Hanging man vs hammer candlestick

The hanging man and hammer candlestick patterns in trading, including their definitions, trading strategies, appearance, some examples, user experiences, and success rates. By incorporating these keywords into your content, you can attract more organic traffic from users who are interested in learning about these candlestick patterns and how to use them in their trading strategies.

What are Hanging Man and Hammer Candlestick Patterns?

The hanging man and hammer candlestick patterns are two important candlestick patterns that many traders use to analyze the market and make informed trading decisions. These patterns can provide valuable insights into market sentiment and potential price reversals.

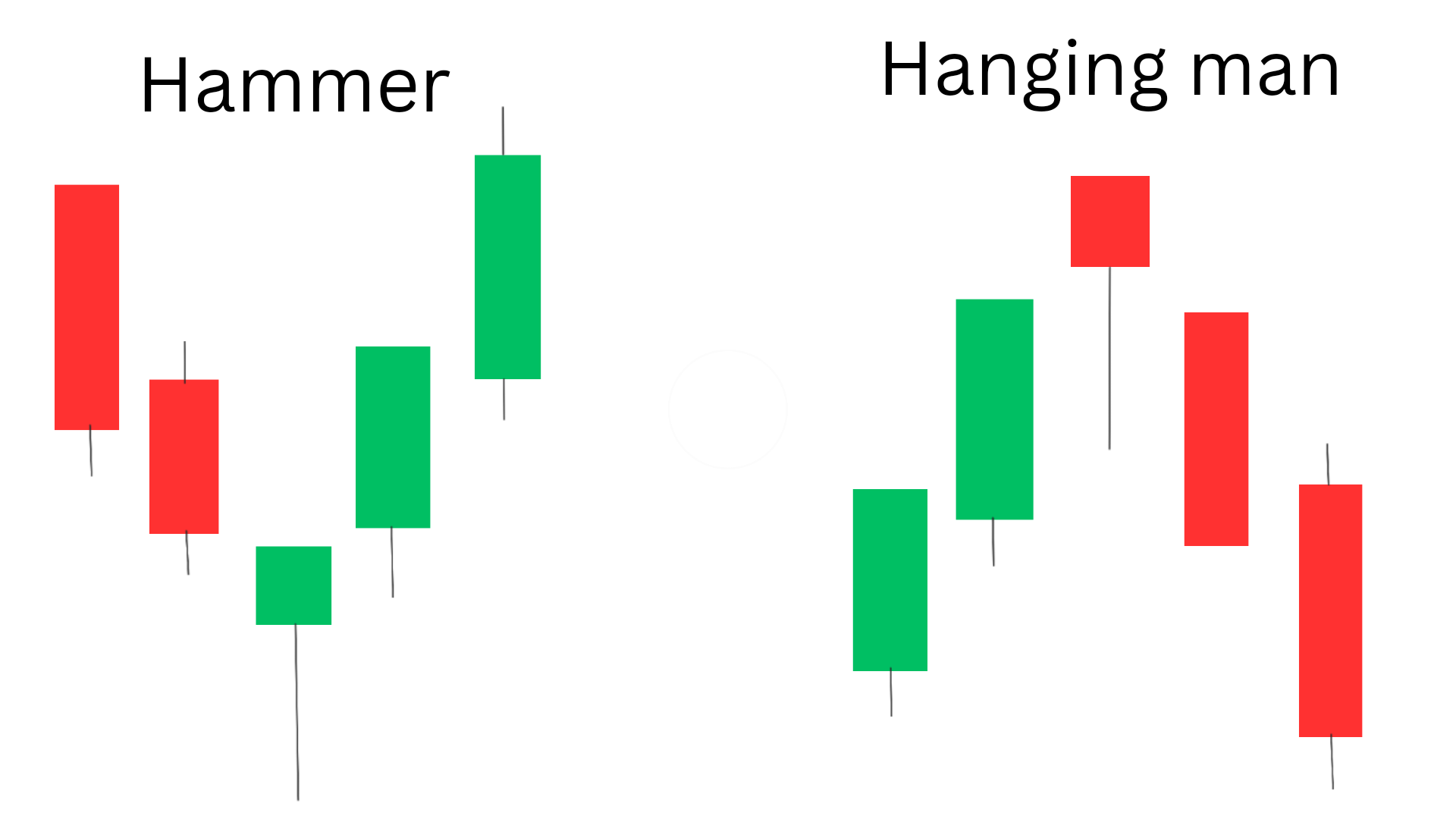

The hanging man candlestick pattern is a single candlestick bearish reversal pattern that forms at the end of an uptrend. It has a small body with a long lower shadow and little to no upper shadow. The pattern indicates that buyers were initially in control but lost momentum, leading to a potential trend reversal as sellers are ready to take the charge.

