How to Trade Cup and handle pattern?

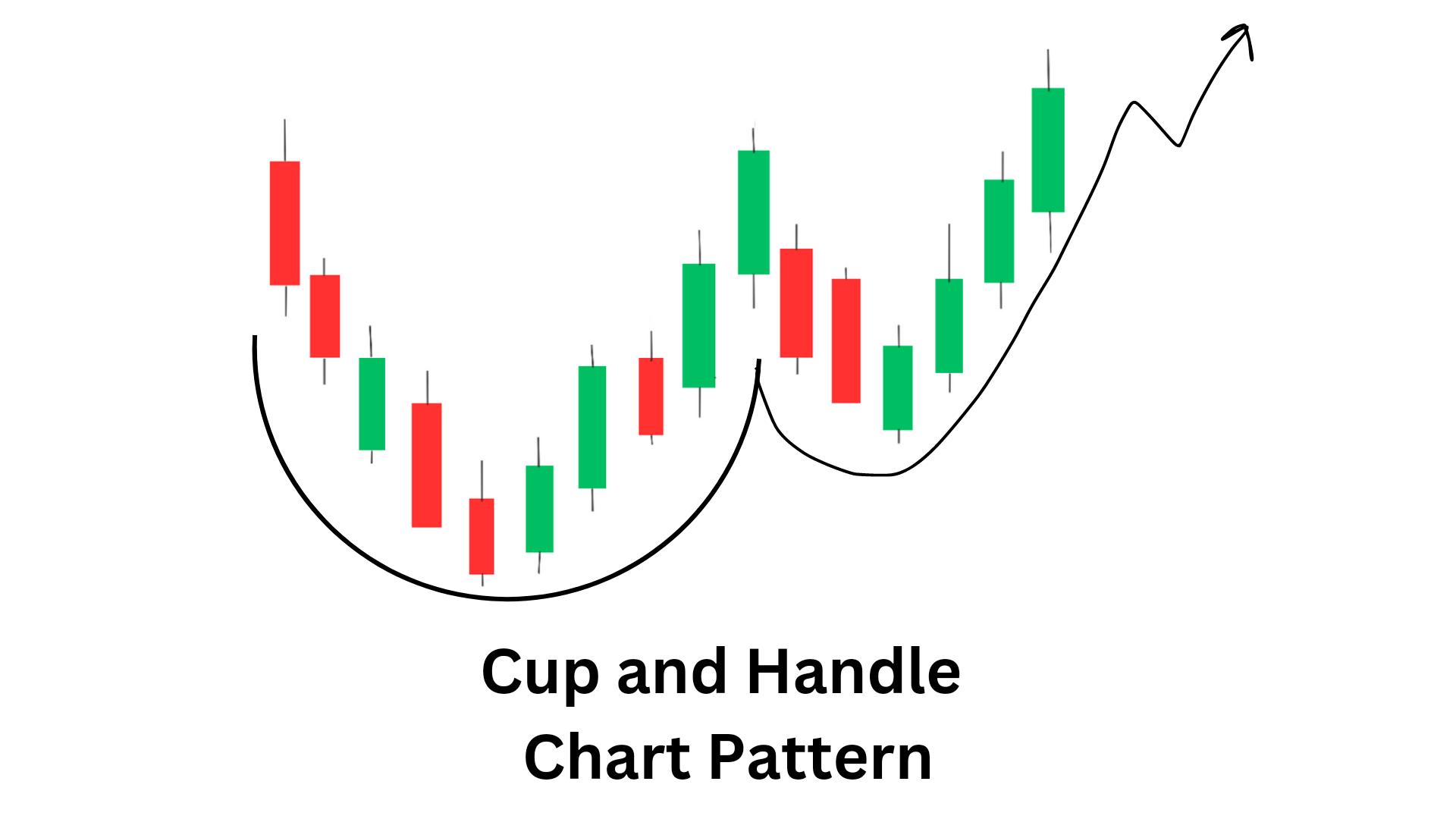

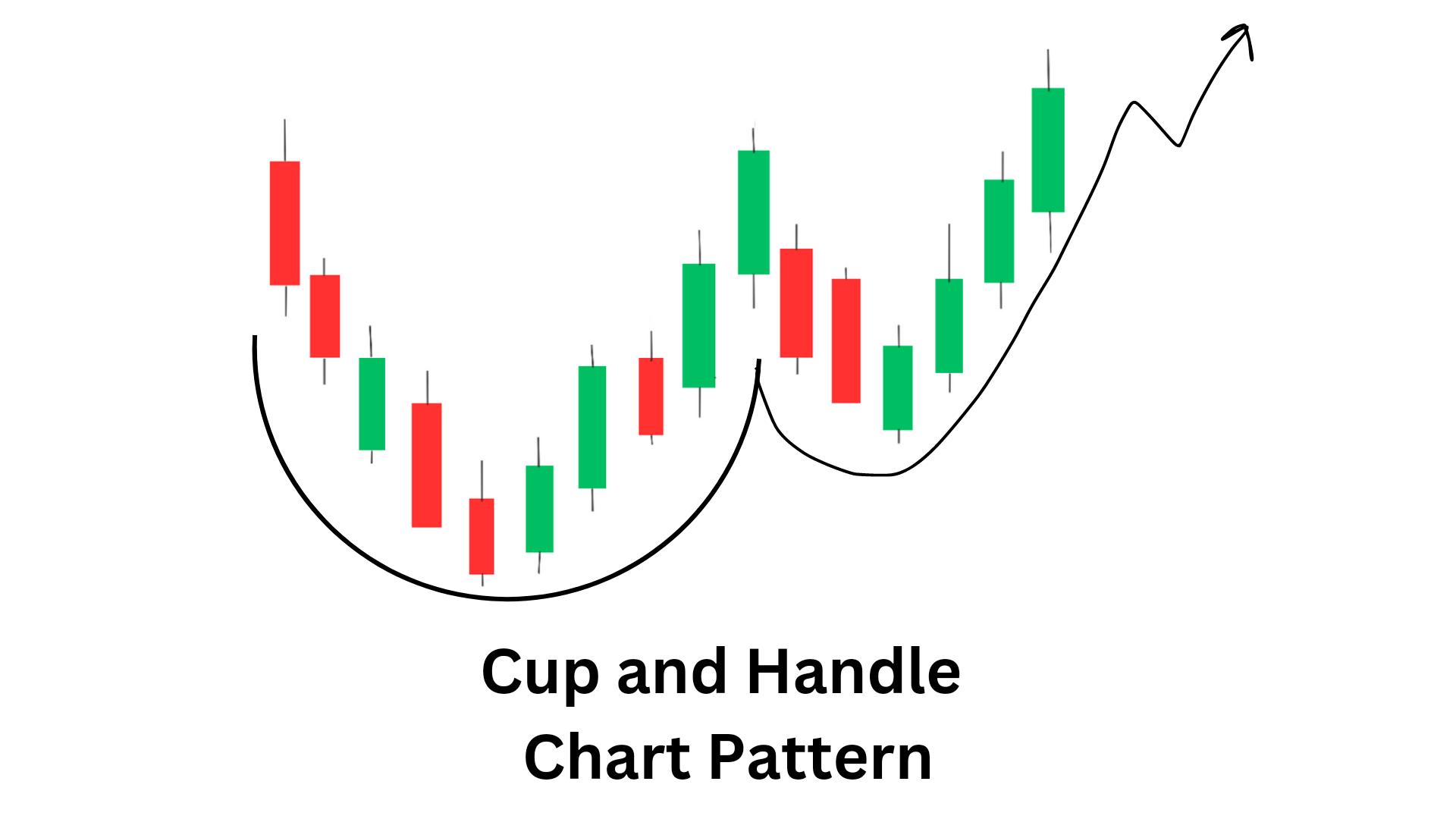

Cup and handle pattern is a powerful technical analysis tool used by traders for decades to identify potential bullish trends in the stock market. It is a U-shaped bottom followed by a slight downward slope in the form of a handle. This pattern is known for its proven track record and widely used by traders to make profitable trades in the stock market.

In this blog, we will discuss the cup and handle pattern, its significance, and how to use it for trading, Cup and handge target,

What is a Cup and Handle Pattern?

The Cup and Handle pattern is a bullish continuation chart pattern that indicates a potential uptrend in the stock market. The body of the cup resembles a ‘U’ shape while the handle looks like a ‘V’ shape. It is formed when the price of a stock drops to a low point, then rises again, forming a U-shaped bottom. This is followed by a slight downward slope in the form of a handle.

