Falling Three Methods: A Small guide

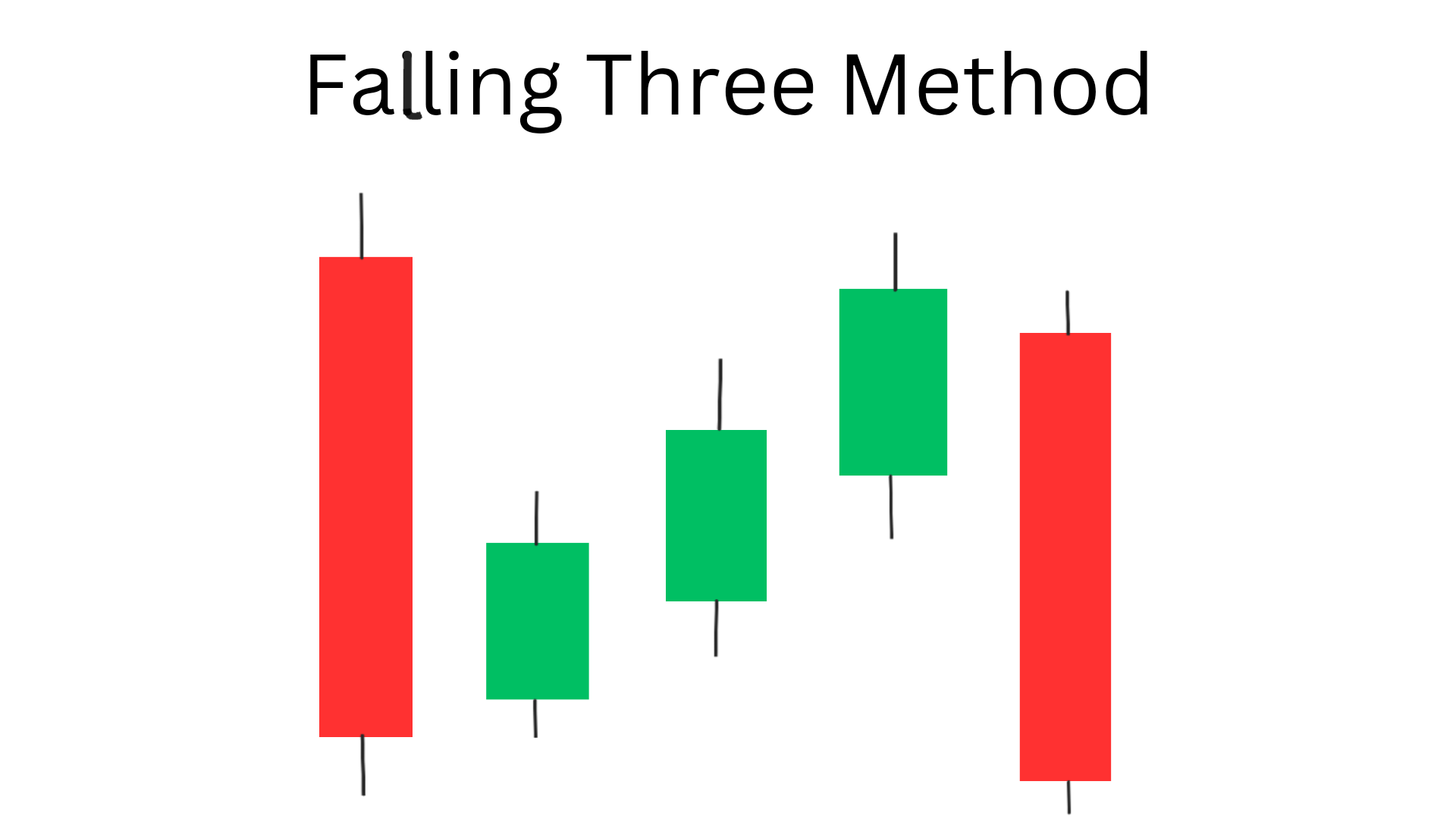

Falling three methods is a bearish candlestick pattern that signals a potential reversal in an downtrend. It is a bearish continuation pattern that consists of five candles, with the 1st and 5th candle as bearish and the remaining three candle are small bullish candle. In this blog post, we will explore the falling three methods pattern, how to identify it, and how to trade it.

