What is Inverted Head and Shoulder Pattern? 5 FAQs

Technical analysis is a popular method used by traders to predict the future price movements of financial assets. One of the most reliable patterns in technical analysis is the inverted head and shoulder pattern, which is a bullish reversal pattern that signals the end of a downtrend and the start of an uptrend.

What is an inverted head and shoulder pattern?

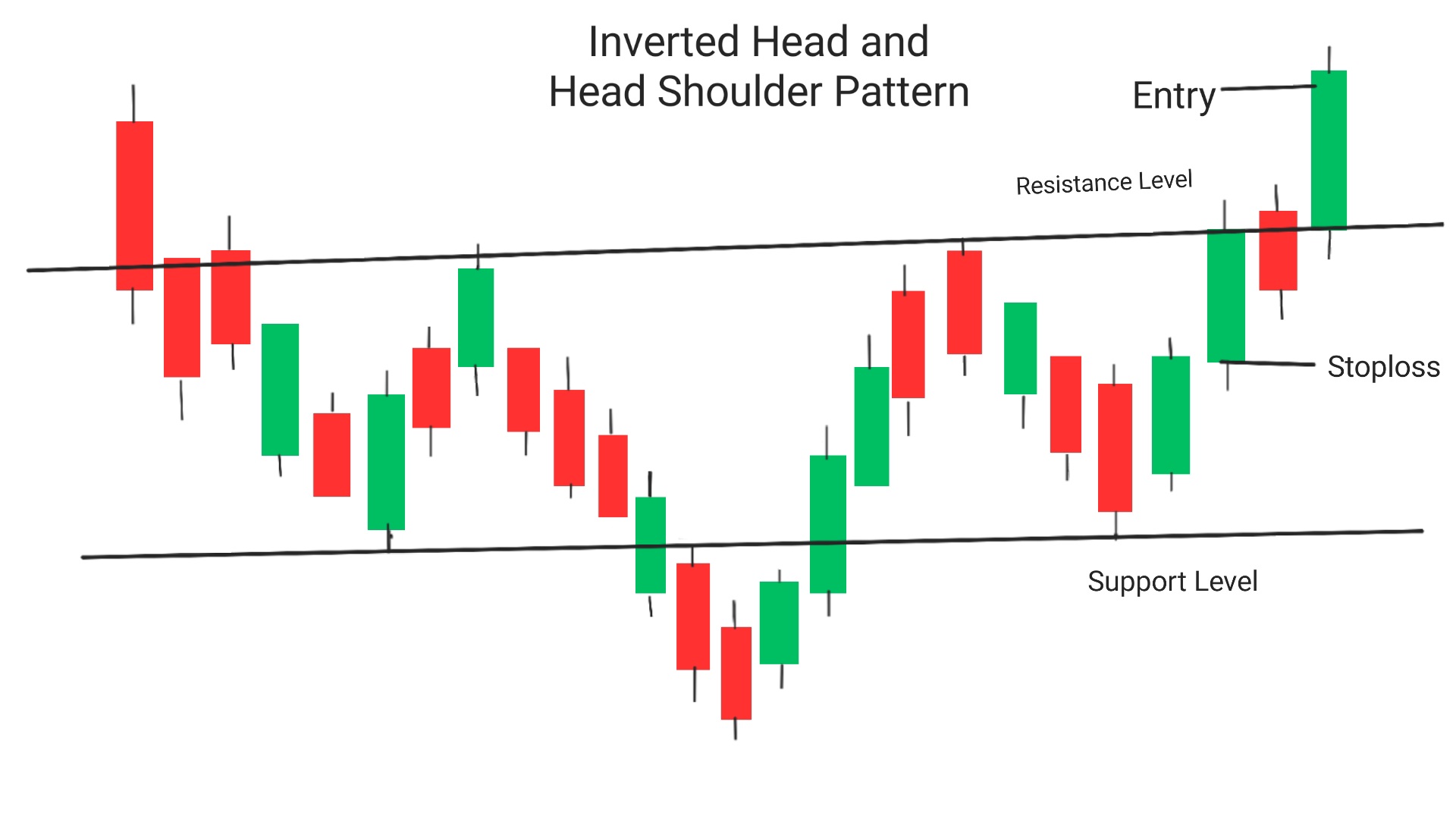

An inverted head and shoulder pattern is a bullish reversal chart pattern that forms after a downtrend(it has the potential to conver uptrend into downtrend). It consists of three lows with the middle low (the head) being the lowest, and the other two lows (the shoulders) being slightly higher.