In stock cup and handle pattern is considered a reliable technical analysis tool because it shows a gradual decline followed by a gradual rise. This pattern is used by traders to identify potential buying opportunities in the stock market.

Cup and Handle Formation

The cup and handle pattern is formed over a period it can range for several weeks of time as the stock price goes through a specific series of movements. Here are the general steps involved in the formation of a cup and handle pattern:

1. Downtrend: The stock price was in a downtrend, with prices falling for an extended period.

2. U-Shaped Bottom: The stock price reaches a bottom creating a U-shaped bottom. The bottom should be rounded, not V-shaped.

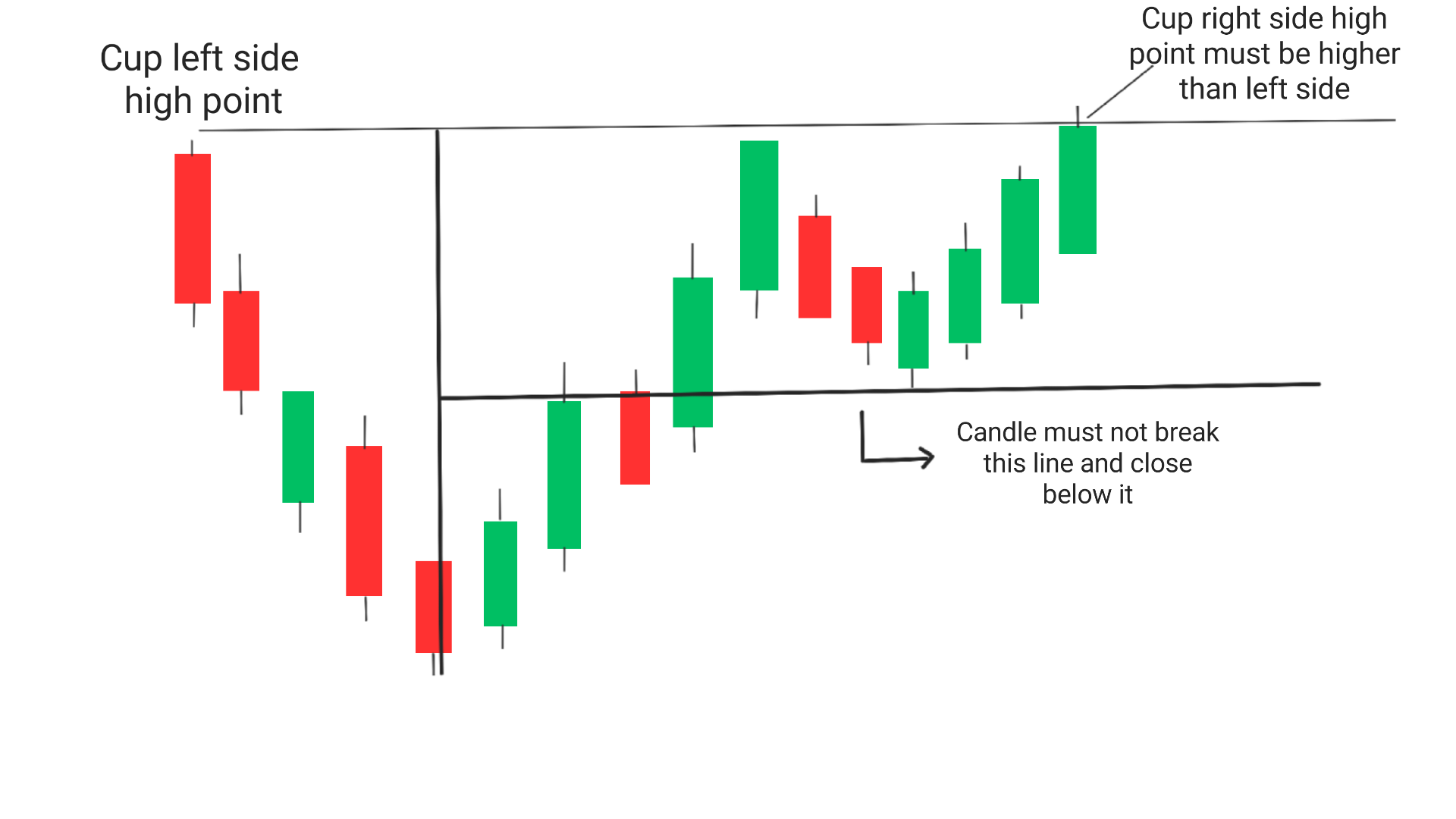

3. Resistance: The stock price starts rising from the U-shaped bottom and reaches a significant resistance level. This resistance level is the top of the “cup” formation.

