How to trade Bull Pennant and Bear Pennant? 5 FAQs

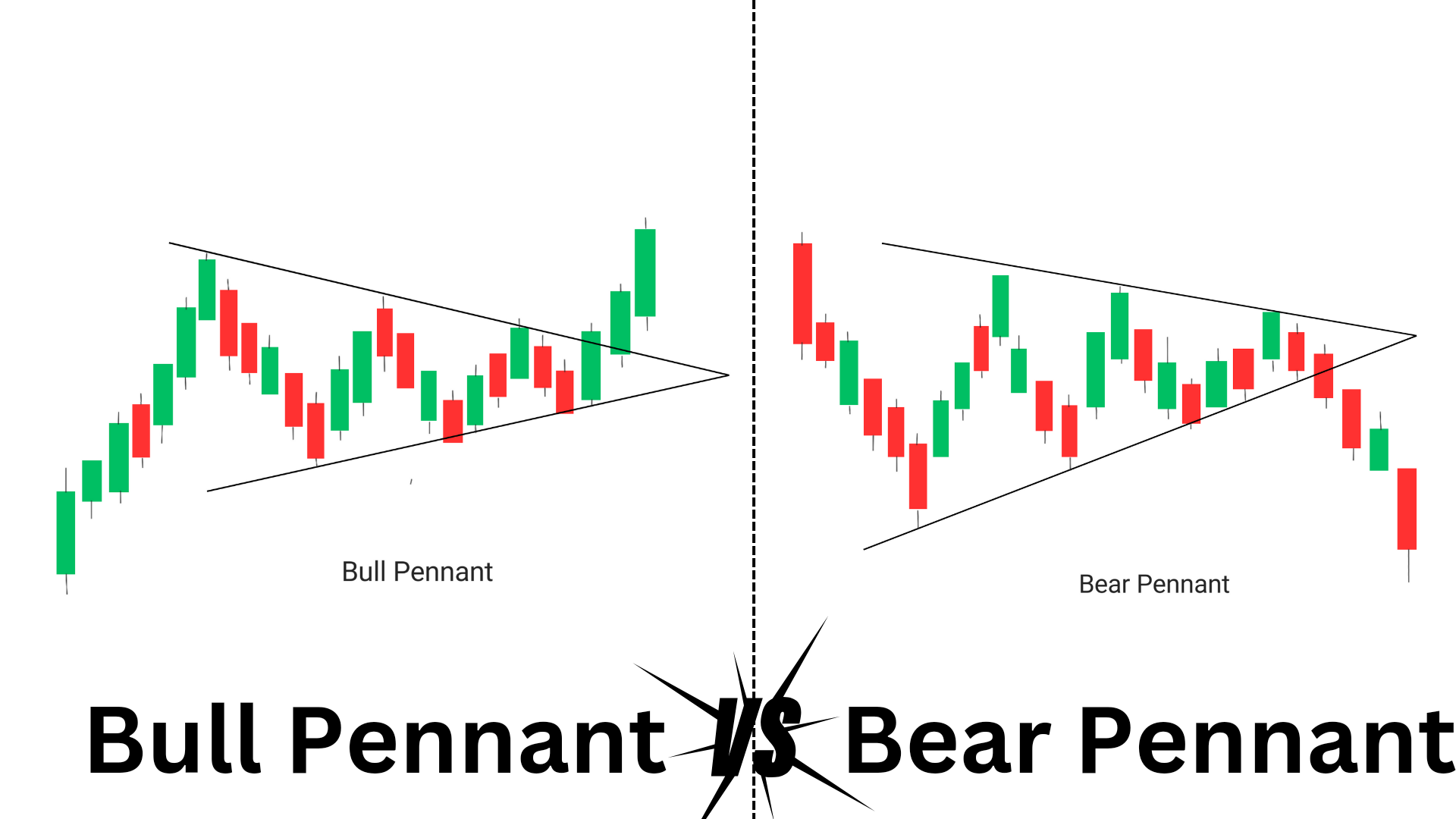

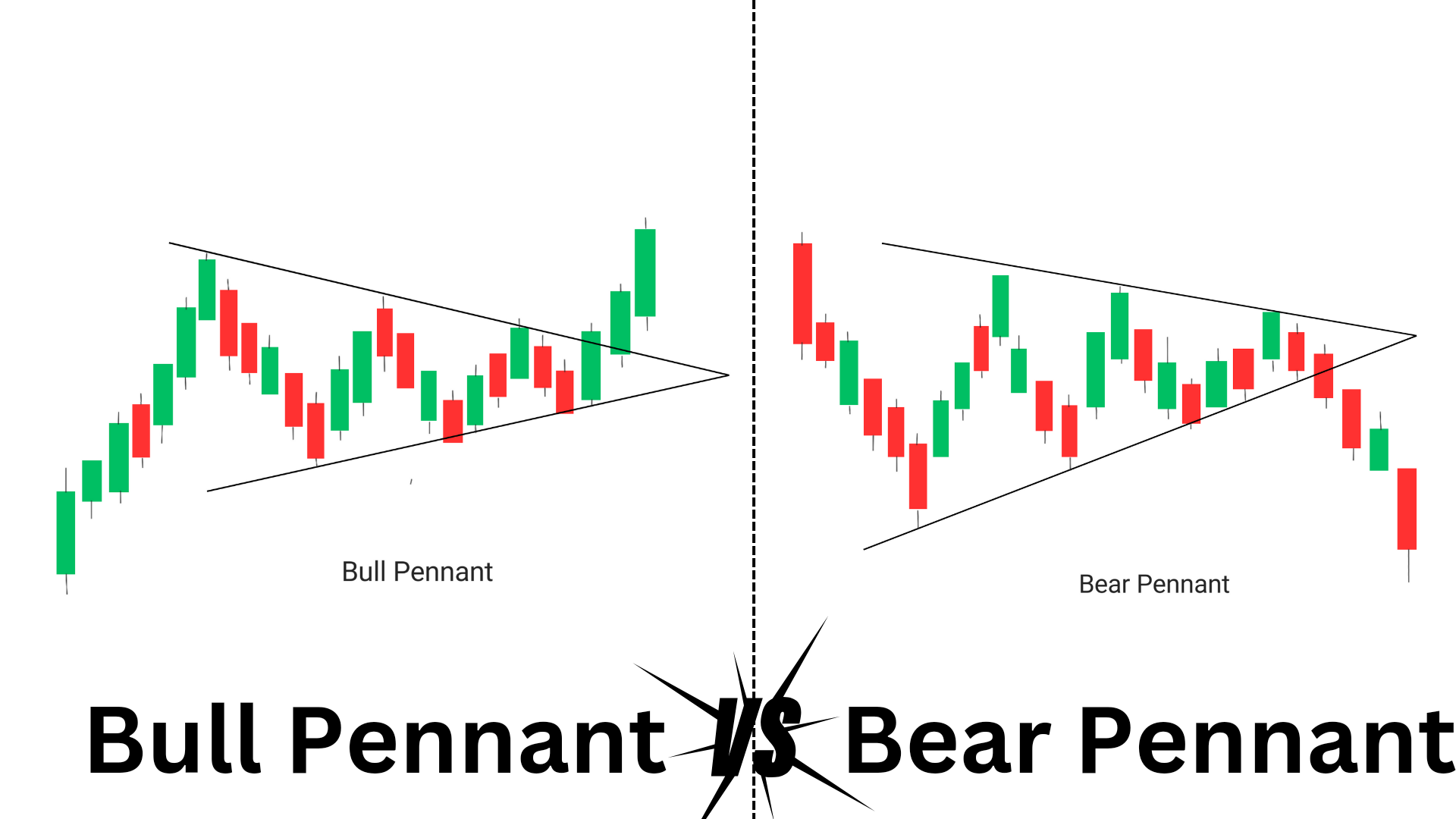

Are you looking for a profitable trading opportunity? Then you might want to consider the bull pennant and bear pennant pattern. This is a bullish and bearish continuation pattern respectively, that occurs after a price increase, similar to the bull flag and bear flag pattern. However, the bull and bear pennant has a slightly different shape and can offer unique opportunities for traders.

What is a Bull Pennant Pattern?

