Rising Window Candlestick Pattern: A Sign of Bullishness

The stock market is a dynamic and ever changing environment, all traders and investors are always on the lookout for patterns that can help them make informed decisions. One such pattern is the rising window candlestick pattern, which is a bullish signal that indicates a potential uptrend in the market.

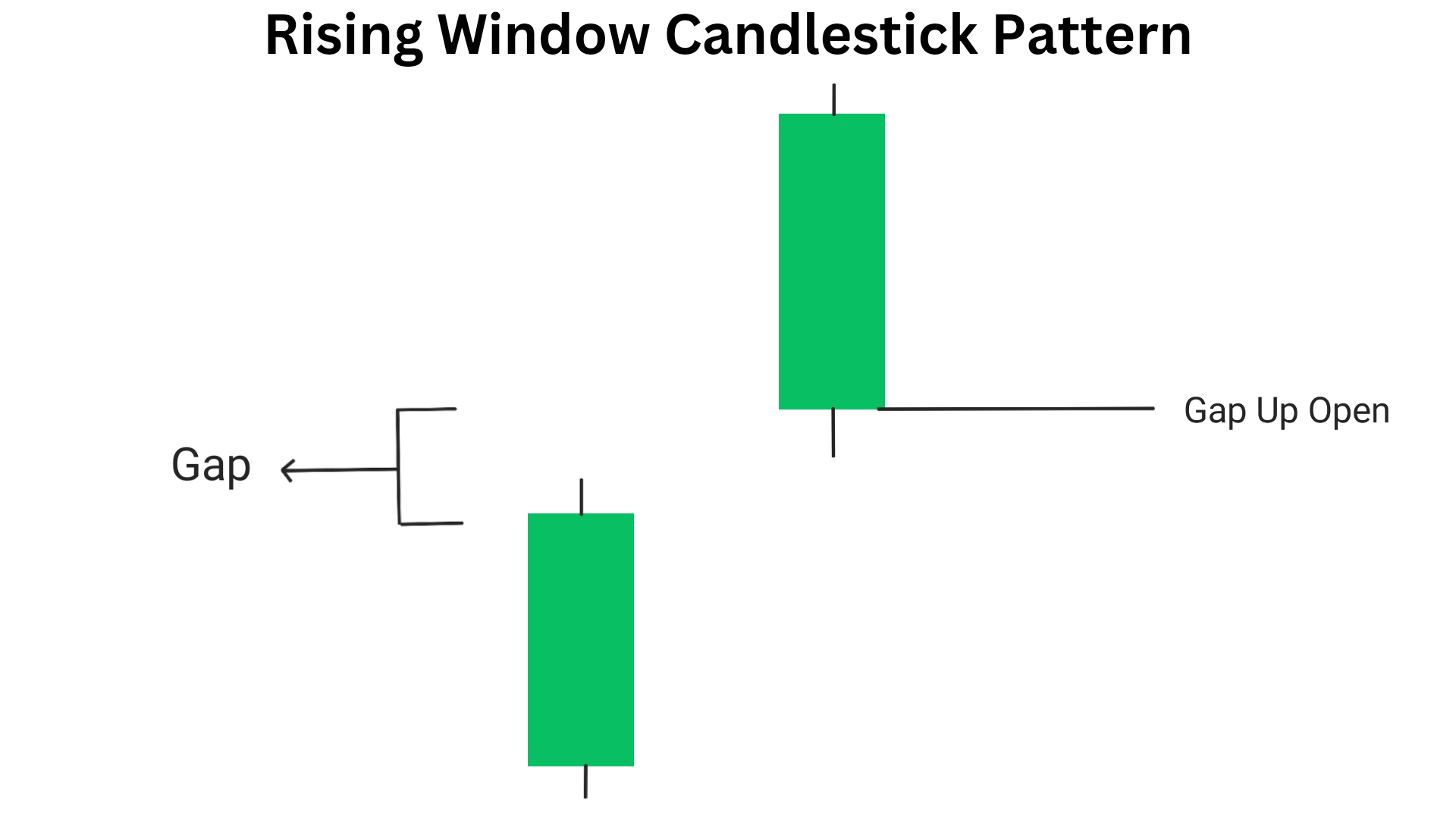

What is the Rising Window Candlestick Pattern?

The rising window candlestick pattern is two candlestick bullish reversal or continuation pattern. It appear after a pullback or during an uptrend and consists of two bullish candles, in whichs the second candle appears with a gap up opening.