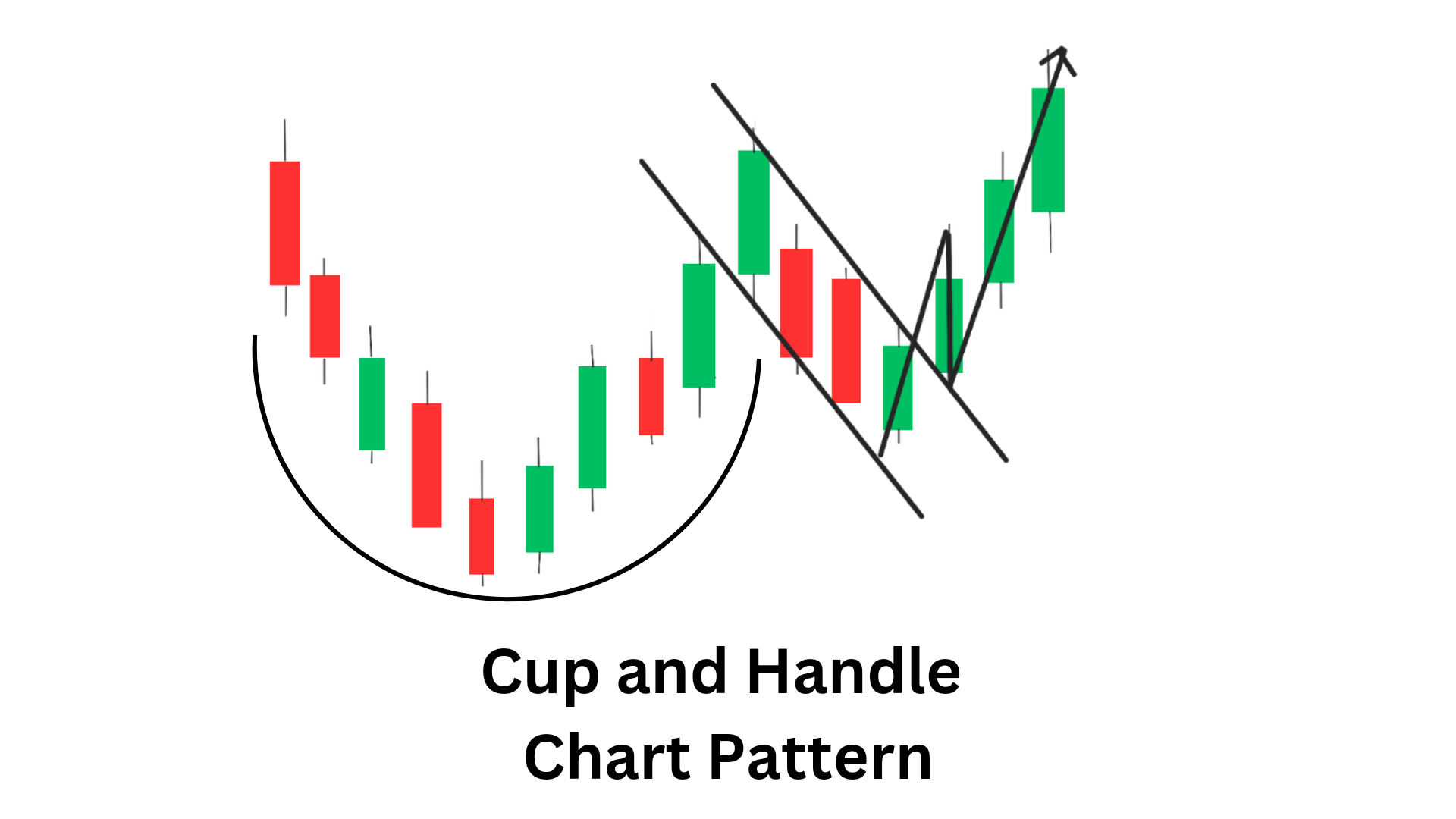

4. Pullback: The stock price pulls back from the resistance level, forming a handle. The handle should be relatively shallow and form on lower volume.

5. Breakout: The stock price breaks out above the resistance level of the handle, confirming the pattern. This breakout should be accompanied by higher volume, indicating that buyers are taking control.

