Evening Doji Star

Candlestick charts are widely used in technical analysis to identify potential market trends and price movements. One of the most popular and reliable candlestick patterns is the Evening Doji Star. This pattern is considered to be a strong bearish reversal signal, indicating that the uptrend is about to end and the market is likely to move in a downward direction. In this blog, we will discuss the Evening Doji Star in detail, its formation, interpretation, and how it can be used in trading.

What is an Evening Doji Star?

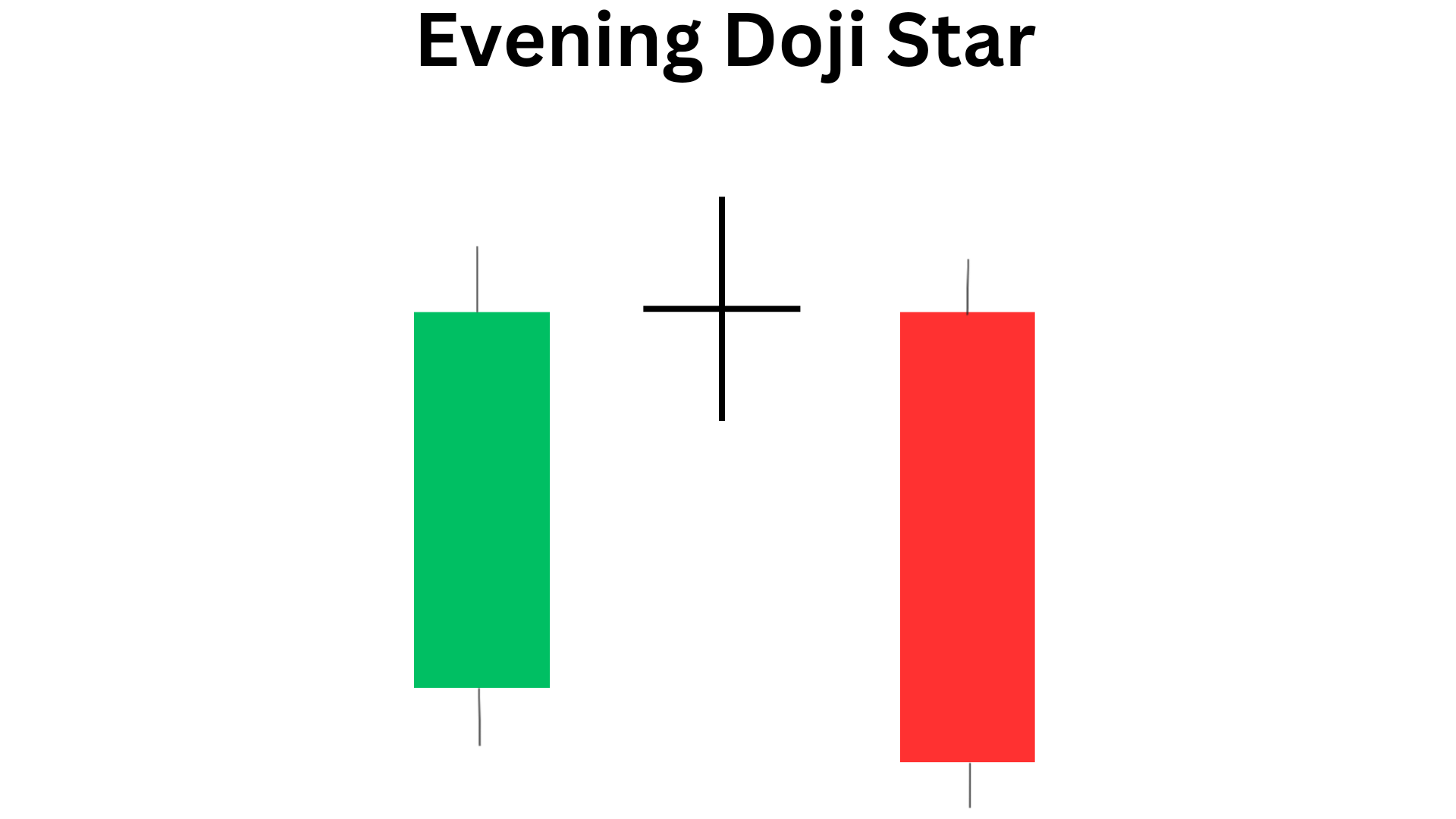

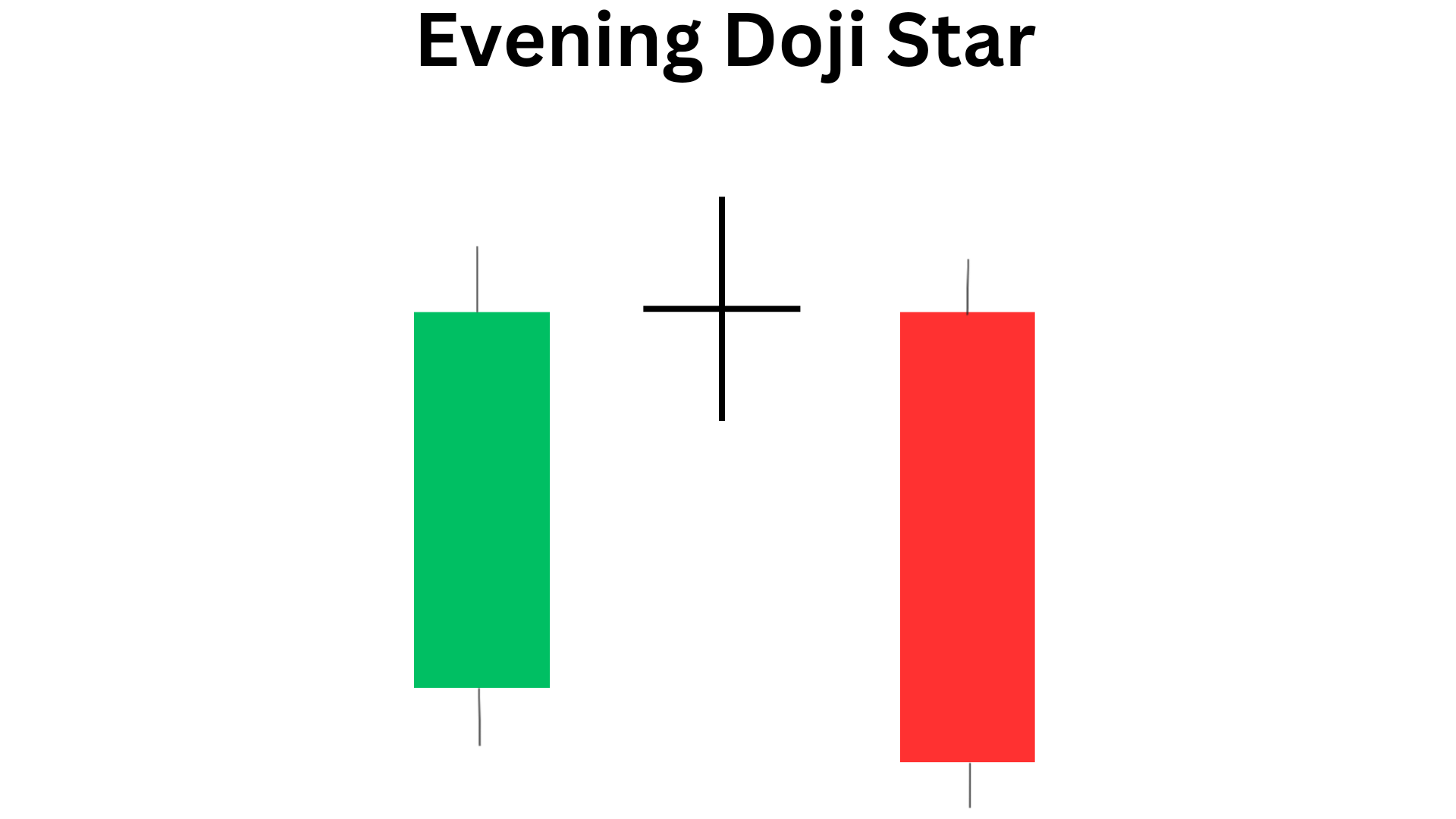

An Evening Doji Star is a three candlestick bearish reversal pattern that appears at the end of an uptrend. It consists of a long bullish candlestick, followed by a small Doji candlestick, and then a long bearish candlestick. The Doji candlestick represents indecision in the market, where buyers and sellers are in equilibrium. The long bearish candlestick that follows the Doji indicates that the sellers have taken control of the market and are pushing prices down.

The Evening Doji Star is a reversal pattern, which means that it signals a change in the direction of the trend. It is also a bearish pattern, suggesting that the market is likely to move downward in the future.

Key features of evening doji Star

The Evening Doji Star is a three-candlestick pattern that appears at the end of an uptrend.

- It consists of a long bullish candlestick, followed by a small Doji candlestick, and then a long bearish candlestick.

