How To Trade Mat Hold candlestick pattern?

Are you tired of constantly searching for the perfect trading strategy? Look no further than the Mat Hold candlestick pattern. This powerful pattern is often overlooked or neglected but can provide traders with a clear signal of a trend continuation. In this blog, we’ll o through all the details of the Mat Hold pattern and how you can use it to improve your trading game. Get ready to light up your profits with this exciting candlestick formation.

What Is Mat Hold Candlestick Pattern?

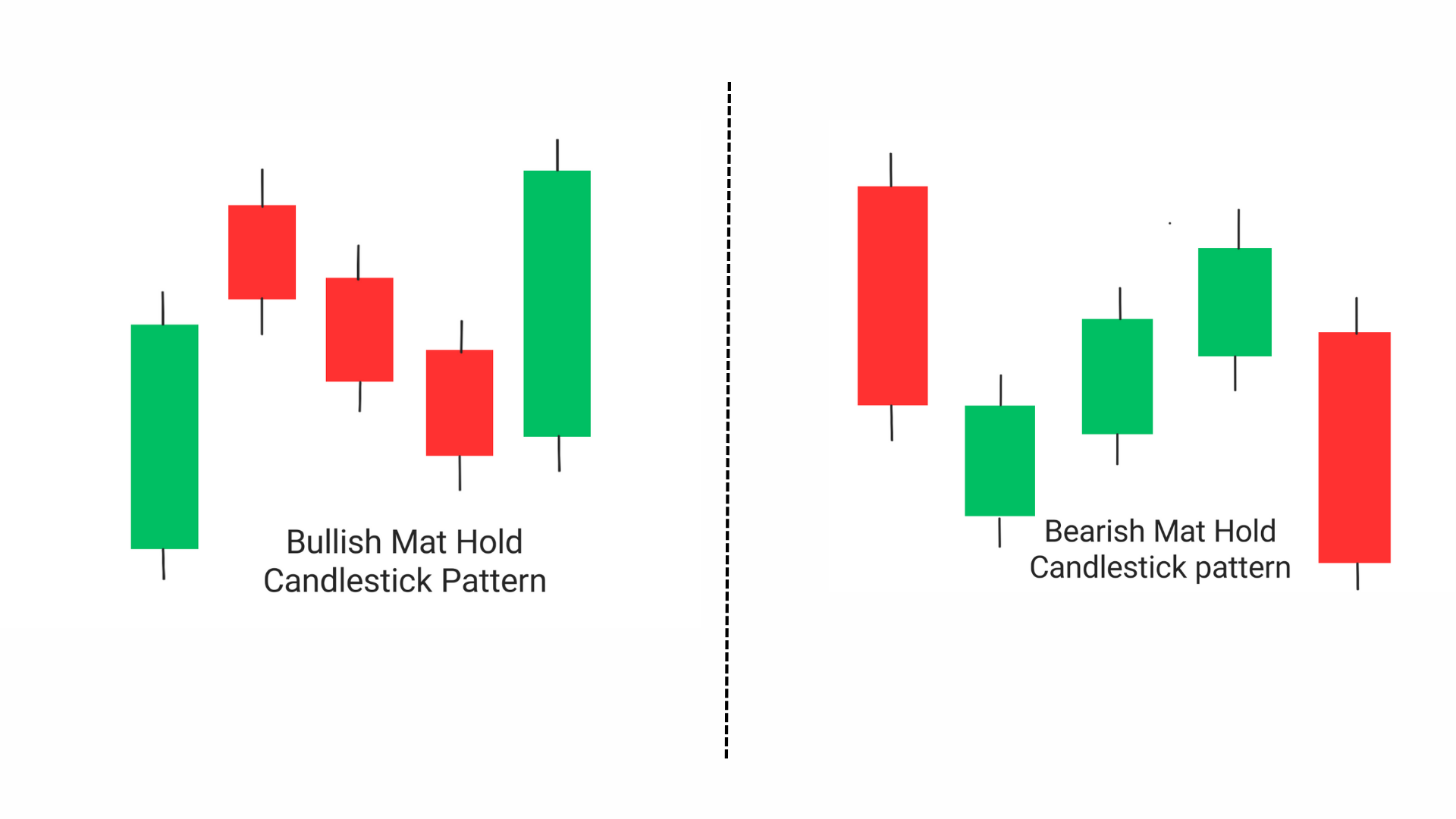

The Mat Hold candlestick pattern is a Five candlestick continuation pattern respective to their place of formation i.e during an uptrend or downtrend.