On the other hand, the hammer candlestick pattern is a single candlestick bullish reversal pattern that forms at the end of a downtrend. It has a small body with a long lower shadow and little to no upper shadow. The pattern suggests that sellers were initially in control but lost momentum, signaling a potential trend reversal to the upside as the buyers are ready to take the charge.

Hanging man Vs Hammer in tabular form

| Hanging Man | Hammer |

|---|---|

| It is a single candlestick bearish reversal pattern. | It is a single candlestick bullish reversal pattern. |

| It is formed at the top of an uptrend. | It is formed at the end of a downtrend. |

| It indicates that buyers are loosing control and sellers are going to dominate market. | It indicates that sellers are losing grip and buyers are ready to take charge of the market. |

to learn trading from scratch you will need a guidance from external sources so here is the best guide for trading , it includes charts, candlesticks and theories.

Trading Strategy for Hanging Man and Hammer Candlestick Patterns

When it comes to trading strategies for the hanging man and hammer candlestick patterns, traders often look for confirmation signals before making any trading decisions. This can include waiting for the next candle to close in the opposite direction of the hanging man or hammer pattern to confirm the potential reversal.

In one line, understand the whole whole concept behind hanging man and hammer candlestick. If a hanging man candlestick pattern forms at the end of an uptrend, traders may wait for the next candle to close lower before considering a short position. Similarly, if a hammer candlestick pattern forms at the end of a downtrend, traders may wait for the next candle to close higher before considering a long position.

In addition to confirmation signals, traders may also use other technical indicators and chart patterns to support their trading decisions when incorporating hanging man and hammer candlestick patterns into their strategies.

Appearance of Hanging Man and Hammer Candlestick Patternsthe

The appearance of hanging man and hammer candlestick patterns is characterized by their unique shapes and long shadows. The hanging man pattern typically has a small body at the top of the candle with a long lower shadow, resembling a person hanging from a rope. On the other hand, the hammer pattern has a small body at the bottom of the candle with a long lower shadow, resembling a hammer.

These distinct shapes make it relatively easy for traders to identify hanging man and hammer candlestick patterns on price charts. When these patterns appear at key levels of support or resistance, they can provide valuable insights into potential market reversals.

Examples of Hanging Man and Hammer Candlestick Patterns

Let’s take a look at some examples of hanging man and hammer candlestick patterns in real trading scenarios:

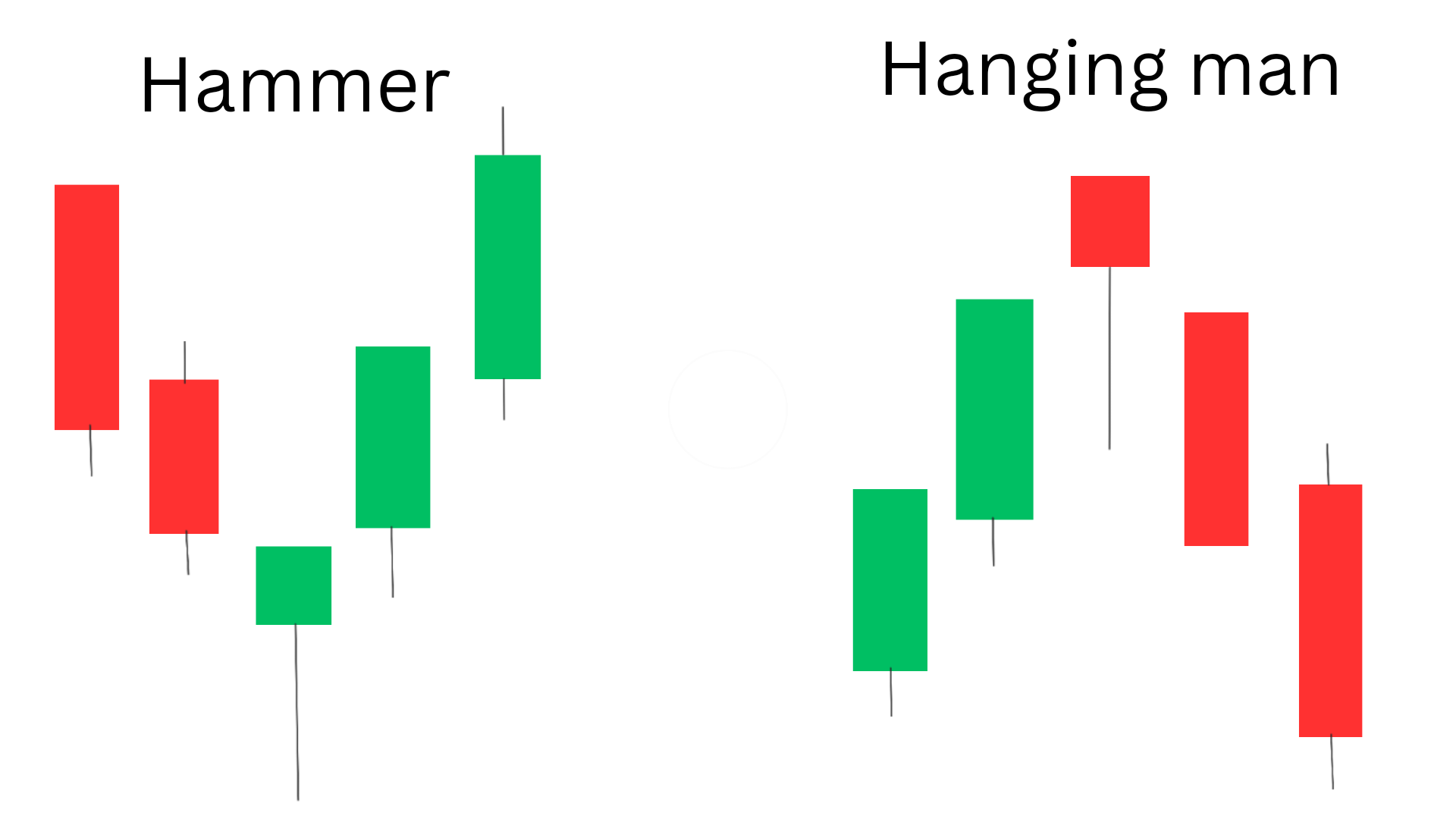

Example 1: Hanging Man Pattern

In this example, we see a hanging man candlestick pattern forming at the end of an uptrend on a daily chart for a particular stock. The small body of the candle is located at the top with a long lower shadow, indicating potential selling pressure. Traders may consider waiting for confirmation signals before entering a short position.

Hanging Man:

Entry: traders can take entry from the candle formed next to hammer. A short position can be entered when the low of the hanging man candlestick is broken.

Exit: Traders can exit the trade when the price movement reaches a support level, if you want to trade more then look for a real breakout and trade until new support level is achieved . In simple words, profit can be taken when the price reaches a support level or when a bullish reversal pattern appears.

Stop-loss: The stop-loss can be placed above the high of the hanging man candlestick to protect against a potential bullish reversal

