Three Inside Down

If you are a trader or an investor, you must have heard about the ‘Three Inside Down’ pattern. It is a bearish candlestick pattern that signals a potential reversal in an uptrend. In this blog post, we will discuss what the Three Inside Down pattern is, how to identify it, and how to trade it.

What is the Three Inside Down candlestick Pattern?

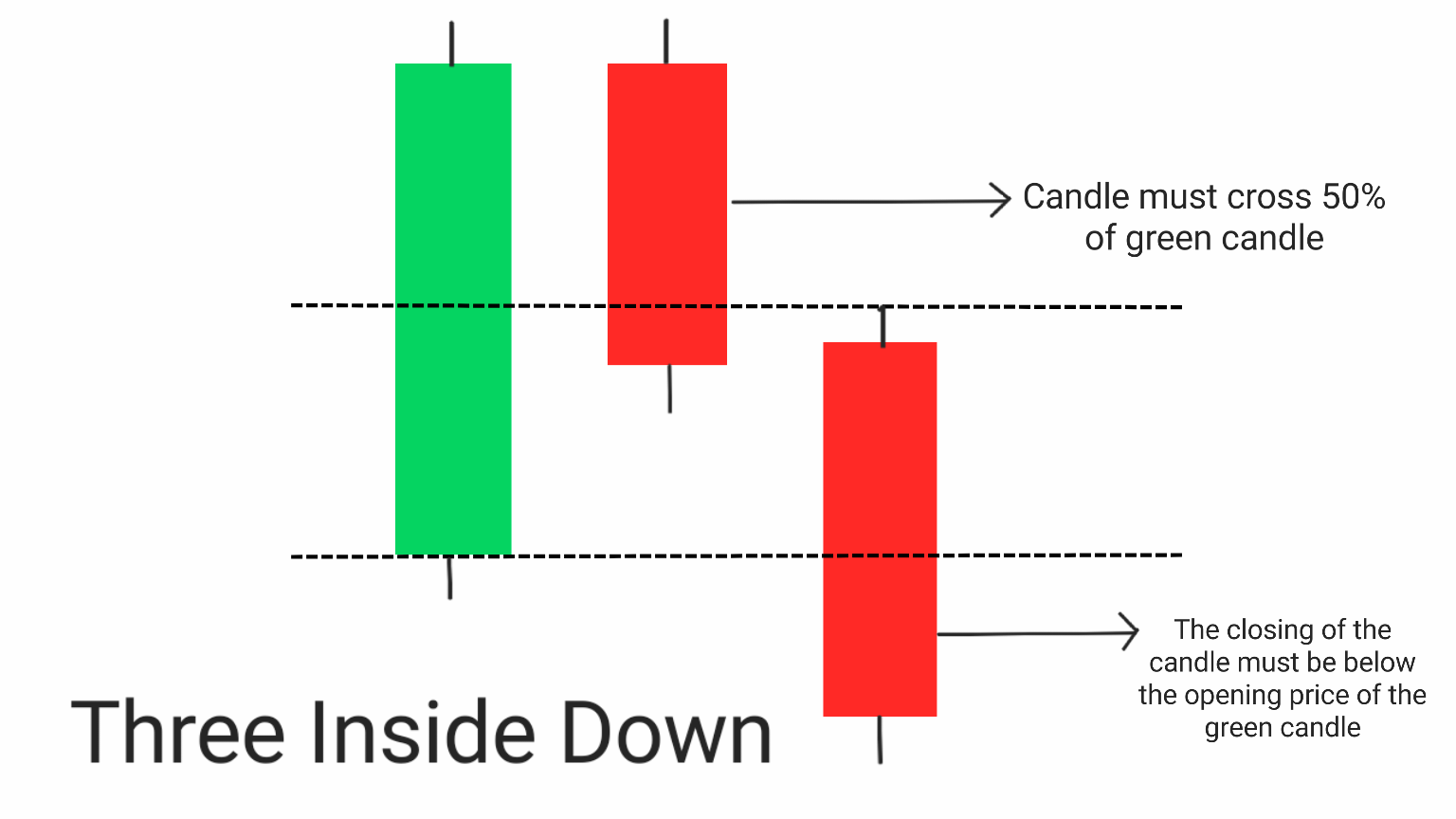

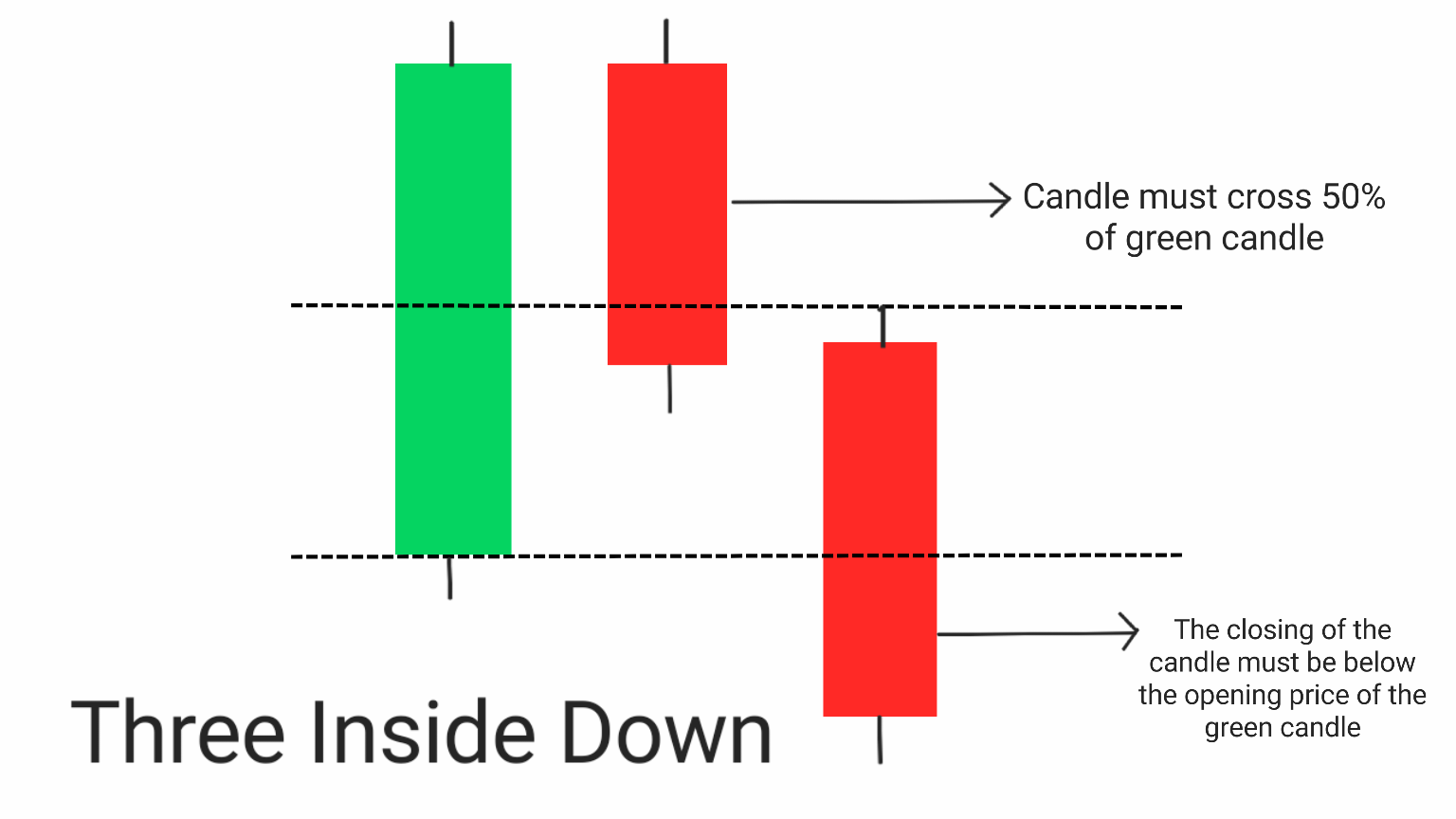

The Three Inside Down pattern is a three candlesticks bearish reversal pattern, which forms at the end of an uptrend. The first candlestick is a long bullish candlestick that forms during an uptrend. The second candlestick is a small bearish candlestick that opens above the first candlestick’s high and closes below its midpoint, if we have a look at the first two candle, then it remembers us of bearish harami candlestick pattern.The third candlestick is a long bearish candlestick that closes below the second candlestick’s low.

This pattern is a bearish reversal pattern that suggests that the bulls (buyers) are losing control, and the bears (sellers) are taking charge. It is a signal that the trend is about to reverse, and traders should consider shorting the asset.

key features of three inside down

- It is a bearish reversal pattern.

- It is formed at the end of an upward trend.

- It consists of three candlesticks – a long bullish candlestick, a small bearish candlestick, and a long bearish candlestick.

- The second candlestick opens above the first candlestick’s high and closes below its midpoint.

- The third candlestick closes below the second candlestick’s low.

- Traders can use the this pattern to make profitable trades by placing a short trade when the price breaks below the low of the third candlestick.