Characteristics of the Mat Hold pattern

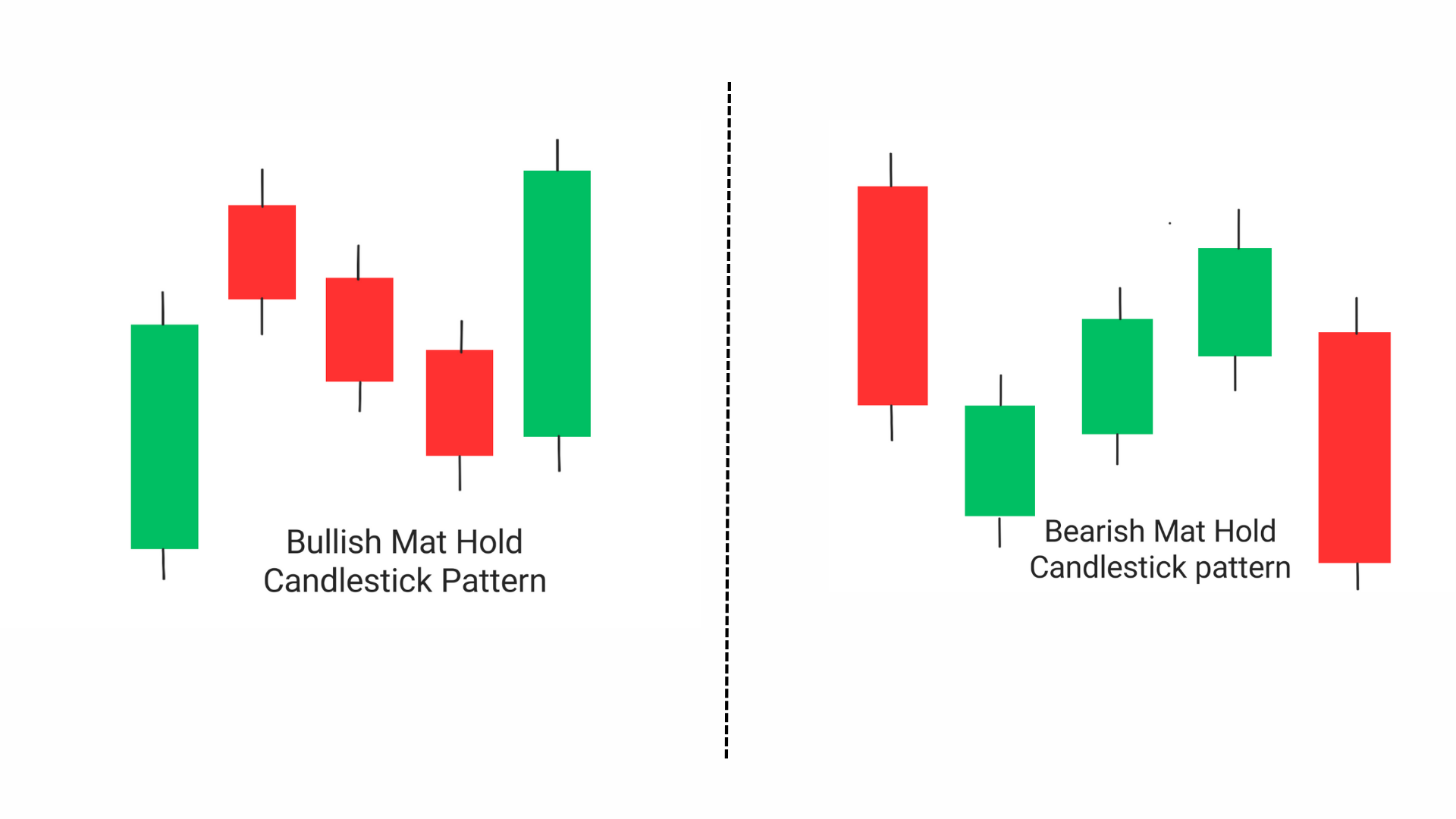

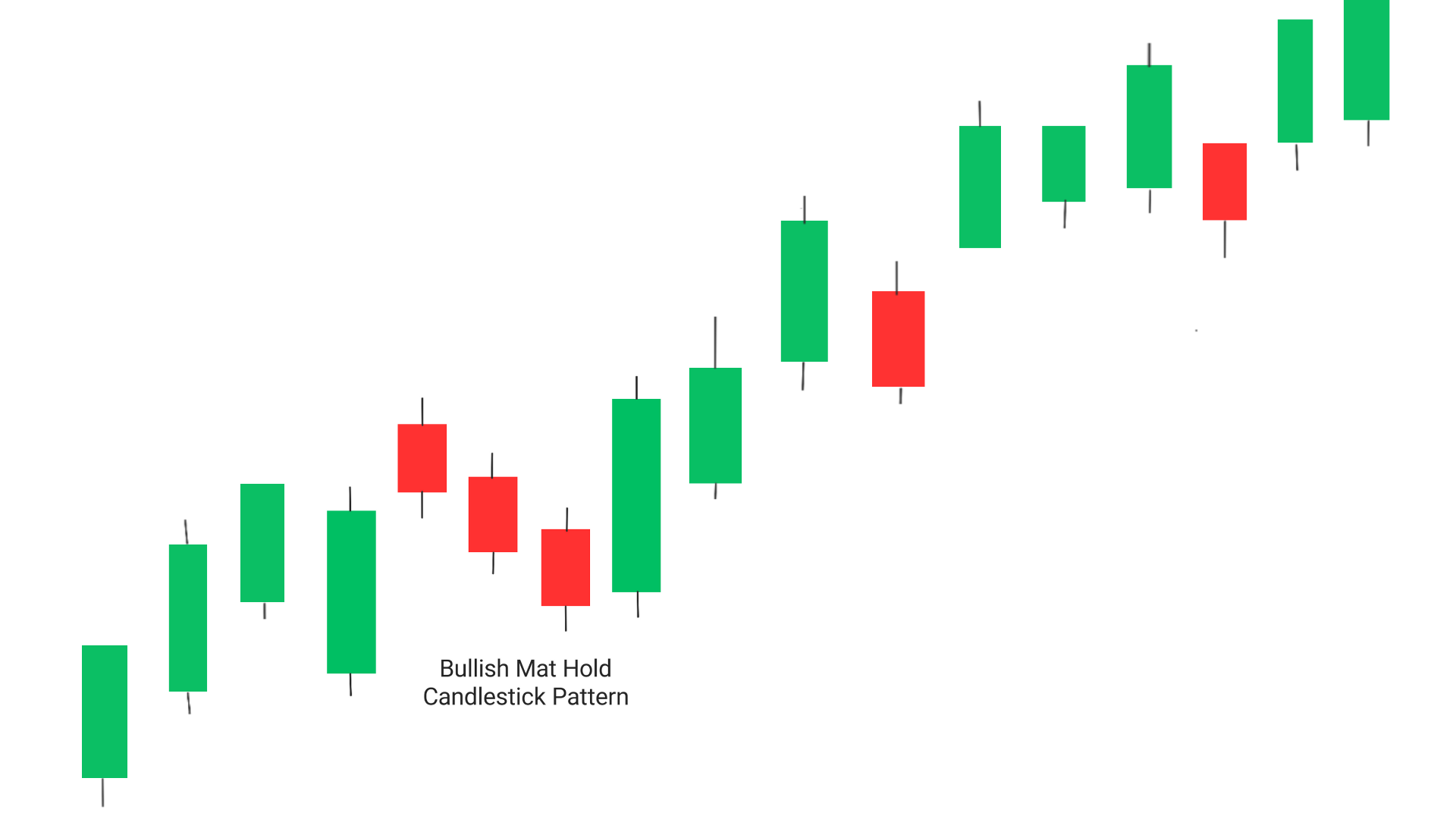

(i) Bullish Mat Hold Candlestick Pattern

- It consists of five candles,

- with the first candle being a long white or green candlestick that represents a strong uptrend.

