The In Neck Candlestick Pattern

If you’re a trader, you’ve probably heard about In Neck candlestick pattern. This pattern is one of a popular technical analysis tool used to identify potential trend continuation in the market. In this article, we’ll go through and will understand in detail about what the In Neck pattern is, how it works, and how to trade in neck candlestick pattern.

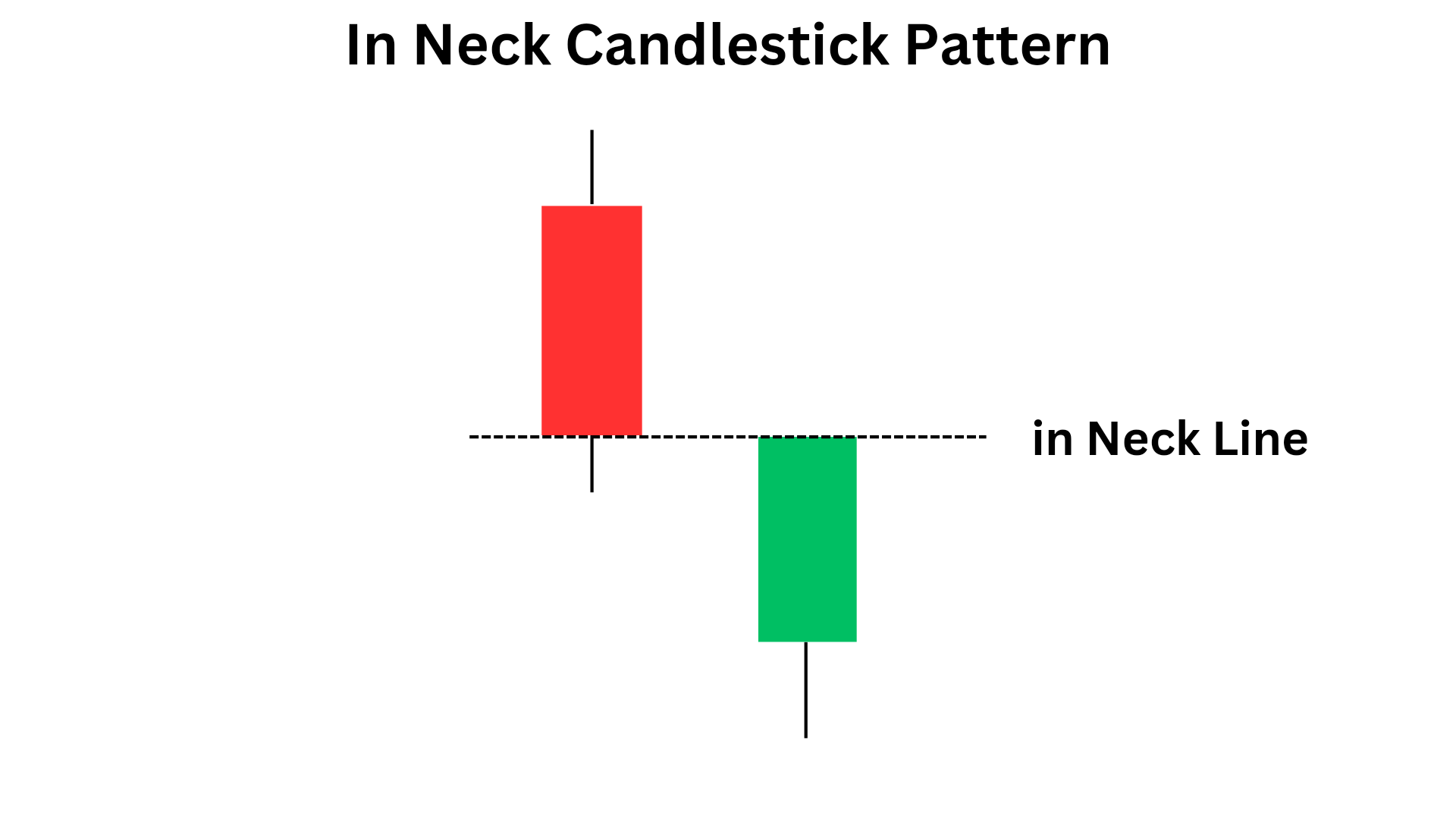

What is the In Neck Candlestick Pattern?

The In Neck candlestick pattern is two candlestick bearish continuation pattern that appears after during a downtrend. The first candle is a long bearish candle and the second candles is a bullish candle(can be of any size) that opens above the low of the previous day’s candle and closes below the low of the red candle.

Characteristics Of In Neck Candlestick Pattern

- The first candle is red(bearish or black) while the next candle is green(bullish or white) in colour.

- The high of the first candle must cross low of the red candle.

- It is a bearish continuation pattern.

- It is formed during a downtrend.

- first candle must be in medium to large size, while the secon cand candle can be of any size.

How Does the In Neck Candlestick Pattern Work?

- The In Neck pattern is a bearish continuation pattern. It suggests that the downtrend is likely to continue after a brief pause.

- The small bullish candle that follows the long bearish candle indicates that buyers have tried to push the price up, but they were unsuccessful in creating a significant uptrend.

- As a result, sellers take control againi.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

How to trade In Neck Candlestick Pattern?