How to Identify the Three Inside Down Pattern?

Identifying the Three Inside Down pattern is quite easy. You just need to look for three consecutive candlesticks on a price chart. The first candlestick should be a long bullish candlestick, followed by a small bearish candlestick, and finally, a long bearish candlestick. Here are the steps to identify the pattern:

Step 1: Look for an uptrend on the price chart.

Step 2: Identify the first candlestick, which should be a long bullish candlestick.

Step 3: Look for the second candlestick, which should be a small bearish candlestick that opens above the first candlestick’s high and closes below its midpoint.

Step 4: Finally, look for the third candlestick, which should be a long bearish candlestick that closes below the second candlestick’s low.

If you see these three candlesticks in sequence, you have identified the Three Inside Down pattern.

Bestseller mastermind book to learn trading from scratch along with examples in here.

To trade the Three Inside Down pattern, traders should follow these steps:

Once you have identified the pattern, you can use it to trade the market. Here are the steps to trade the Three Inside Down pattern:

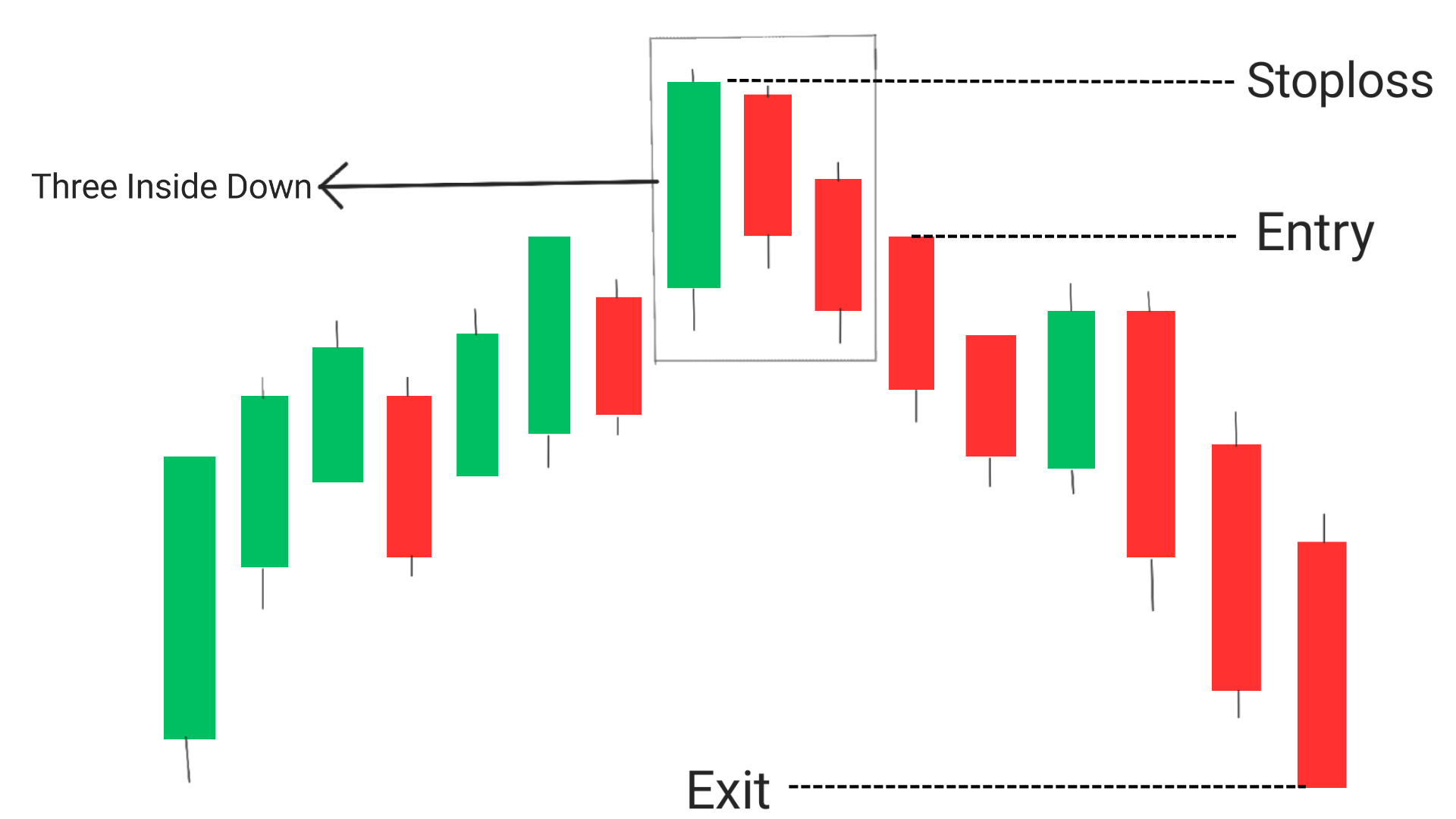

Entry: Traders can enter a short trade when the price breaks below the low of the third candlestick in the pattern.

