look for the following characteristics:

1. Forms during an uptrend: The pattern occurs during an uptrend, so you need to identify a clear uptrend in the chart.

2. A long bullish candle at 1st position: The first candle should be a long bullish candle that indicates strong buying pressure.

3. Three small bearish candles: The next three candles should be small bearish candles that trade within the range of the first candle. These candles indicate that the bears are trying to push the price down, but they are not yet successful.

4. A long bullish candle at 5th position: The fifth candle should be a long bullish candle that closes above the high of the first candle. This candle indicates that the bulls have taken control of the market, and a potential uptrend may continue.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

How to Trade the Rising Three Methods Pattern?

Once you have identified the rising three methods pattern, you can use it to make trading decisions. Here are some trading strategies you can use:

Entry: Traders can enter a long position when the price breaks above the high of the first bullish candle in the pattern.

Exit: Traders can exit their long position when the price reaches a predetermined target or if a bearish reversal pattern forms or reaches a resistance level. If you want to trade more, you must look for a breakout near the resistance level, if that happens then take another trade upto next significant resistance level.

Stop-loss: Traders can set their stop-loss below the low of the pattern to limit potential losses if the price moves against their position.

General steps to be followed before taking any trade

1. Long position: When you see the rising three methods pattern, you can take a long position. You can enter the trade when the price breaks above the high of the fifth candle. You can place your stop loss below the low of the first candle.

2. Call options: Another way to trade the rising three methods pattern is to buy call options. Call options give you the right to buy an asset at a predetermined price. When you see the pattern, you can buy call options with a strike price above the high of the fifth candle.

3. Wait and watch: If you are not sure about the direction of the market, you can wait and watch. You can wait for the price to break out of the ascending channel before making any trading decisions.

Conclusion

The rising three methods pattern is a bullish continuation pattern that occurs during an uptrend. It signals a potential continuation in the market and a potential uptrend may continue. To identify the pattern, you need to look for an uptrend, a long bullish candle, three small bearish candles, and a long bullish candle. You can use the pattern to make trading decisions such as taking a long position or buying call options.

NOTE: it is important to remember that no trading strategy is foolproof, and you should always use risk management techniques to protect your capital.

Frequently Asked Questions (FAQs)

1.What are the 3 rising methods?

The 3 rising methods is a bullish continuation pattern formed during an uptrend. It consists of 5 candles – 1st long bullish then next three small bearish and 5th candle is a long bullish candle.

2.What is the rising three formation?

The rising three methods is a bullish continuation pattern formed during an uptrend. It consista of 5 candles – 1st long bullish then next three small bearish and 5th candle is a long bullish candle.

3.What is the 3 green candles strategy?

The “3 green candles strategy” is not a commonly used trading term. It is possible that it refers to a strategy where traders look for three consecutive bullish candles as an indication of a potential uptrend, but without more context or information, it is difficult to determine the exact meaning of this term.

4.What is the bullish 3-method?

The bullish 3-method is a bullish continuation candlestick pattern that consists of 5 candles. It has a long bullish candle, followed by 3 small-bodied bearish candle that gaps down, and then a long bullish candle. This pattern indicates that sellers are losing control of the market and that buyers are likely to take over

5.What is the rising method?

The rising method means bullish continuation patter, that can possibly indicate bullish movement whenever formed in a chart.