- The Doji candlestick represents indecision in the market, while the long bearish candlestick indicates that the sellers have taken control of the market.

- The Evening Doji Star is a reversal pattern, indicating a change in the direction of the trend.

- It is a bearish pattern, suggesting that the market is likely to move downward in the future.

- Traders can use this pattern to enter short positions or exit long positions, but should confirm it with other technical indicators and use proper risk management techniques.

How to Identify an Evening Doji Star?

Top Bestseller mastermind book to learn trading from scratch along with examples click here.

How to identify an Evening Doji Star?

you need to look for three candles that meet the following criteria:

1. The first candle should be a long bullish candlestick, indicating that the market is in an uptrend.

2. The second candle should be a small Doji candlestick, indicating indecision in the market.

3. The third candle should be a long bearish candlestick, indicating that the sellers have taken control of the market.

The length of the first and third candles should be roughly equal, while the second candle should have a small body and long wicks. The wicks of the Doji candlestick should not overlap with the first and third candles.

What does Evening Doji Star tells you?

The Evening Doji Star is a strong bearish reversal signal, indicating that the uptrend is about to end and the market is likely to move in a downward direction. It suggests that the buyers are losing momentum, and the sellers are taking control of the market.

The long bullish candlestick In the pattern represents the buying pressure in the market, but the small Doji candlestick that follows indicates that the buyers are losing their grip, and the market is becoming indecisive. The long bearish candlestick that follows the Doji suggests that the sellers have taken control of the market, and prices are likely to move down.

The Evening Doji Star Is a reliable pattern, but it should not be used in isolation. Traders should look for other technical indicators and confirmations to validate the pattern.

How to Trade an Evening Doji Star?