Exit: Traders can exit the trade when the price reaches a predetermined profit target or when a bullish reversal pattern forms. If you want to trade more then look for a breakout at support level, if this happens then take trade for the next support level.

Stop loss: Traders can place a stop loss above the high of the first candlestick in the pattern to limit potential losses.

Step 1: Wait for the Three Inside Down pattern to form on the price chart.

Step 2: Place a short trade or sell assets when the price breaks below the low of the third candlestick.

Step 3: Place a stop loss above the high of the first candlestick.

Step 4: Take profit when the price reaches the next support level.

Following are the General steps to be followed to trade by using three inside down candlestick pattern

1. Identify an uptrend in the market.

2. Look for the Three Inside Down pattern formation, which consists of three candlesticks.

3. Confirm the pattern with other technical indicators and price action analysis.

4. Enter a short position when the third candlestick closes below the low of the second candlestick.

5. Place a stop loss above the high of the first candlestick.

6. Set a profit target by measuring the height of the first candlestick and projecting it downwards from the low of the third candlestick or using support and resistance level.

7. Monitor the trade and adjust the stop loss and profit target as needed.

Traders should always use proper risk management techniques and only trade with a risk-to-reward ratio of at least 1:2.

Success Rate of Three Inside Down

The success rate of the 3 Inside Down pattern varies depending on the market conditions and the trader’s skill level. However, this pattern is considered a reliable bearish reversal signal when it occurs after an uptrend. According to some reports and article, the Three Inside Down pattern has a success rate of around 60-70%. However, traders should always use other technical indicators and price action analysis to confirm the pattern before entering a trade.

Conclusion

The Three Inside Down pattern is a bearish reversal pattern that signals a potential trend reversal. It consists of three candlesticks, and traders can use it to make profitable trades. To identify the Three Inside Down pattern, you need to look for three consecutive candlesticks on a price chart. Once you have identified the pattern, you can place a short trade when the price breaks below the low of the third candlestick. Remember to use risk management and trade with discipline.

Frequently Asked Questions (FAQs)

1.What is three inside down?

Three Inside Down is a bearish candlestick pattern that signals a potential trend reversal. It consists of three consecutive candles, with the second candle being a bearish candle that engulfs the first bullish candle, and the third candle being a bearish candle that closes below the second candle’s low.

2.What is the 3 candlestick rule?

The 3 candlestick rule refers to the requirement that the Three Inside Down pattern must consist of three consecutive candles in order to be valid.

3.What is the meaning of three outside down?

Three Outside Down is a bearish candlestick pattern that is similar to Three Inside Down, but with a more significant bearish signal. It consists of three consecutive candles, with the second and third candles being bearish candles that engulf the previous bullish candle, and the third candle closing lower than the first candle’s low.

4.What is the 3 inside pattern?

The 3 inside pattern is another name for the Three Inside Down pattern, which is a bearish candlestick pattern that signals a potential trend reversal.

5. What is the Three Inside Down pattern?

The Three Inside Down pattern is a bearish reversal pattern that occurs after an uptrend. It consists of three candlesticks, where the first candlestick is a long bullish candlestick, the second candlestick is a small bearish or bullish candlestick that trades within the range of the first candlestick, and the third candlestick is a long bearish candlestick that closes below the low of the second candlestick.

6. How reliable is the Three Inside Down pattern?

The Three Inside Down pattern is considered to be a reliable bearish reversal pattern when it occurs after a prolonged uptrend. However, traders should always confirm the pattern with other technical indicators and price action analysis before making any trading decisions.

7. Can the Three Inside Down pattern occur in any timeframe?

Yes, the Three Inside Down pattern can occur in any timeframe, but it is more reliable in higher timeframes such as daily, weekly or monthly charts.

8. What is the profit target for the Three Inside Down pattern?

The profit target for the Three Inside Down pattern can be determined by measuring the height of the first candlestick and projecting it downwards from the low of the third candlestick. Traders can also use support and resistance levels or Fibonacci retracement levels to set their profit targets.

9. Is the Three Inside Down pattern suitable for all trading styles?

No, the Three Inside Down pattern is more suitable for swing and position traders who are looking to capture a larger move in the market. Day traders may find it difficult to trade this pattern due to its longer time frame.