Bullish engulfing pattern

The bullish engulfing pattern is a one of the most used and reliable candlestick pattern that can add value to your decisions into market trends and potential trading opportunities.

What is a bullish engulfing pattern?

A bullish engulfing is a bearish reversal pattern that consists of two candlesticks in which the first candlestick is bullish and the second candlestick is bearish. It is mainly formed at the bottom of a downtrend, This pattern signifies a shift in momentum from sellers(bear) to buyers(bull) and suggests that buyers(bulls) are taking charge to control over the market.

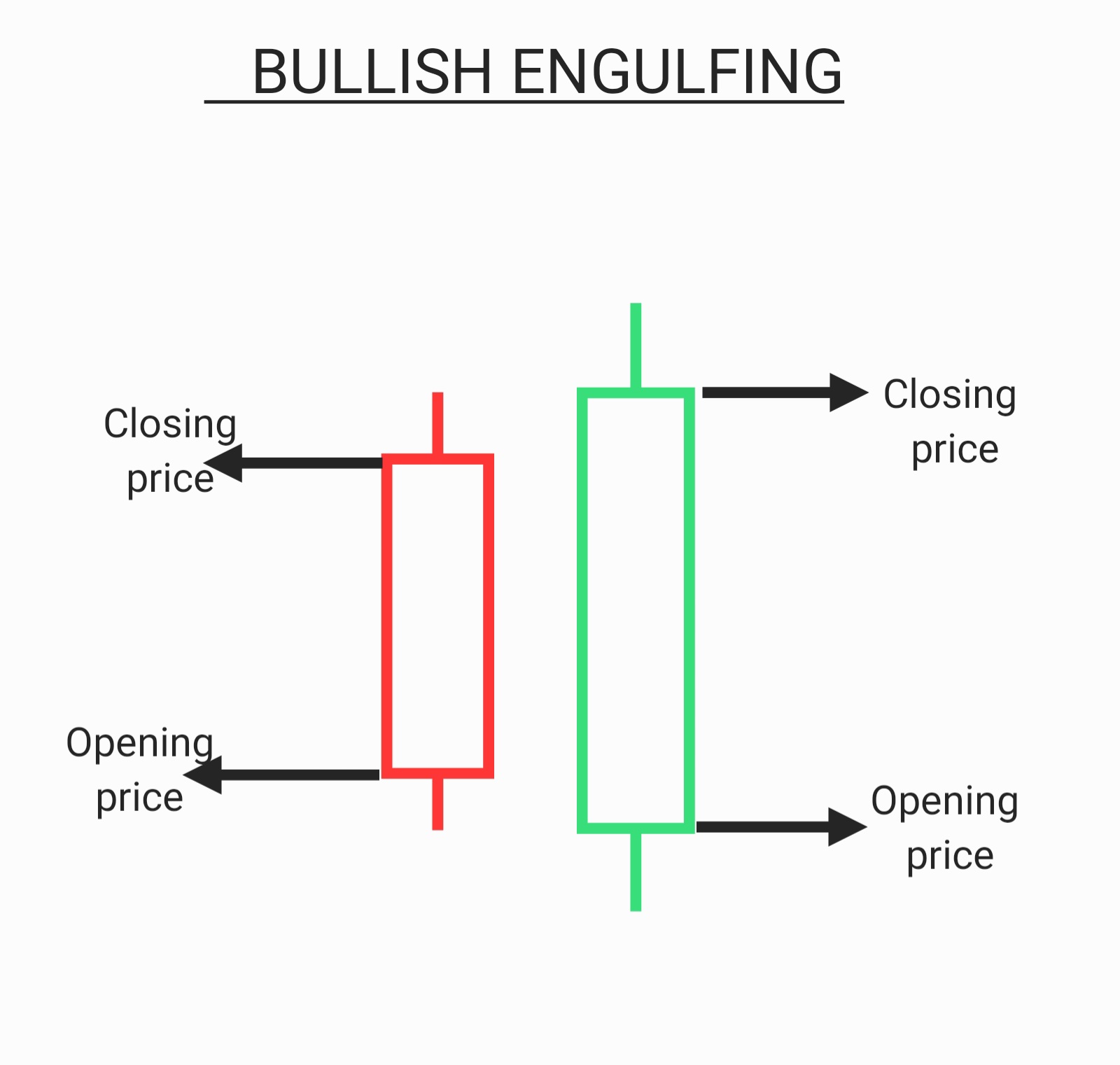

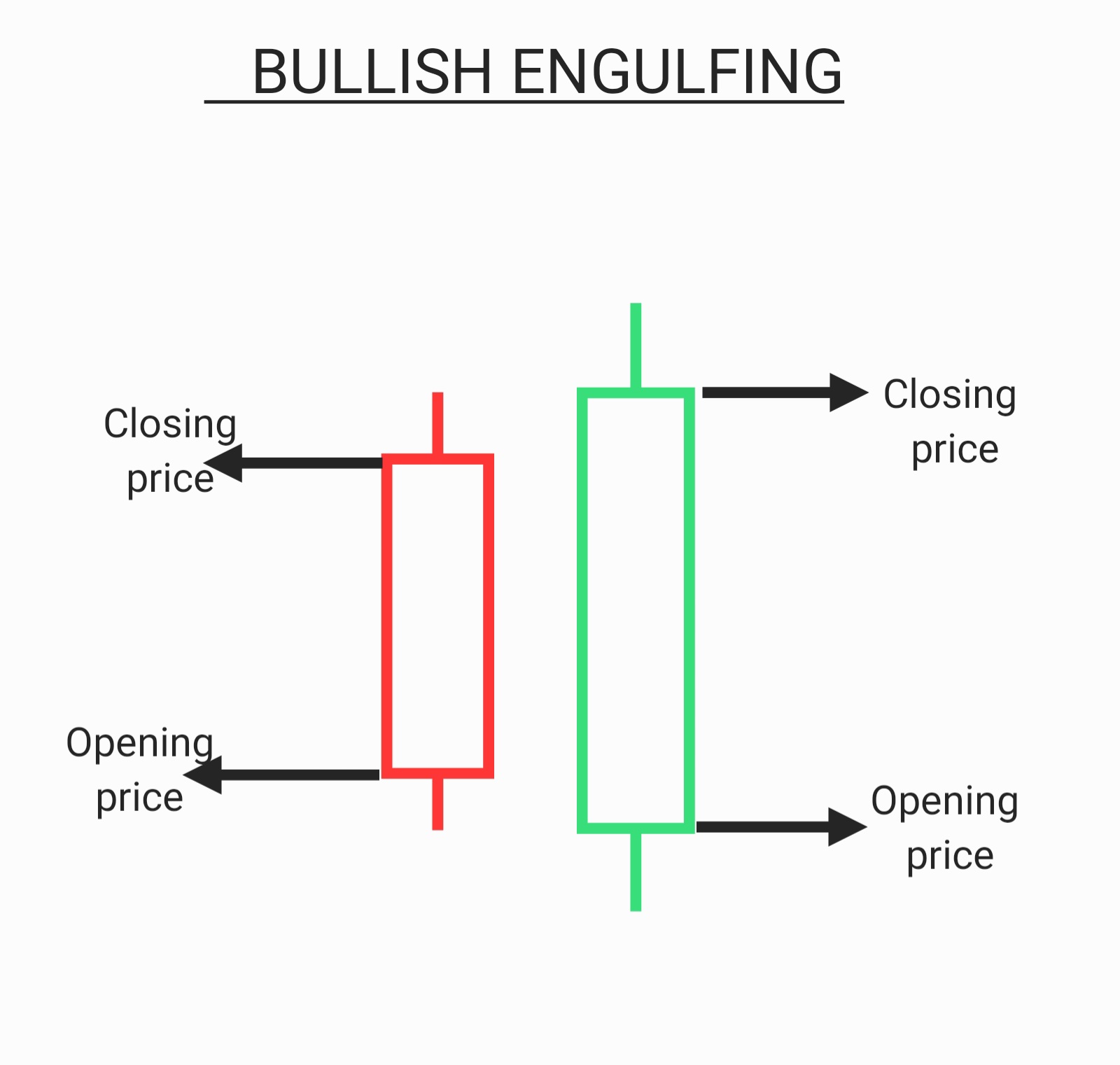

How does bullish engulfing pattern looks?

