Bullish Counterattack Pattern

In the world of trading, there are many patterns that traders use to identify potential price movements. One such pattern is the Bullish Counterattack Pattern. This pattern is a reversal pattern that occurs after a downtrend and signals a potential upward movement in the price of an asset. In this blog, we will explore what the Bullish Counterattack is, how it works, and how traders can use it to their advantage.

What is the Bullish Counterattack Pattern?

The Bullish Counterattack Pattern is a two candlestick bullish reversal pattern that occurs after a downtrend. It is characterized by two candlesticks, with the first being a bearish candlestick and the second being a bullish candlestick.

The pattern is named after its resemblance to a counterattack in a battle. In a battle, a counterattack is a sudden and aggressive move made by the defending side in response to an attack by the opposing side. Similarly, in trading, the Bullish Counterattack is a sudden and aggressive move made by buyers in response to selling pressure by sellers.

Key features of bullish counterattack

- A bearish candlestick is followed by a bullish candlestick.

- The bullish candlestick closes above the high of the bearish candlestick.

- Indicates a potential reversal in the price of the asset.

- Buyers have taken control of the market.

- Traders can enter a long position when the bullish candlestick closes above the high of the bearish candlestick.

- Stop-loss order should be placed below the low of the bearish candlestick.

- Exit strategy is to exit the trade when the price reaches a resistance level or when the pattern is invalidated by a bearish candlestick.

How does the Bullish Counterattack Pattern work?

The Bullish Counterattack Pattern works by signaling a change in market sentiment. During a downtrend, sellers are in control of the market and are pushing prices lower. However, when the Bullish Counterattack Pattern forms, it indicates that buyers have entered the market and are pushing prices higher.

The pattern works because it shows that buyers have overwhelmed sellers and have taken control of the market. The bullish candlestick completely engulfs the bearish candlestick, indicating that buyers have completely erased the losses made by sellers in the previous period.

How to identify the Bullish Counterattack Pattern?

To identify the Bullish Counterattack Pattern, traders should look for two candlesticks. The first candlestick should be a bearish candlestick, and the second candlestick should be a bullish candlestick that completely engulfs the bearish candlestick.

Traders should also look for other indicators that confirm the pattern, such as an increase in trading volume and a break above a key resistance level. These indicators can provide further confirmation that the pattern is valid and that a potential reversal in the price of the asset is likely.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

How to trade Bullish Counterattack Pattern?

Traders can use the Bullish Counterattack Pattern to their advantage by entering long positions after the pattern has formed. Long positions involve buying a share with the expectation that its price will increase in the future.

