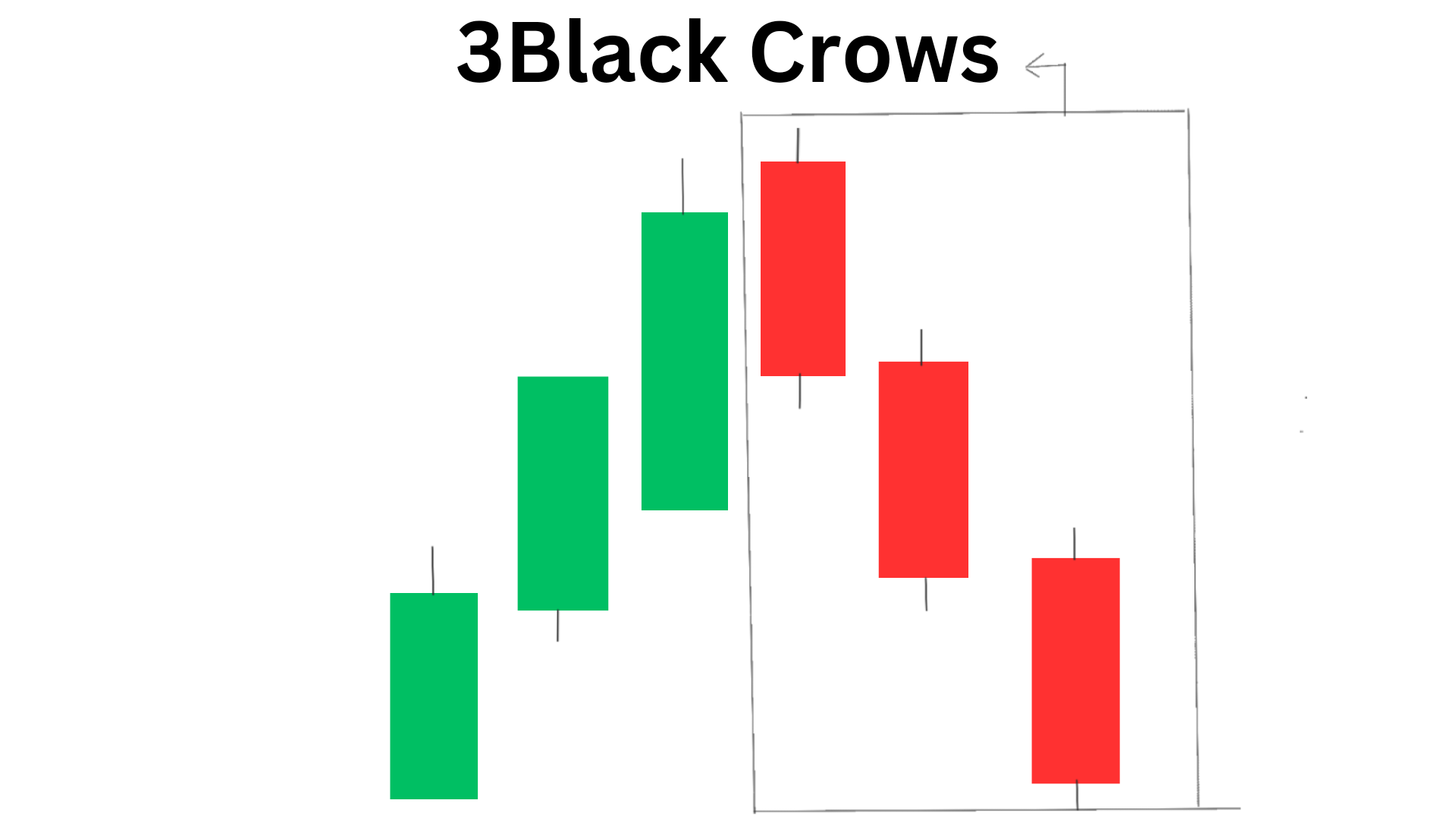

3 Black Crows Candlestick Pattern

The Three Black Crows pattern is a Three candlestick bearish reversal pattern that is formed by three consecutive long black candles with very small to no shadows. Each candle opens within the previous day’s real body and closes below the previous day’s low. This pattern indicates a strong selling pressure and a potential trend reversal from an uptrend to a downtrend.