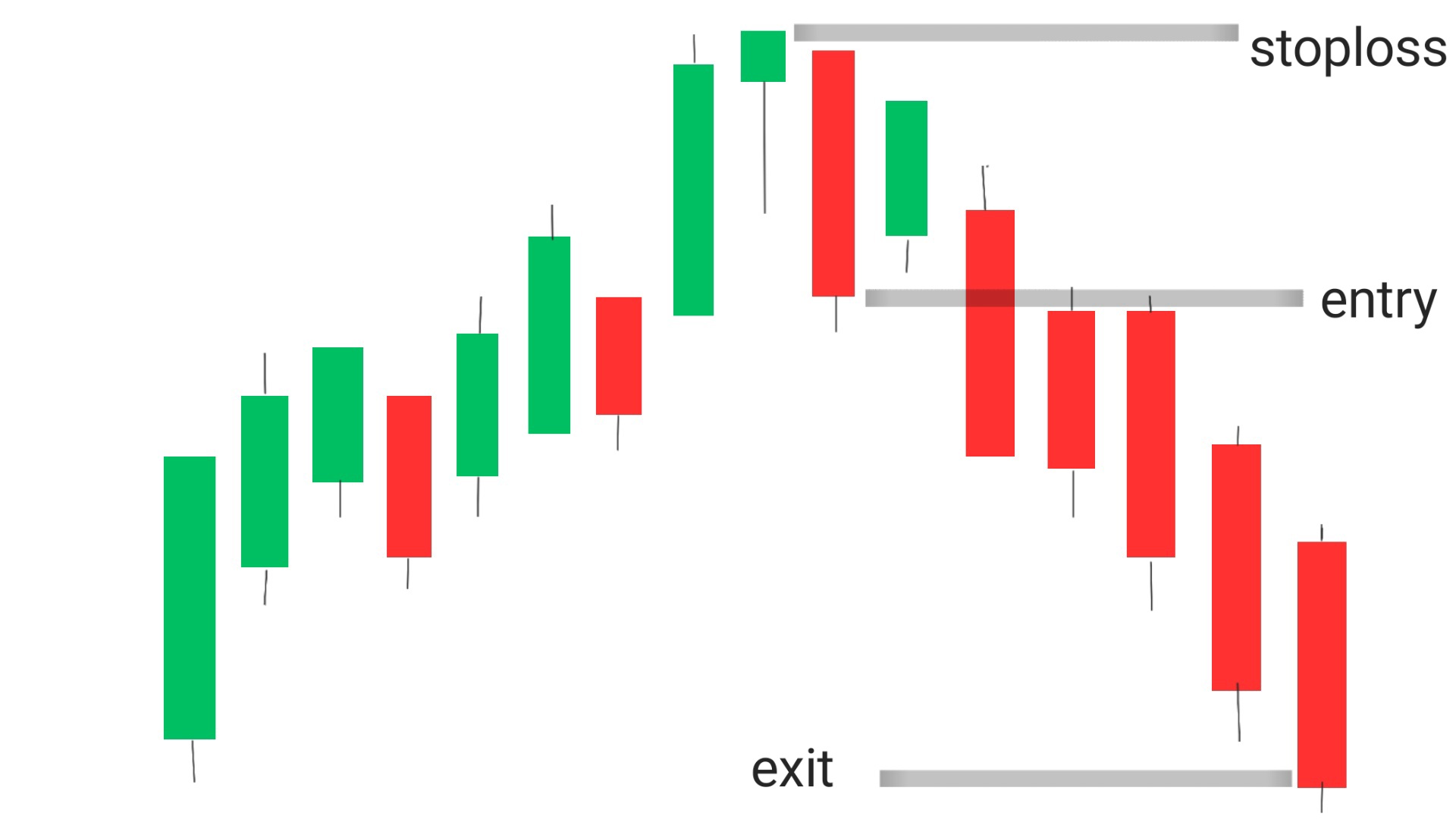

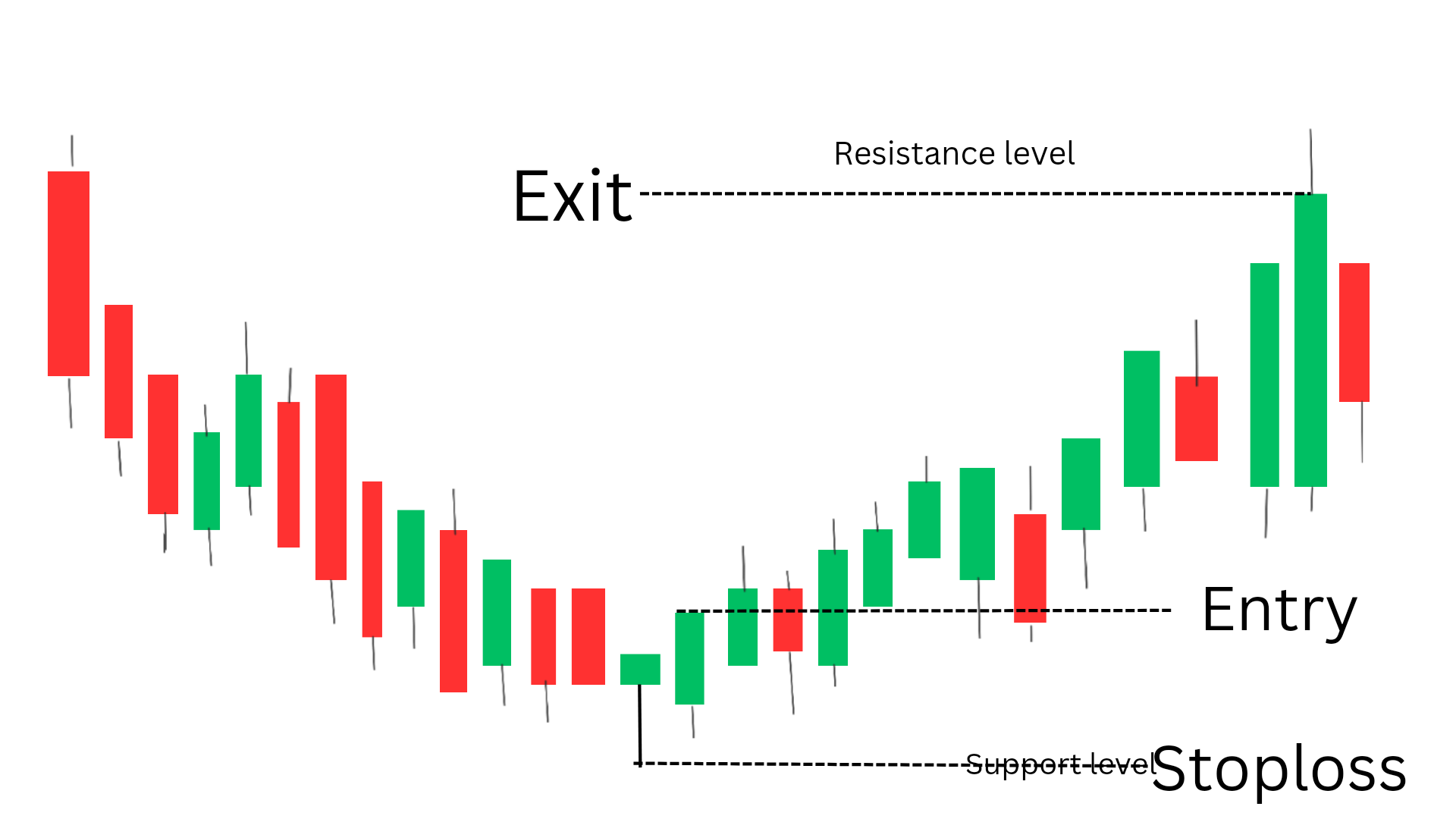

Example 2: Hammer Pattern

In this example, we observe a hammer candlestick pattern forming at the end of a downtrend on an hourly chart for a currency pair. The small body of the candle is located at the bottom with a long lower shadow, suggesting potential buying pressure. Traders may wait for confirmation signals before considering a long position.

Entry: traders can take entry from the candle next to the hammer. In simple words, a long position can be entered when the high of the hammer candlestick is broken.

Exit: Traders can exit the trade when the price movement reaches a resistance level, if you want to trade more then look for a real breakout and trade until new resistance level is achieved. In simple words, profit can be taken when the price reaches a resistance level or when a bearish reversal pattern appears.

Stop-loss: The stop-loss can be placed below the low of the hammer candlestick to protect against a potential bearish reversal.

User Experience and Success Rate

Many traders have reported positive experiences when incorporating hanging man and hammer candlestick patterns into their trading strategies. Overall, in general hammer has a success rate around 60% and hanging man has around 59%.

The success rate of trading with hanging man and hammer candlestick patterns can vary depending on various factors such as market conditions, timeframe, and risk tolerance. Some traders may achieve consistent success with these patterns, while others may experience mixed results.

hanging man and hammer candlestick patterns are valuable tools for traders looking to analyze market sentiment and identify potential trend reversals. By considering these points surely, you will be able to improve your trading decisions.

Frequently Asked Questions(FAQs)

1.Is hanging man the same as a hammer?

yes, both are same in appearance. But the difference is in their place of formation eg. when hanging maan is formed at bottom it is called hammer and vice versa

2.Is Hanging Man bullish or bearish?

Hanging man is bearish , as it is formed at uptrend and has potential to reverse trend i.e. bullish to bearish.

3.Is hanging man and inverted hammer same?

NO, hanging man is just opposite of inverted hammer.