Morning doji star

In the world of technical analysis, the Morning Doji Star is a one of the most used candlestick pattern that signifies a potential bullish trend reversal. This pattern is mainly used by traders and investors due to its reliability and effectiveness in predicting price reversals. By understanding this powerful candlestick pattern, you can enhance your trading strategies and can take decisions more effectively in the financial markets.

What is a Morning Doji Star?

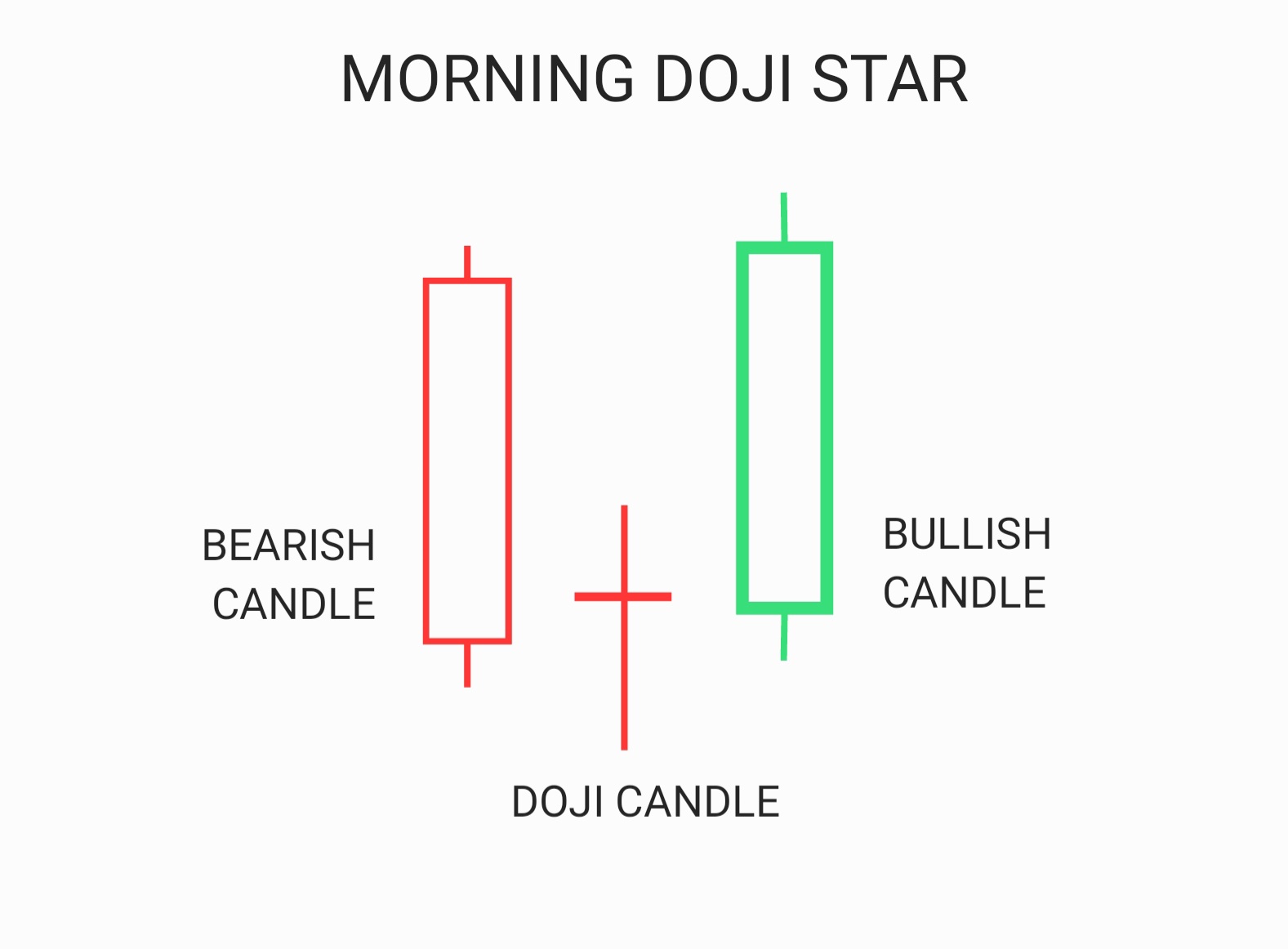

It is a three-candlestick pattern that appears during a downtrend, indicating a potential reversal in the market. It is a bullish candlestick pattern, consists of three candles i.e. the first candle is a long bearish candle i.e a long red candle, indicating that bears were dominating the market during the trading session. The second candle is a small bodied Doji candle, which means that the opening price and closing price of the session were almost the same, indicating indecision in the market. The third candle is bullish control i.e. a long green candle, indicating that bulls have started gaining control over market.

How to find a Morning Doji Star in chart?

To identify a this candlestick,you must check for following criteria in the candlestick formation. The first candlestick should be a long bearish candlestick (red candle), The second candlestick, known as the Doji, has a small body and represents indecision between buyers and sellers. Finally, the third candlestick must be a long bullish candlestick.

Significance and Reliability of the Morning Doji Star

The Morning Doji Star pattern is highly regarded for its reliability in predicting trend reversals. Traders often consider it a strong buy signal, as it indicates a shift in market sentiment from bearish to bullish. However, it is crucial to confirm this pattern with other technical indicators and analysis tools to increase its reliability.

How to trade using the Morning Doji Star?

Several trading strategies can be employed using the Morning Doji Star pattern. One such approach is to enter a long position after the confirmation of the pattern, setting a stop-loss below the low of the Doji candlestick can improve your trade and minimizes risk of loss. Another strategy involves combining the Morning Doji Star with other technical indicators, such as moving averages or trendlines, to further validate the reversal signal.

In conclusion, the Morning Doji Star pattern is a powerful tool in technical analysis that can assist traders in identifying potential trend reversals. Its formation and interpretation provide valuable insights into market sentiment and can be used to enhance trading strategies. While this pattern alone does not guarantee success, when combined with other technical analysis tools, it can significantly improve decision-making capabilities in the financial markets.

Frequently asked questions

1. What is the bullish Morning doji Star?

A bullish Morning doji Star is a candlestick which appears at the bottom of a downtrend, it has potential of bullish trend reversals. It consists of three candles a long bullish candle(red), a doji and a long bullish candle.

2. What does doji Star means?

Doji Star, is a candle with opening and closing prices are very close to each other.

3. Is doji bullish or bearish?

A doji candle indicates equivalent bullish and bearish trends in a trade for more details do visit moneyinspires.