- The second candle is a small black or red candlestick.

- The third candle is another a small red or black candlestick that closes above the high of the first candle, indicating that the uptrend is still strong.

- The fourth is again a small black or red candle and fifth candle is a long white or green candlesticks that close above the high of second candle.

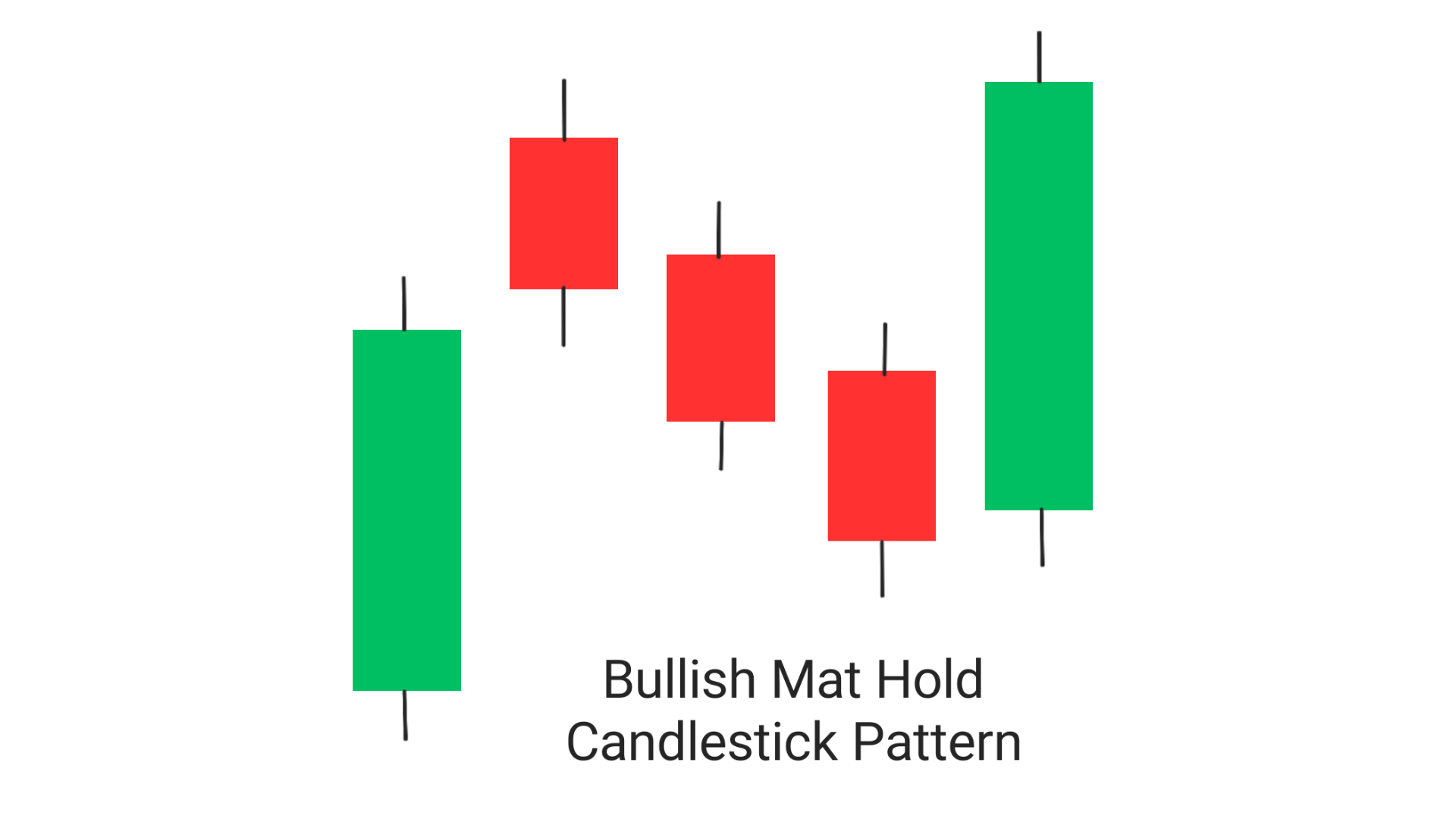