6. Uptrend: The stock price enters an uptrend, with prices rising for an extended period.It’s important to note that not all cup and handle chart patterns will look exactly the same, and some may take longer to form than others. However, the general structure of the pattern should follow these steps.

Significance of Cup and Handle Pattern

The cup and handle chart pattern is significant because it signals a potential bullish trend in the stock market. When the price breaks out of the handle formation, it is a bullish signal, and traders can expect the price to continue rising.

The cup and handle pattern is also significant because it helps traders in identifying potential buying opportunities in the stock market. Traders can use this pattern to set entry and exit points, determine their stop-loss order, and take profits.

The cup and handle pattern is a popular technical analysis tool used by traders to identify potential bullish trends in the stock market. This pattern is named after its shape, which resembles a cup with a handle on the right side.

How to Identify the Cup and Handle Pattern?

To identify the cup and handle pattern, you must look for a U-shaped bottom formation, followed by a smaller dip on the right side. The handle should be relatively shallow, with the price moving sideways or slightly downward before breaking out to the upside. The handle should also be at least one-third the depth of the cup, but no more than half.

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

Why is the Cup and Handle Pattern Important?

The cup and handle pattern is important because it provide traders with a clear entry point for buy positions. When the price breaks out of the resistance level at the handle, it signals that buyers have taken control and that the stock is likely to continue its upward trend. Traders can use this pattern to set stop-loss orders below the handle as it has very less chances of failure, which can help minimize losses if the trade doesn’t go as planned.

How to Use Cup and Handle Pattern for Trading:

1. Identify the Pattern:

The first step in trading cup and handle pattern is to identify the pattern. Look for a U-shaped bottom followed by a slight downward slope in the form of a handle. The pattern should have a gradual decline followed by a gradual rise.

2. Confirm the Pattern:

The next step is to confirm the pattern. Look for confirmation that the pattern is valid by checking the volume during the cup formation and the handle formation. The volume should be higher during the cup formation and lower during the handle formation.

3. Set Entry and Exit Points:

Determine your entry point by setting a buy order above the resistance level of the handle. Set a stop-loss order below the support level of the handle to limit your losses if the breakout fails. Determine your exit point by setting a sell order at a target price that is at least twice the size of the cup’s depth.

4. Monitor the Trade:

Keep an eye on the trade and adjust your stop-loss order as needed. If the price breaks out of the handle, it’s a bullish signal, but if it falls below the support level, it’s a bearish signal.

5. Take Profits:

Take profits when the price reaches your target price or when you see signs of a trend reversal.

What should be Cup and Handle pattern Target?

Cup and handle pattern example:

The target for a cup and handle chart pattern must be the distance between Neckline(Top of cup and handle pattern) and bottom of Cup and Handle pattern and then add this target distance to the breakout point. This gives an estimate of how high the stock price may rise after breaking out of the pattern.

However, it’s important to note that this target may change according to price action theory. The stock price may not reach the target, or it may exceed it. Traders should also consider other factors such as market conditions, company fundamentals, and technical indicators before making any trading decisions based on a cup and handle pattern.

Conclusion

The cup and handle pattern is a reliable technical analysis tool used by traders to identify potential buying opportunities in the stock market. By following the steps outlined in this blog, traders can use this pattern to make profitable trades in the stock market. Remember to do your research, use proper risk management techniques, and never risk more than you

Frequently Asked Questions (FAQs)

1.Is cup and handle pattern bullish?

Yes, the cup and handle pattern is a bullish continuation pattern.

2.What are the rules for the cup and handle pattern?

The rules for the cup and handle pattern include:

– A U-shaped bottom followed by a slight downward slope in the form of a handle

– The cup should have a gradual decline followed by a gradual rise

– Volume should be higher during the cup formation and lower during the handle formation

– The breakout should occur above the resistance level of the handle

3.What is the cup and handle pattern called?

The cup and handle pattern is called a bullish continuation pattern.

4.Is cup and handle pattern buy or sell?

Yes,The cup and handle pattern is a buy signal as it indicates a potential uptrend in the stock market.

5.Is cup and handle bearish?

No, the cup and handle pattern is not bearish. It is a bullish continuation pattern that signals a potential uptrend in the stock market.

2 thoughts on “How To Trade Cup and handle pattern? 5 FAQs”