The pattern is completed when the price breaks above the neckline, which is a horizontal line drawn through the highs between the two shoulders. This pattern is also known as three Budhhas, It also resembles an inverted man.

Why is it called an inverted head and shoulder pattern?

The inverted head and shoulder pattern aldo termed as inverse head and shoulder pattern is called so because it looks like an upside-down version of the head and shoulder pattern, which is a bearish reversal pattern. In the head and shoulder pattern, there are three highs with the middle high (the head) being the highest, and the other two highs (the shoulders) being slightly lower.

How to identify an inverted head and shoulder pattern?

To identify an inverted head and shoulder pattern, traders should look for the following characteristics:

1.A downtrend leading to the formation of the pattern

2.Three lows with the middle low being the lowest

3.The two shoulders should be roughly equal in height and width

4.The neckline should be drawn through the highs between the two shoulders

5.The breakout should occur on high volume

How an Inverted Head and Shoulder Pattern is formed?

- Previous trend must be in downtrend.

- At a certain depth price takes support and starts rising up. It creates the left shoulder of the pattern.

- After rising for some distance price takes resistance and again falls down and breaks the previous support level and takes support at a price lower than the left shoulder.

- From the 2nd support price starts rising up and takes resistance at the same level where the first uptrend has taken resistance(This can vary 2-3% up/down than the 1st). this process creates the head of the pattern.

- From the standard support level, Price starts rising again and takes resistance at the same level where the high of first shoulder has taken resistance. From this level price starts dalling down, creating the right shoulder.