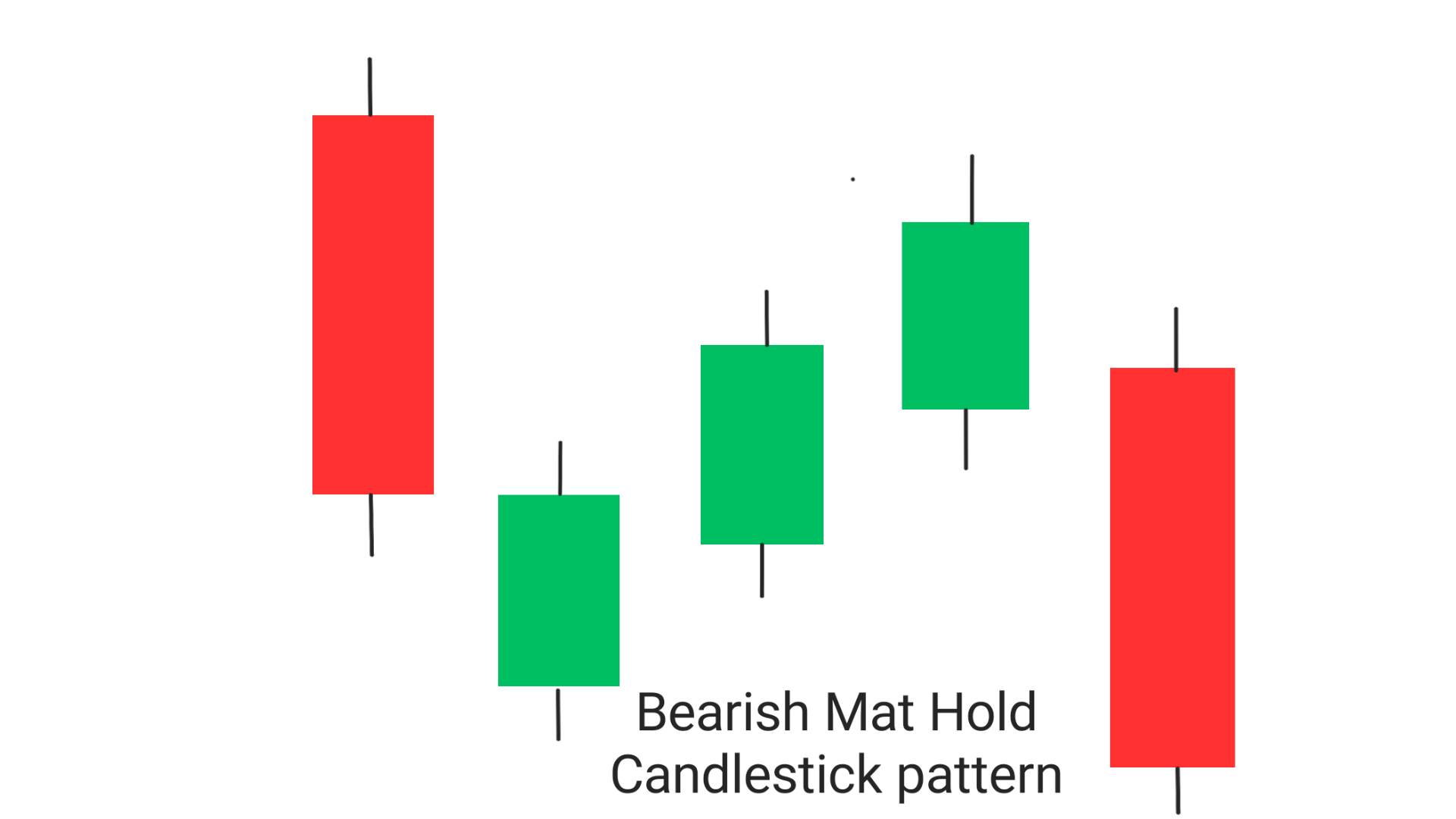

(ii) Bearish Mat Hold candlestick pattern

- It consists of 5 candles,

- with the first candle being a long black or red candlestick that represents a strong downtrend.

- The second candle is a small green or white candlestick.

- The third candle is another small white or green candlestick that closes above the high of the second candle, indicating that the uptrend is still strong.