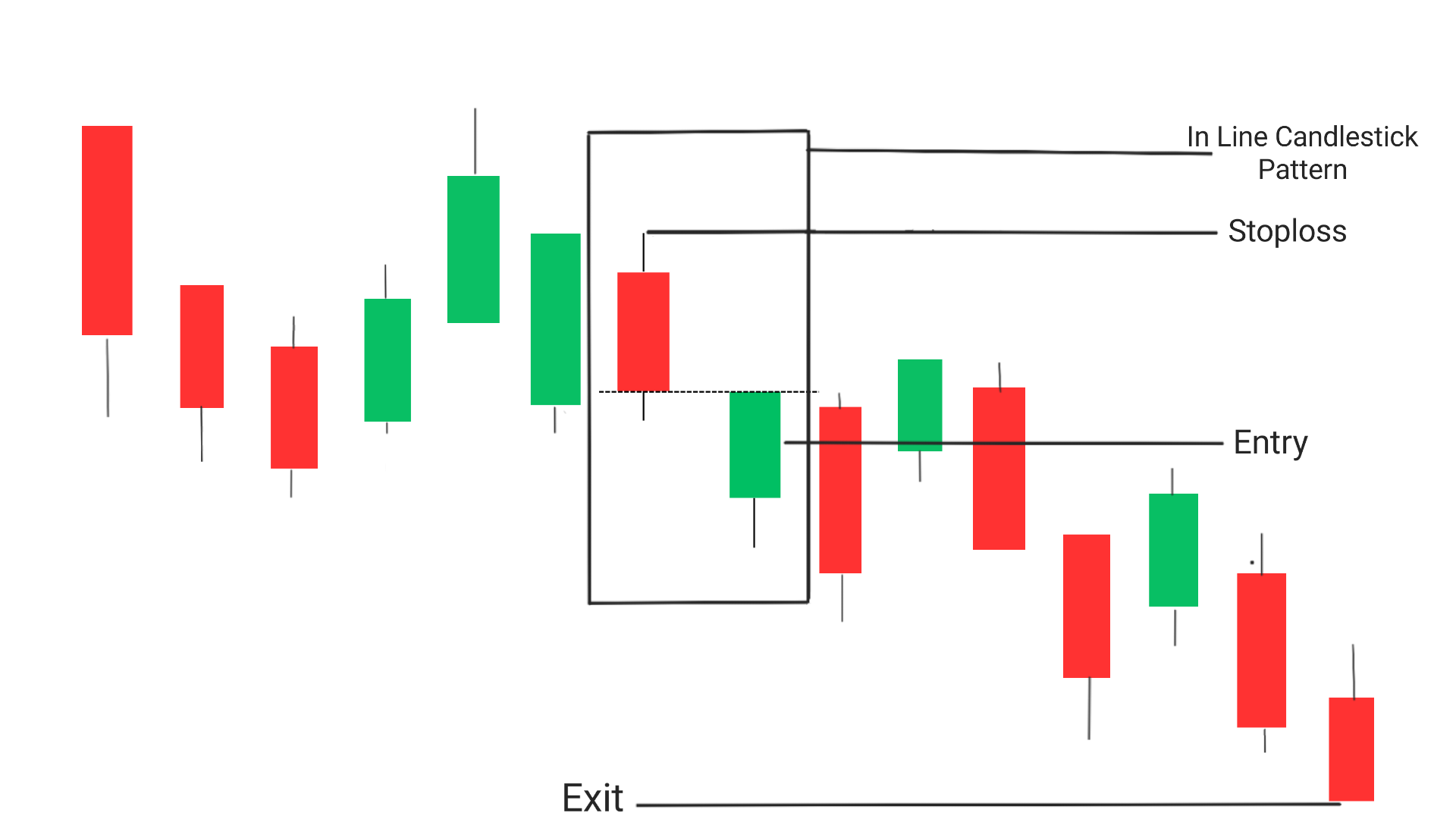

Entry for In neck pattern: The best entry point to trade while using in neck candlestick pattern is from the candle next to the pattern.

Exit point for In Neck pattern: Exit the trade when you have achieved your target or when price reaches a significant support level, If you want to trade more you can look for a breakout near support level if it happens then take trade upto next support level.

Stoploss: In order to minimise the risk of stoploss hitting, stoploss must be set at the high of the candlestick pttern.

You can use the in Neck pattern for shorting(selling) opportunities in the market. When you see this pattern, it suggests that the downtrend is likely to continue, and you should consider opening a short position.

Conclusion

The In Neck candlestick pattern is a bearish continuation pattern ,used by technical analysts for shorting opportunities in the mmarket. It’s easy to spot, once it gets confirmed add stoploss at the high of the candle previous to in neck pattern and exit trade when you reached your target.

Frequently Asked Questions(FAQs)

1.What is the in neck pattern candlestick?

Bullish neckline pattern are bullish continuation pattern that are formed during an uptrend. It consists of two candles creating a neckline between them. It is of two types (i) In Neck and (ii) On Neck Candlestick pattern.

2.What is the bullish neckline pattern?

The bullish neckline pattern is a three-candlestick pattern that appears during a downtrend. The first candlestick is a long bearish candle, followed by a small bullish candle that opens below the previous candle’s close but closes above it. The third candlestick is a long bullish candle that confirms the reversal of the trend.

3. The 3 candle rule refers to a trading strategy where traders wait for three

3 candle rule is a bullish reversal pattern which consists of 3 candles , in which the first candle is a red with a long body. The second candle is a green with a small real body that opens and closes within the real body of the first red candle. The third candle is a green that closes above the close of the second candle.

4.What is the most trusted candlestick pattern?

The most trusted candestick pattern is Inverted Hammer Candlestick Pattern.

5.What is the bullish neckline pattern?

Bullish neckline pattern are bullish continuation pattern that are formed during an uptrend. It consists of two candles creating a neckline between them. It is of two types (i) In Neck and (ii) On Neck Candlestick pattern.