It is mainly formed at the bottom of a downtrend. The first candle is a bearish candle followed by a larger bullish candle that completely engulfs the body of the first bearish candle i.e. (lies within the shadow of the first candlestick).

to learn all the candlestick pattern at one place you will need to have a hardcopy of candlestick pattern. here is the best book for chart pattern book.

It is too important to analyse multiple charts at a same time for this you can check for best ultrawide monitors from here.

What does bullish engulfing pattern indicates?

The bullish engulfing pattern indicates a bullish reversal whenever forms at bottom of a downtrend. This pattern forms when the stock market opens at a lower price on the next day(Day 2) than it is closed on the previous day(Day 1). It is also required for the next day candle to appear with a gap down opening such that it can engulf the previous day candle.

When this pattern appears after a long downtrend, it suggests that sellers are losing their grip and buyers are taking charge to drive prices higher. Traders can use the bullish engulfing pattern as a signal to enter long positions or to close out short positions.

How to trade using bullish engulfing pattern?

Now that we have understood all the aspects of bullish engulfing pattern, let’s explore some effective trading strategies to make the most of this powerful pattern.

Confirmation: While the bullish engulfing pattern is a strong signal of a potential trend reversal, it is essential to wait for confirmation before entering a trade. Traders often look for additional indicators such as volume confirmation or other technical analysis tools to validate the bullish engulfing pattern.

Entry: To be on the safer side traders often enters at the closing price of the second bullish candle iof the bullish engulfing. once you enter from here, then you have a long way to go near the resistance level of the chart pattern.

Exit points: When trading the bullish engulfing pattern, it is crucial to identify clear entry and exit points. Traders can enter long positions when the bullish engulfing pattern forms and set stop loss orders below the low of the opening price of the engulfing candle to manage risk. You can exist the trade at the resistance or you can chech foe breakout at the resistance, if it breaks then your resistance level will become support and you can take a long trade.

Risk management: In trading, risk management is the most crucial thing, when trading the bullish engulfing pattern. Traders should carefully consider their risk to reward ratio and position sizing to ensure that potential losses are minimized.

Timeframe analysis: The effectiveness of the bullish engulfing pattern can increase significantly using across different timeframes. Traders should consider analyzing multiple timeframes like( 5 min. , 10 min. , 30 min.) to confirm the strength of the bullish engulfing pattern and to identify the best potential entry and exit points.

Using other technical indicators: While the bullish engulfing can provide valuable insights, traders may take more benefit by applying other technical indicators such as moving averages, oscillators, vwap or trend lines to confirm the strength of the potential reversals.

Frequently Asked Questions

- How reliable is bullish engulfing?

bullish engulfing pattern is considered to be a reliable in technical analysis by many traders. As most of the times it works . It gives the same result in the price chart as mentioned ‘ bullish engulfing pattern converts downtrend to uptrend whenever it forms at the bottom” .

this chart can help you in finding the accuracy of bullish engulfing pattern

- does Bullish engulfing need confirmation?

mostly no, but if you can confirm it using some other indicators like vwap, moving average it will surely help you in taking devisions precisely. This will not only increase your profit but also it will enhance your decision making capacity.

- What is psycology behind bullish engulfing pattern?

there is a simple psycology behind itthat buyers are taking the conrol and are ready to dominate the the market this happens because you would have noticed that the second candle is a long bullish in nature with little wicks, it means the price is almost near to its its . so there are much probility that from the next candle the price eill move in upward direction.

the bullish engulfing pattern is a powerful candlestick pattern that can offer valuable trading opportunities for traders. By understanding the characteristics of this pattern and implementing effective trading strategies, traders can capitalize on potential trend reversals and make informed trading decisions. However, it is essential to exercise caution and use risk management techniques when trading any pattern or strategy in the financial markets.

1 thought on “Bullish engulfing pattern: meaning, how to trade, 3 FAQs”