- The fourth is small green or white candle and fifth candle are small black or red candlesticks that close below the lowof the second candle.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

Interpretation of the Mat Hold pattern

The Mat Hold candlestick pattern can be either bullish or bearish, depending on the direction of the trend before and after the pattern appears.

Bullish Mat Hold Candlestick Pattern:

- The pattern starts with a long bullish candlestick, indicating a strong uptrend.

- The second day opens higher, but then trades lower and forDefinitionms a small bearish candlestick.

- The third day opens higher again, but instead of continuing the downtrend, it forms a long bullish candlestick that completely engulfs the small bearish candlestick from the previous day.

- The fourth and fifth days continue the uptrend with long bullish candlesticks.

A bullish Mat Hold pattern is a strong indication of a continuation of the uptrend. The small bearish candlestick in the middle of the pattern is seen as a temporary pause or pullback, but the fact that it is completely engulfed by the subsequent long bullish candlestick shows that buyers are in control and are pushing prices higher.

Bearish Mat Hold Candlestick Pattern:Definition

- The pattern starts with a long bearish candlestick, indicating a strong downtrend.

- The second day opens lower, but then trades higher and forms a small bullish candlestick.

- The third day opens lower again, but instead of continuing the uptrend, it forms a long bearish candlestick that completely engulfs the small bullish candlestick from the previous day.

- The fourth and fifth days continue the downtrend with long bearish candlesticks.

A bearish Mat Hold pattern is a strong indication of a continuation of the downtrend. The small bullish candlestick in the middle of the pattern is seen as a temporary pause or pullback, but the fact that it is completely engulfed by the subsequent long bearish candlestick shows that sellers are in control and are pushing prices lower.

What is the Difference between Rising and Mat hold Candlestick Pattern?

| Rising Three Pattern | Mat Hold Pattern |

|---|---|

| There is no gap down or gap up opening between Fist and Second candles of the pattern. | There is a gap between the Fist and the Second candle of the pattern |

Trading strategies using the Mat Hold pattern

It is quite easy to trade mat hold pattern by simply using Entry, Exit and Stoploss

Entry : The best possible entry place while trading bullish mat hold is from the next candle which closes above the high of the mat hold pattern.

Exit: Exit the trade when you have achieved your goal or if the price has reached a certain significant resistance level. If you want to trade more , Then look for a breakout near resistance level if it happens then take another trade upto a new resistance level.

Stoploss: In order to minimize the risk of Stoploss hitting, Stoploss must be set at the low of the Mat Hold.

Trading Strategy For Bearish Mat Hold Candlestick Pattern

Entry : The best possible entry place while trading Bearish Mat Hold is from the next candle which closes above the high of the mat hold pattern.

Exit: Exit the trade when you have achieved your goal or if the price has reached a certain significant support level. If you want to trade more , Then look for a breakout near support level if it happens then take another trade upto a new support level.

Stoploss: In order to minimize the risk of Stoploss hitting, Stoploss must be set at the high of the Mat Hold.

Conclusion

The Mat Hold candlestick pattern is a powerful and one of the most reliable candlestick pattern that can provide valuable insights into market trends and potential trading opportunities. Its formation during uptend and downtrend clearly indicates bullish or bearish movement. Understand the best Entry, Exit and exit points while trading will surely help you to make profits.

Frequently Asked Questions (FAQs)

1.What is the most powerful candlestick pattern?

The most powerful candlestick pattern is Bullish/Bearish Engulfing pattern, the Hammer/Hanging Man pattern, and the Morning/Evening Star pattern.

2.What is the 3 candle rule in trading?

The 3 candle rule in trading refers to a rule of thumb used by traders to confirm a trend reversal. The rule states that if three consecutive candlesticks in an uptrend form lower highs and lower lows, or three consecutive candlesticks in a downtrend form higher highs and higher lows, then a trend reversal is likely to occur.

3.What is the most reliable candlestick pattern?

The most reliable candlestick pattern is the Doji pattern, the Piercing Line/Bullish Harami pattern, and the Dark Cloud Cover/Bearish Harami pattern. It is important to note that no pattern is 100% reliable and should always be used along with other technical analysis tools.