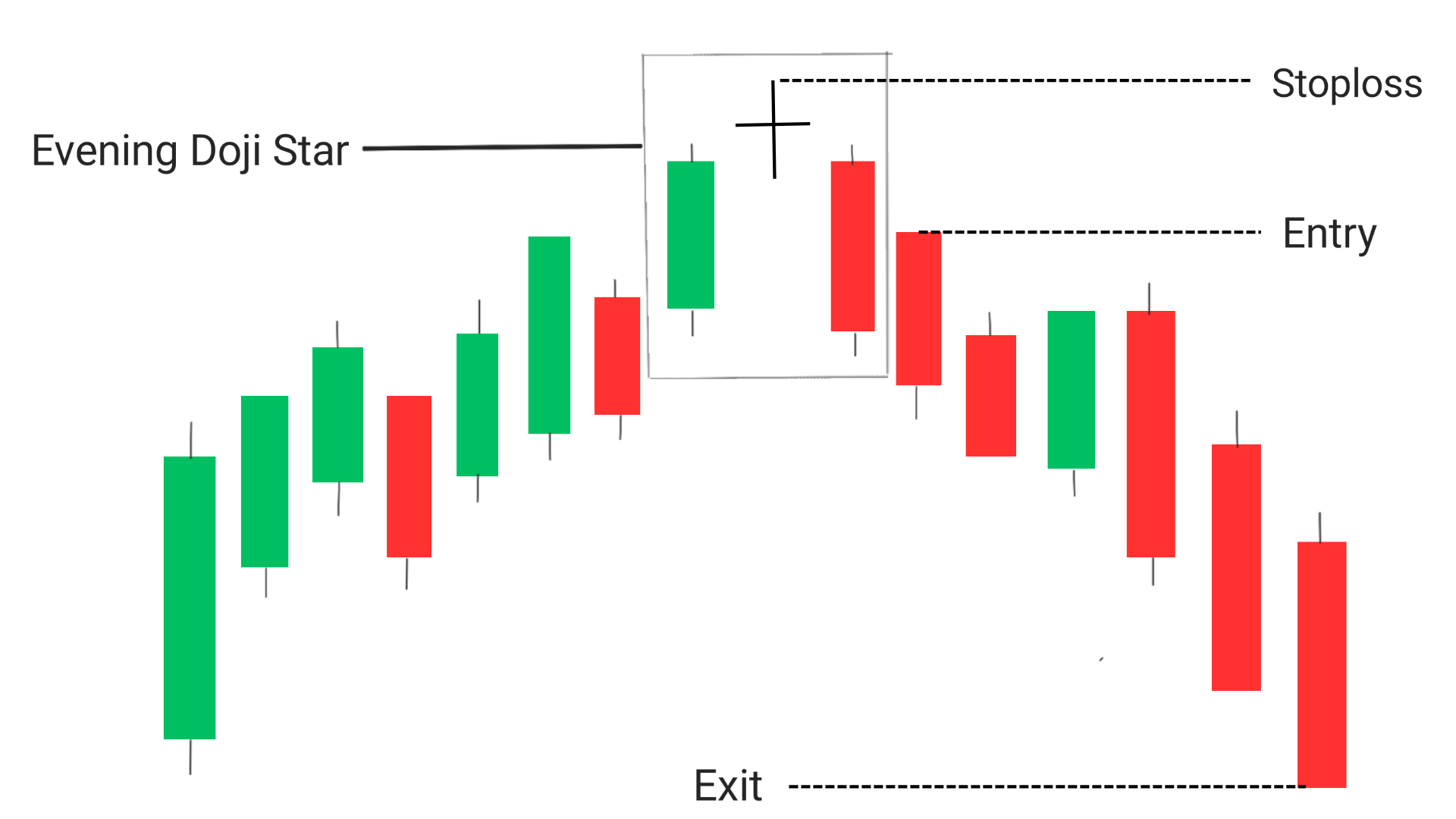

Traders can use the Evening Doji Star pattern to enter short positions or exit long positions. To trade this pattern, traders should follow these steps:

The entry for an Evening Doji Star pattern would be to enter a short position at the open of the candle following the Doji candlestick.

The exit could be based on a target price or when the graph reaches a support level, if you want to trade more you can look for a breakout at support level, if it happoens then you can trade upto next support level.

A stop loss could be placed above the high of the Doji candlestick to limit potential losses if the pattern fails. However, traders should confirm the pattern with other technical indicators and use proper risk management techniques before entering any trades.

general steps are as follows

1. Identify the Evening Doji Star pattern on the chart.

2. Confirm the pattern with other technical indicators such as moving averages, trend lines, or support and resistance levels.

3. Enter a short position at the close of the third candlestick.

4. Place a stop-loss order above the high of the first candlestick.

5. Take profit at a predetermined level or exit the trade when a bullish reversal pattern appears.

Success rate of Evening Doji Star

The success rate of evening Star candlestick pattern is near about 70%, which means for every 10 trades taken, you will be able to make profit in 7 out of those 10 trades. Suuccess rate depends on various factors such as the market conditions, time frame, and other technical indicators. It is not possible to provide a specific success rate for this pattern.

Conclusion

The Evening Doji Star is a reliable bearish reversal pattern that can help traders identify potential market trends and price movements. It is Important to remember that this pattern should not be used in isolation and should be confirmed with other technical indicators. Traders should also use proper risk management techniques and follow a trading plan to maximize their profits and minimize their losses.

In conclusion, the Evening Doji Star is an important candlestick pattern that traders should be aware of. By understanding its formation and interpretation, traders can use it to make informed trading decisions and improves.

Frequently Asked Questions(FAQs)

1.Is Evening Star a bearish or bullish?

Evening Star is a bearish candlestick pattern.

2.Is a doji bullish or bearish?

A doji can be both bullish or bearish depending on its position and the preceding trend

3.What does a bullish doji star mean?

A bullish doji star indicates a potential reversal of the previous downtrend and a possible bullish trend ahead.

4.What is the success rate of evening Star candlestick?

The success rate of evening Star candlestick pattern is near about 70%, which means for every 10 trades taken, you will be able to make profit in 7 out of those 10 trades. Suuccess rate depends on various factors such as the market conditions, time frame, and other technical indicators. It is not possible to provide a specific success rate for this pattern.

5. What is the significance of the Doji candlestick in the Evening Doji Star pattern?

The Doji candlestick represents indecision in the market, indicating that neither buyers nor sellers have control. It serves as a warning sign that the trend may be losing momentum and could reverse.

6. Is the Evening Doji Star pattern reliable?

Like any technical analysis tool, the Evening Doji Star pattern is not 100

7. Can the Evening Doji Star pattern occur in any market?

Yes, the Evening Doji Star pattern can occur in any market, including stocks, forex, and commodities.

8. How can traders use the Evening Doji Star pattern in their trading strategy?

Traders can use the Evening Doji Star pattern to enter short positions or exit long positions. However, they should confirm it with other technical indicators and use proper risk management techniques.

9. Are there any other candlestick patterns similar to the Evening Doji Star?

Yes, there are several candlestick patterns that are similar to the Evening Doji Star, such as the Evening Star and the Bearish Engulfing pattern. Traders should learn to identify and differentiate between these patterns to make informed trading decisions.