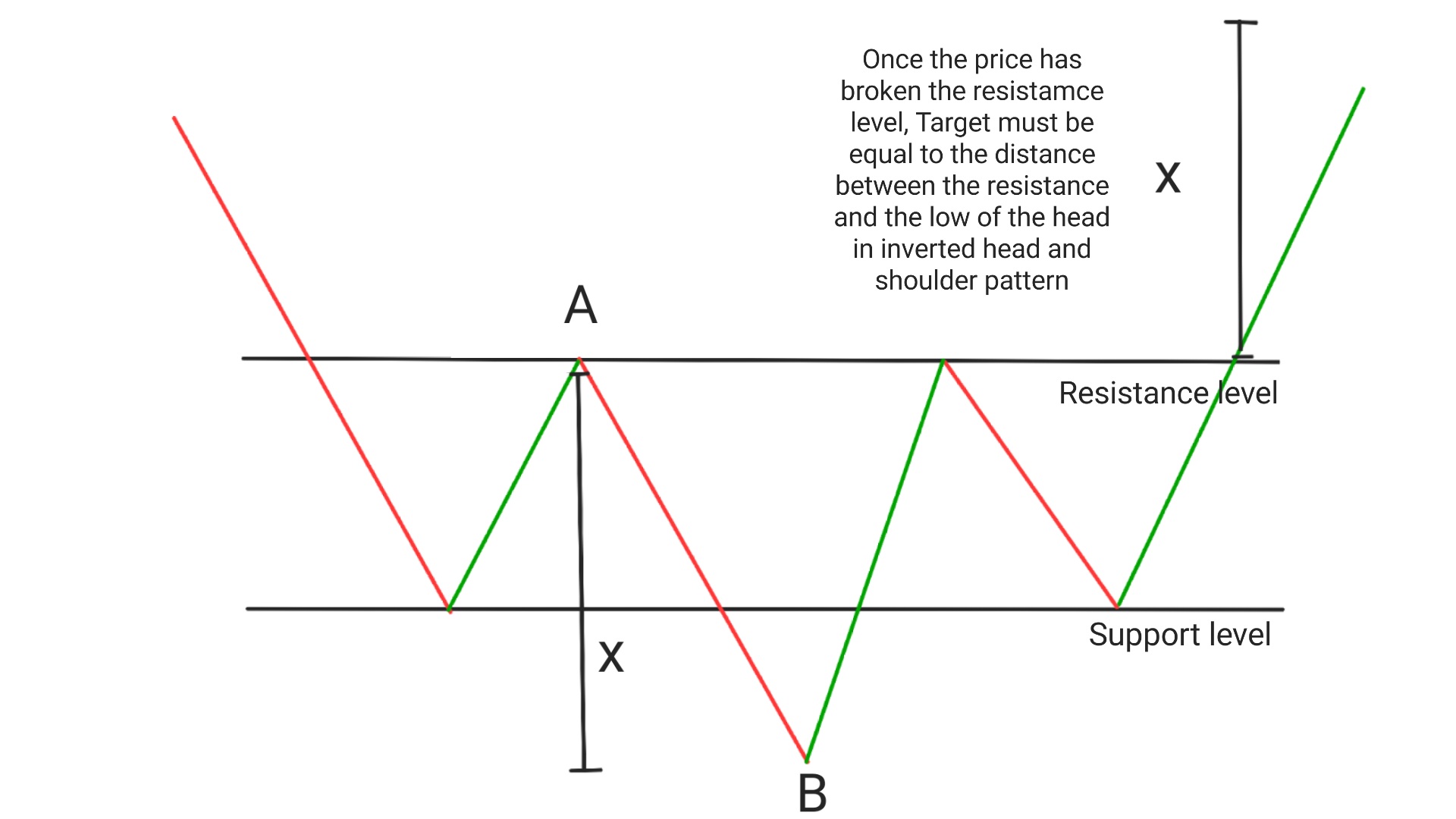

- If the price breaks the resistance at this point, enter a long position with target equal to the distance between resistance the the lowest point of the inverted head and shoulder pattern.

- Refer the following table to check validity of inverted head and shoulder pattern.

-

Type Of Investment Gap Between Two highs Intraday Chart 7-8 Candles Gap Short Term 3-4 Weeks Gap Medium Term 3-4 Months Gap Long Term 1-2 Years or more

What does an inverted head and shoulder chart pattern indicate?

An inverted head and shoulder pattern indicates that the downtrend is coming to an end, and a new uptrend is about to begin. The pattern is considered a reliable bullish reversal signal because it shows that buyers are starting to gain control over sellers.

How to trade an inverted head and shoulder pattern?

Traders can trade an inverted head and shoulder pattern by buying when the price breaks above the neckline. The stop-loss should be placed below the right shoulder, and the profit target should be set at least equal to the distance between the head and the neckline.

The inverted head and shoulders pattern is a bullish reversal pattern that occurs after a downtrend. Here are the steps to trade this pattern:

1. Identify the pattern: Look for a chart with a clear downtrend and an inverted head and shoulders pattern forming at the bottom of the trend.

2. Confirm the pattern: Confirm the pattern by checking if the left shoulder, head, and right shoulder are clearly visible. Also, check if the neckline is well-defined.

3. Wait for a breakout: Wait for the price to break above the neckline or resistance of the pattern. This is a confirmation that the pattern is valid and the price is likely to continue higher.

4. Enter a long position: Once the breakout occurs, enter a long position with a stop loss below the right shoulder of the pattern. The target price can be calculated by measuring the distance between the head and the neckline and adding it to the breakout point.

Inverted Head and Shoulder target

Once the price has given breakout at the resistance level, Trader must project a target equal to the distance between the resistance and the lowest point of the inverted head and shoulder pattern i.e difference between points A and B.

Conclusion

the inverted head and shoulder OR inverse head and shoulder pattern is a reliable bullish reversal pattern that signals the end of a downtrend and the start of an uptrend.

Traders can use this pattern to identify potential buying opportunities and manage their risk by placing stop-loss orders with target equal to the distance between the resistance and low of the pattern.

By understanding this pattern, traders can improve their technical analysis skills and increase their chances of success in the financial markets.

Frequently Asked Questions(FAQs)

1.Is inverted head and shoulders bullish?

Yes, the inverted head and shoulders pattern is considered bullish in technical analysis.

2.What does the inverse head and shoulders pattern mean?

The inverse head and shoulders pattern is a bullish reversal pattern that forms after a downtrend. It consists of three lows, with the middle low (the head) being lower than the two surrounding lows (the shoulders). The pattern is completed when the price breaks above the neckline, which is drawn through the highs between the shoulders.

3.What is the head and shoulder reversal pattern?

The head and shoulder reversal pattern is a bearish reversal pattern that forms after an uptrend. It consists of three peaks, with the middle peak (the head) being higher than the two surrounding peaks (the shoulders). The pattern is completed when the price breaks below the neckline, which is drawn through the lows between the shoulders.

4.What is the inverse head and shoulders pattern confirmation?

The confirmation of the inverse head and shoulders pattern occurs when the price breaks above the neckline on high volume, signaling a potential trend reversal.

5.What is the success rate of inverted head and shoulders?

The success rate of inverted head and shoulders patterns is nearly 90%, Which means for every 10 trades taken you can book profit in 9 ot of those 10 trades on the basis of inverted head and shoulder pattern.