In this blog, we will explore the Three Black Crows pattern in detail, including its formation, interpretation, and trading strategies.

What is 3 Black Crows candlestick pattern?

The 3 Black Crows pattern is a Three candlestick bearish reversal pattern that consists of three consecutive long bearish candlesticks. This pattern indicates a strong shift in market sentiment from bullish to bearish, and it often signals a potential trend reversal from an uptrend to a downtrend. The pattern is named after the appearance of three black crows sitting on a branch, which is seen as a bad omen in some cultures.

Key features of 3 Black Crows

• Consists of three long bearish(red) candles with small or no wicks.

• Each candle opens within the previous candle’s real body and closes lower than the previous candle’s close.

• Occurs after an uptrend, indicating a potential trend reversal to a downtrend.

• Indicates a strong shift in market sentiment from bullish( buyers) to bearish(sellers).

• Traders may use it as a signal to sell or short a security, or to exit long positions.

to learn everything about trading with proper examples and explanation in detail do check this bestseller guide for trading.

Formation and success rate of the Three Black Crows Pattern

The Three Black Crows pattern is formed when three consecutive long black candles appear on a chart. The candles should have small or no shadows, indicating a strong selling momentum. Each candle should open within the previous day’s real body and close below the previous day’s low.

success rate

According ro some reports,The success rate of 3 black crows pattern is around 80% , which means for every 5 trade taken you will be able to make profit in 4 out of those five. It may vary from charts to charts.

Interpretation of the Three Black Crows Pattern

The Three Black Crows pattern is a bearish reversal pattern that indicates a potential trend reversal from an uptrend to a downtrend. The pattern suggests that the bears(sellers)have taken control of the market and are pushing prices lower. Traders often look for confirmation of the pattern with other technical indicators or chart patterns before entering a short position.

How to trade using 3 Black Crows pattern?

There are several trading strategies that traders can use when trading the Three Black Crows pattern. These include:

Entry: The entry point for a 3 black crows pattern would be after the third consecutive bearish candlestick has closed.

Exit: The exit point would depend on the trader’s individual strategy and goals, but it could be when the price reaches a predetermined target or when it reaches a significant resistance level or when a bullish reversal pattern forms. If you want to trade for more time then look for a breakout at resistance level and take a trade untill it reaches another resistance level.

Stoploss: The stop-loss order can be placed above the high of the third bearish candlestick to limit potential losses if the pattern fails. Again, it’s important to conduct thorough research and analysis before making any trading decisions.

Apply this points only after following the steps given below, it will not only mimimise the risk of loss but also

1. Selection the stock: Traders can enter a short position when the Three Black Crows pattern appears on the chart. They can place a stop loss above the high of the third candle and take profit at a predetermined level.

2. Using technical indicators: Traders can use technical indicators such as moving averages, RSI, and MACD to confirm the Three Black Crows pattern. If these indicators also show a bearish signal, traders can enter a short position.

3. Combining with other chart patterns: Traders can combine the Three Black Crows pattern with other chart patterns such as support and resistance levels, trend lines, and Fibonacci retracements to confirm the pattern and enter a short position.

Conclusion

The Three Black Crows pattern is a bearish reversal pattern that has potential to reverse trend from an uptrend to a downtrend. Traders can use this pattern to enter a short position and take advantage of the bearish momentum in the market.

Frequently Asked Questions (FAQs)

1.What does 3 black crows indicate?

The 3 Black Crows pattern indicates a strong shift in market sentiment from bullish to bearish, and it often signals a potential trend reversal from an uptrend to a downtrend.

2.What to do with three black crows?

Traders may use the 3 Black Crows pattern as a signal to sell or short a security, or to exit long positions. When this pattern appears on top of an uptrend , it indicates a potential bearish trend reversal in market.

3.What is the success rate of the 3 black crows?

The success rate of the 3 Black Crows pattern depends on various factors such as the strength of the trend, the timeframe, and other technical indicators used in conjunction with the pattern. It is important to conduct thorough analysis and risk management before making any trading decisions based on this pattern.