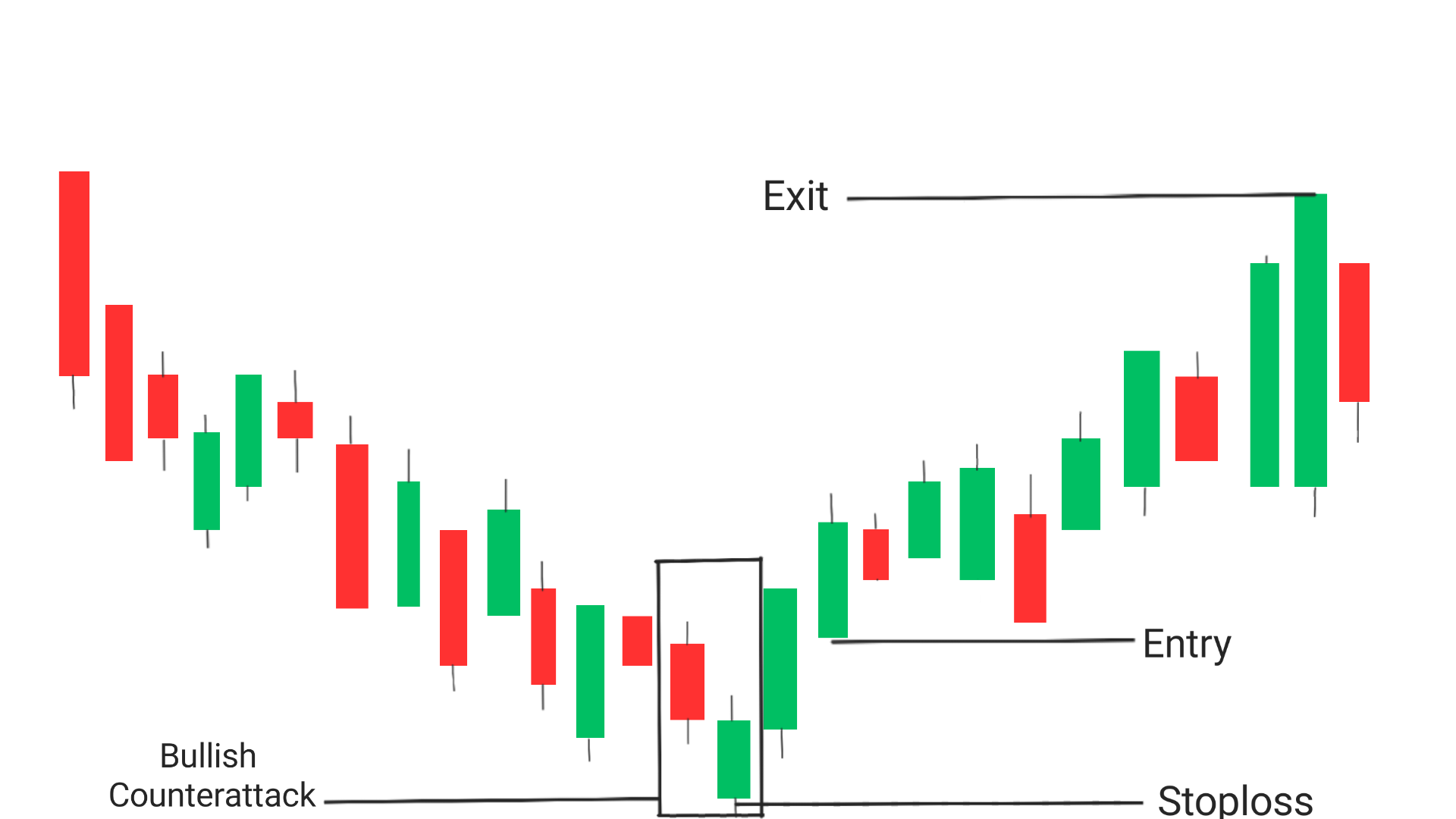

Entry: The best entry place is when candle next to bullish counterack closes above the it.

Exit: exit the trade when it reaches a significant resistance level. If you want to trade more youthen look for a breakout near resistance level, if it happens then take trade untill it reaches a new resistance level.

Stoploss: In order to be safe from losses, stoploss must be the the low of the bullish counterattack.

To enter a long position after the Bullish Counterattack Pattern has formed, traders should wait for the bullish candlestick to close above the high of the bearish candlestick. This indicates that buyers have taken control of the market and that a potential reversal in the price of the asset is likely.

Traders should also set stop-loss orders to limit their losses if the trade does not go as planned. Stop-loss orders are orders placed with a broker to sell an asset if its price falls below a certain level. By setting stop-loss orders, traders can limit their losses if the trade does not go as planned.

How To Trade Bearish Counterattack Pattern

Entry: The best entry place is when, candle next to bearish counterack below above the it.

Exit: exit the trade when it reaches a significant support level. If you want to trade more youthen look for a breakout near support level, if it happens then take trade untill it reaches a new support level.

Stoploss: In order to be safe from losses, stoploss must be the the low of the bullish counterattack.

Conclusion

The Bullish Counterattack Pattern is a powerful reversal pattern that traders can use to their advantage. It signals a potential reversal in the price of an asset after a downtrend and can help traders identify profitable trading opportunities.

To use the Bullish Counterattack Pattern effectively, traders should look for two candlesticks, with the second candlestick completely engulfing the first. They should also look for other indicators that confirm the pattern, such as an increase in trading volume and a break above a key resistance level.

By entering long positions after the Bullish Counterattack Pattern has formed and setting stop-loss orders to limit their losses, traders can take advantage of this powerful pattern and potentially profit from the rever

Frequently Asked Questions (FAQs)

1.What are the 3 rising methods?

The 3 rising methods is a bullish continuation pattern ,that is formed during an uptrend, it is similar to falling three method.

2.What is the rising three formation?

The rising three formation is a 5 candlestick bullish candlestick pattern formed during an uptrend, that consists of three small bodied bearish candles in between a large bearish and a bullish candle.

3.What is the 3 green candles strategy?

The 3 green candles strategy is not a commonly used trading term. It is possible that it refers to a strategy where traders look for three consecutive bullish candles as an indication of a potential uptrend, but without more context or information, it is difficult to determine the exact meaning of this term.

4.What is the bullish 3-method?

The bullish 3 method is a bullish candlestick pattern that consists of three candles: a long bearish candle, followed by a small-bodied candle that gaps down, and then a long bullish candle. This pattern indicates that sellers are losing control of the market and that buyers are likely to take over.

5.What is the rising method?

The rising method is a bullish continuation pattern, similar to 3 rising method that is formed during an uptrend.