Shooting star vs inverted hammer

Candlestick patterns are the most popular tool used by technical analysts to predict future price movements in financial markets. Among the various patterns, the shooting star and inverted hammer are two widely recognized candlesticks. By understanding the significance of shooting stars and inverted hammers. Traders can make more accurate decisions when analyzing price charts.

Inverted Hammer vs Shooting Star

| Shooting Star | Inverted Hammer |

|---|---|

| A shooting star is a bearish candlestick pattern which forms at the top of an uptrend. It indicates a bearish reversal. which can covert uptrend into downtrend. | An inverted hammer is a bullish candlestick pattern which appears at the bottom of downtrend.It can covert bearish movement to bullish. |

| It forms at top of an uptrend. | it forms at the bottom of a downtrend. |

| visual appearance resmebles of a star with long tail. its long upper shadow, represents the seller pushing price lower. | It's visual appearance looks like upside down hammer. Its long lower shadow , indicates that buyers are pushing the price higher. |

| Shooting star suggests that sellers are dominating buyers, signalling a potential trend reversal. | Inverted hamer suggests that buyers are dominating over seller. |

| shooting star indicates that buyers are losing control and a bearish move may come. | inverted hammer suggests that sellers are losing control and a bullish move move is about to follow. |

| the long upper shadow acts as a resistance level for the price to move higher. | the lower shadow act as a support level for the price, as it indicates price may suffer to move lower. |

| The shooting star indicates a bearish reversal | The inverted hammer indicates a bullish reversal. |

Definition and Characteristics

A shooting star is a bearish candlestick pattern which forms at top of an uptrend. It has a small real body at the lower end of the price range and a long upper shadow.

It has the ability to convert uptrend to downtrend, if it forms at the bottom of downtrend.

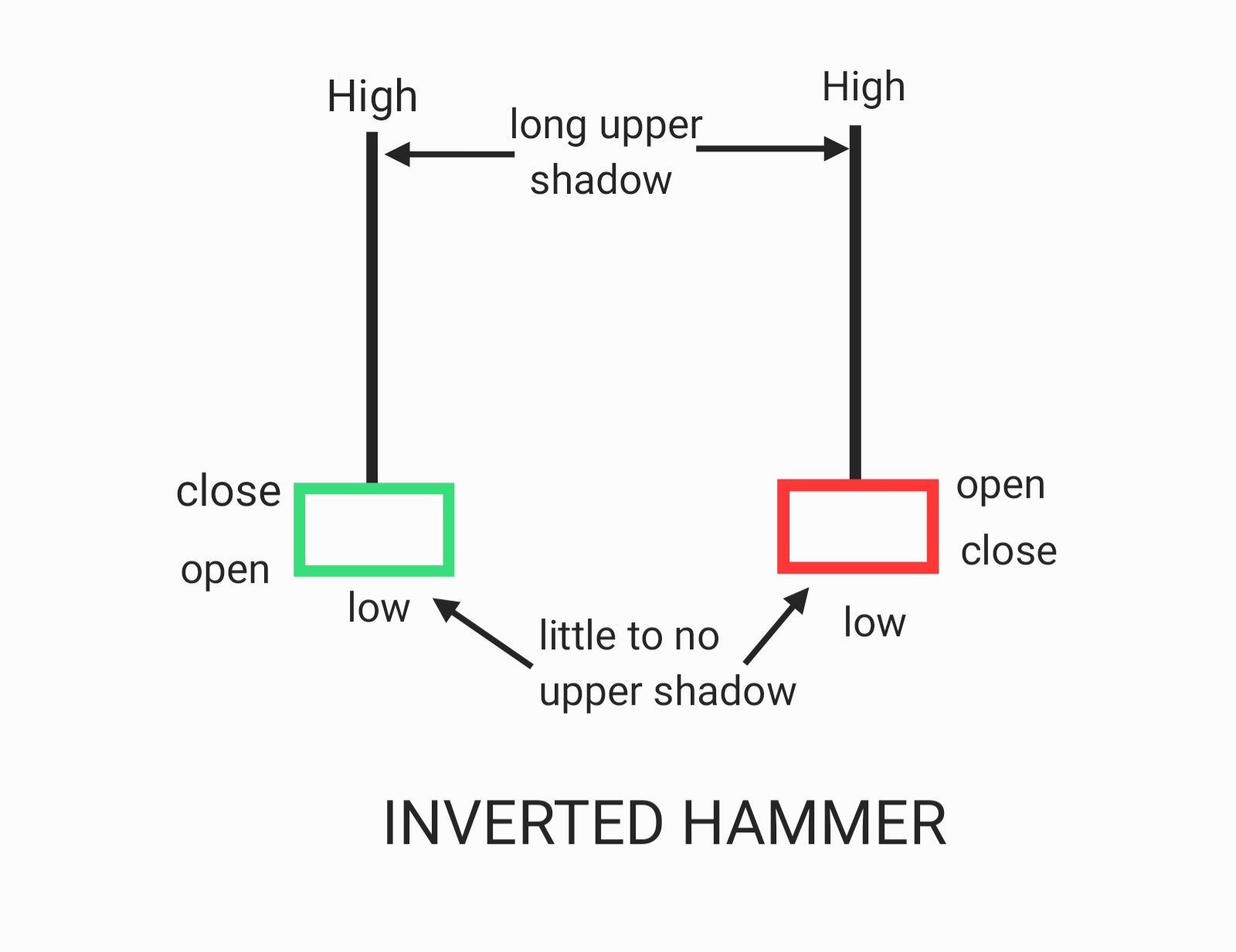

An inverted hammer is a bullish candlestick pattern that forms after a downtrend. It has a small real body at the upper end of the price range and a long lower shadow. It shhas the ability to convert downtrend to uptrend.

You can incorporate shooting stars into their strategies by placing a stop-loss above the shooting star’s high and taking profit near support levels.

one can utilize inverted hammers by placing a stop-loss below the inverted hammer’s low and taking profit near resistance

Direction of Reversal

The shooting star indicates a bearish reversal, suggesting that the uptrend may be coming to an end and a downtrend may follow. On the other hand, the inverted hammer suggests a bullish reversal, indicating that the downtrend may be reversing and an uptrend may begin.

Formation Position

The shooting star forms after at top of an uptrend, while the inverted hammer forms at bootom of a downtrend. This difference in formation position reflects the potential reversal in bearish and bullish reversals respectively.

Shadow Placement

The shooting star has a long upper shadow, which represents the sellers pushing the price lower during the trading session before buyers bring it back up. In contrast, the inverted hammer has a long lower shadow, indicating that buyers pushed the price higher before sellers brought it back down.

Interpretation of Resistance and Support

In the shooting star, the long upper shadow acts as a resistance level, suggesting that the price may struggle to move higher. In the inverted hammer, the long lower shadow acts as a support level, indicating that the price may struggle to move lower.

Trading Strategies

You can put shooting stars into their strategies by placing a stop-loss above the shooting star’s high and taking profit near support levels. For inverted hammers, you can place a stop-loss below the inverted hammer’s low and take profit near resistance levels.

Overall, while both shooting stars and inverted hammers indicate potential trend reversals, they differ in their direction of reversal, formation position, shadow placement, and interpretation of resistance and support levels. Traders should consider these differences when analyzing candlestick patterns and incorporating them into their trading strategies.

for more do visit moneyinspires.

2 thoughts on “Shooting star vs inverted hammer : 7 key points”