In order for the rising window candlestick pattern to occur, the following criteria must be met:

1. The market must be in uptrend, after a pullback.

2. On the first day, there must be a green candlestick.

3. On the second day, there must be a gap up, creating a window between the high of the first day and the low of the second day.

4. The second day must close above the high of the first day.

5. The opening price of the second candle must be above the close price of the first candle.

The rising window candlestick pattern is also known as the “rising gap” or “rising window” pattern.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

Psycology Behing Rising Window Patter?

1.Earlier, the movement was in uptrend, which was controlled by buyers. Then a pullback appears means price started moving downward

2. In this scenario due to fear of loss buyers sells their buy position and some traders see it as a chance to short shares.

3.It concludes that supply is more and price goes in hand of sellers, but after sometime price reaches a support level then first candle of rising window pattern appears which means buyers have started taking control over market.

4. Then bullish second candle of high volume appears with a gap up opening , which encourages nulls to buy shares and create a fear in mind of bears and they exit their position.

5. With this high pressure of buying, price starts moving upward and everyone follows the trend.

Why is the Rising Window Candlestick Pattern Important?

The rising window candlestick pattern is important because it is a strong bullish signal that can indicate a potential trend reversal. When this pattern occurs, it suggests that buyers have taken control of the market and are pushing prices higher.

Traders and investors can use the rising window candlestick pattern as a buy signal, as it indicates that there may be an opportunity to enter a long position in the market. However, it is important to note that no trading strategy is foolproof, and traders should always use risk management techniques to protect their capital.

How to trade Rising Window Candlestick Pattern?

If you are interested in trading the rising window candlestick pattern, here are some tips to keep in mind:

Entry: The best entry point for this pattern is when the chart was earlier in upward movement, but then faces a pullback and again experiences an uptrend movement from a support level. Then rising window pattern forms on the chart.

Exit: Exit the trade , when it reaches your pre-determined target pr when it reaches a significant resistance level. If you want to trade more then you can look for a breakout near the resistance level, if it happens then take trade upto new resistance level.

Stoploss: In order to minimise the risk of loss, stoploss must be set at the low of the candlestick pattern.

1.Confirmation using volume of 2nd candle: While the rising window candlestick pattern is formed, if the volume of the 2nd candle of the pattern is greater than the first it is considerd to be a strong bullish signal.

2. Entry within the second candle: It is important to note that entry must be taken within the second candle otherwise, there are high probability that price will again move up with gap up opening. If you fail to do so then difference between entry and stoploss will be high and ultimately affect your risk to reward ratio.

Conclusion

The rising window candlestick pattern is a bullish signal that can indicate a potential trend reversal in the market. Traders and investors can use this pattern as a buy signal, but it is important to use risk management techniques and consider other factors before making any trading decisions. By understanding the rising window candlestick pattern, traders can gain insights into the market and make informed decisions that can help them achieve their financial goals.

Frequently Asked Questions(FAQs)

1.What is rising window candlestick?

The rising window candlestick pattern is two candlestick bullish reversal pattern, in which the second candle appears with a gap up opening. which forms after a pullback in the market. it signifies that buyers are taking control over the price movement.

2.What is the candlestick pattern in the window gap?

The candlestick pattern in the window gap is the rising window candlestick pattern. It consists of two white or green candles with a gap between their closing and opening prices.

3.What is the most accurate candlestick pattern?

Bullish engulfing is the most accurate cabdlestick pattern with success rate of nearly 70%.There is no one “most accurate” candlestick pattern. Each pattern has its own strengths and weaknesses, and traders should use a combination of patterns and other technical analysis tools to make trading decisions.

4.Which candle is bullish?

Bullish harami , Bullish engulfing , Hammer when formed at bottom is bullish.A bullish candle is a candlestick that indicates a potential uptrend in the market. This can include patterns such as the rising window candlestick pattern, as well as other patterns such as the bullish engulfing pattern or the hammer pattern.

5.What is the three candlestick rule?

The three candlestick rule is a technical analysis rule that involves looking at the previous three candlesticks to determine the trend of the market. If the most recent candlestick is moving in the opposite direction of the previous two candles, it may indicate a potential trend reversal. However, traders should use this rule in combination with other technical analysis tools to make informed trading decisions.

1 thought on “Rising Window Candlestick Pattern: 5 FAQs”