What is the Falling Three Methods Pattern?

The falling three methods pattern is a five candlestick bearish continuation pattern that occurs during a downtrend. It is formed by five candles, with the middle three candles forming an ascending move. The first candle is a long bearllish candle, followed by three small bullish candles that trade within the range of the first candle. The fifth candle is a long bearish candle that closes below the low of the first candle.

The pattern is called “falling three methods” because the middle three candles resemble falling steps or stairs. The pattern indicates that the bulls are losing control of the market, and the bears are gaining momentum.

How to Identify the Falling Three Methods Candlestick Pattern?

To identify the falling three methods candlestick, you need to look for the following characteristics:

1. Forms during a downtrend: The pattern occurs during an uptrend, so you need to identify a clear uptrend in the chart.

2. First and 5th candle is long bearish candle: The first and the 5th candle should be a long bearish candle that indicates strong selling pressure. The fifth candle should close below the low of the first candle. This candle indicates that the bears have taken control of the market, and a potential downtrend may be starting.

3. Three small bullish candles: The next three candles should be small bullish candles that trade within the range of the first candle. These candles indicate that the bulls are trying to push the price upward, but they are not yet successful.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

How to Trade the Falling Three Methods Pattern?

Once you have identified the falling three methods pattern, you can use it to make trading decisions. Here are some trading strategies you can use:

Entry: Traders can enter a short position when the price breaks below the low of the first bearish candle in the pattern.

Exit: Traders can exit their short position when the price reaches a predetermined target or if a bullish reversal pattern forms or when it reaches a significant support level. If you want to trade more, you can look for a real breakout at the support level, if it happens then take another trade upto the next significant support level.

Stop-loss: Traders can set their stop-loss above the high of the pattern to limit potential losses if the price moves against their position.

Following are the general steps to be followed before trading

1. Short position: When you see the falling three methods pattern, you can take a short position. You can enter the trade when the price breaks below the low of the fifth candle. You can place your stop loss above the high of the first candle.

2. Put options: Another best way to trade the falling three methods pattern is to buy put options. Put options give you the right to sell an asset at a predetermined price. Suppose initially you have bought some shares, but now the trend is in downwards and then this pattern formed, then it has given you clear hints to sell and exit the trade in order to minimize the loss.

3. Wait and watch: If you are not sure about the direction of the market, you can wait and watch. You can wait for the price to break out of the descending channel before making any trading decisions.

Conclusion

The falling three methods pattern is a bearish continuation pattern that occurs during a downtrend. It signals a potential reversal in the market and a potential downtrend may be starting. To identify the pattern, you need to look for an downtrend, a long bearish candle, then three small bullish candles, and at 5th position a long bearish candle. You can use the pattern to make trading decisions such as taking a short position or buying put options. However, it is important to remember that no trading strategy is foolproof, and you should always use risk management techniques to protect your capital.

Frequently Asked Questions (FAQs)

1.What is rising three methods?

Rising Three Methods is a five candlestick bullish continuation pattern that consists of a long green candlestick, followed by three small red candles that are contained within the range of the first candle, and then a long green candlestick that closes above the high of the first candle.

2.What is a bearish 3 method formation?

Bearish Three Method Formation is a bearish continuation pattern that is the opposite of the rising three methods, consisting of a long red candlestick, followed by three small green candles that are contained within the range of the first candle, and then a long red candlestick that closes below the low of the first candle.

3.What is the 3 green candles strategy?

3 Green Candles Strategy is a bullish pattern where three consecutive green candles appear on a chart, indicating a potential uptrend. Traders can enter a long position after the third green candle and exit when the price reaches a predetermined target or if a bearish reversal pattern forms.

4.What is the three red candle strategy?

Three Red Candle Strategy is a bearish pattern where three consecutive red candles appear on a chart, indicating a potential downtrend. Traders can enter a short position after the third red candle and exit when the price reaches a predetermined target or if a bullish reversal pattern forms.

5.What is the bullish 3 method formation?

Bullish Three Method Formation is a bullish continuation pattern that is similar to the rising three methods, consisting of a long green candlestick, followed by three small red candles that are contained within the range of the first candle, and then another long green candlestick that closes above the high of the first candle.