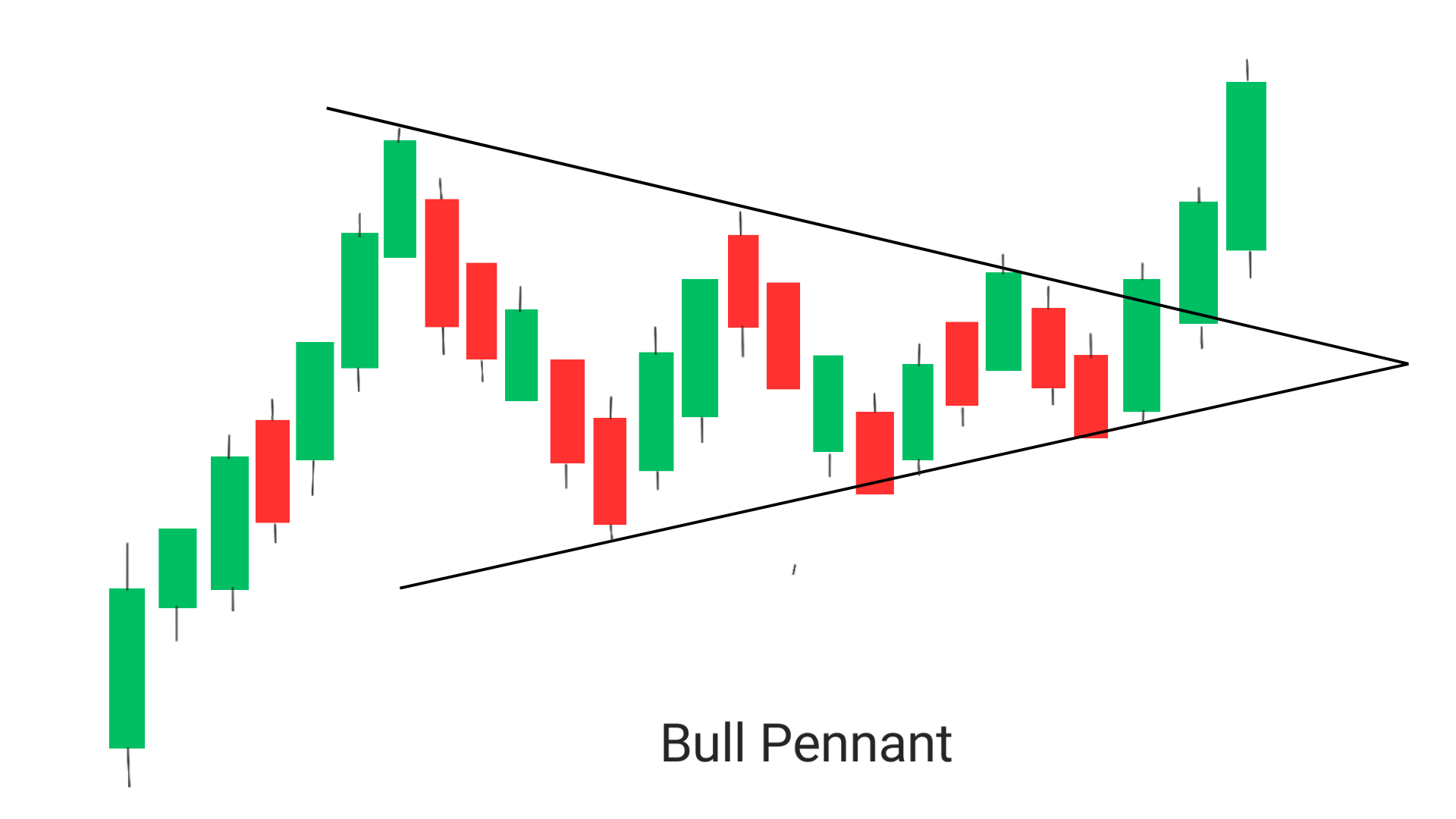

A bull pennant pattern is a bullish continuation chart pattern thaat forms when there is a sharp price increase, followed by a consolidation period in which the price moves in a narrow range. This consolidation period forms a triangular shape, with the upper trendline acting as resistance and the lower trendline acting as support.

This pattern is called a pennant because it resembles a flag on a pole, with the flagpole being the initial price increase and the flag itself being the consolidation period.

How to Identify Bull Pennant Pattern

The bull pennant pattern is a continuation pattern that occurs during an uptrend. Here are the steps to identify a bull pennant pattern:

1.Initial price movement was in sharp uptrend (also known as Flag Pole), After few time it takes resistance and price goes into consolidation period.(volume at the top is greater than during the consolidation period.

2.In this consolidation period 2 resistance levels and support level are formed and the .

3.Draw two lines(i) Touching the resistance of at both the points and (ii) Touching the support level, This two lines meet each other at a point, Forming a pennant shaped pattern.

4. When a candle give breakout at the resitance then it is considered as a valid bull pennant pattern.( Volume of candle is increases as soon as it gives breakout)

Overall, the bull pennant pattern is a bullish continuation pattern that can help traders identify profitable trading opportunities during an uptrend.

How Bull Pennant Flag Is Formed?

The bull pennant pattern is formed when there is a strong upward price movement, followed by a brief period of consolidation. During this consolidation phase, the price forms a symmetrical triangle pattern, with lower highs and higher lows. This indicates that the market is taking a breather before continuing its upward trend.

The consolidation phase is usually characterized by decreasing trading volume, as traders wait for a clear direction to emerge. Once the consolidation phase is over, the price typically breaks out of the triangle pattern, with a sharp increase in trading volume, signaling a continuation of the uptrend.

The formation of the bull pennant pattern is often driven by positive market sentiment, such as strong earnings reports, positive economic data, or other bullish news events. As such, it is important for traders to keep an eye on market news and events that could impact the formation of this pattern.

What is Bear Pennant Pattern?

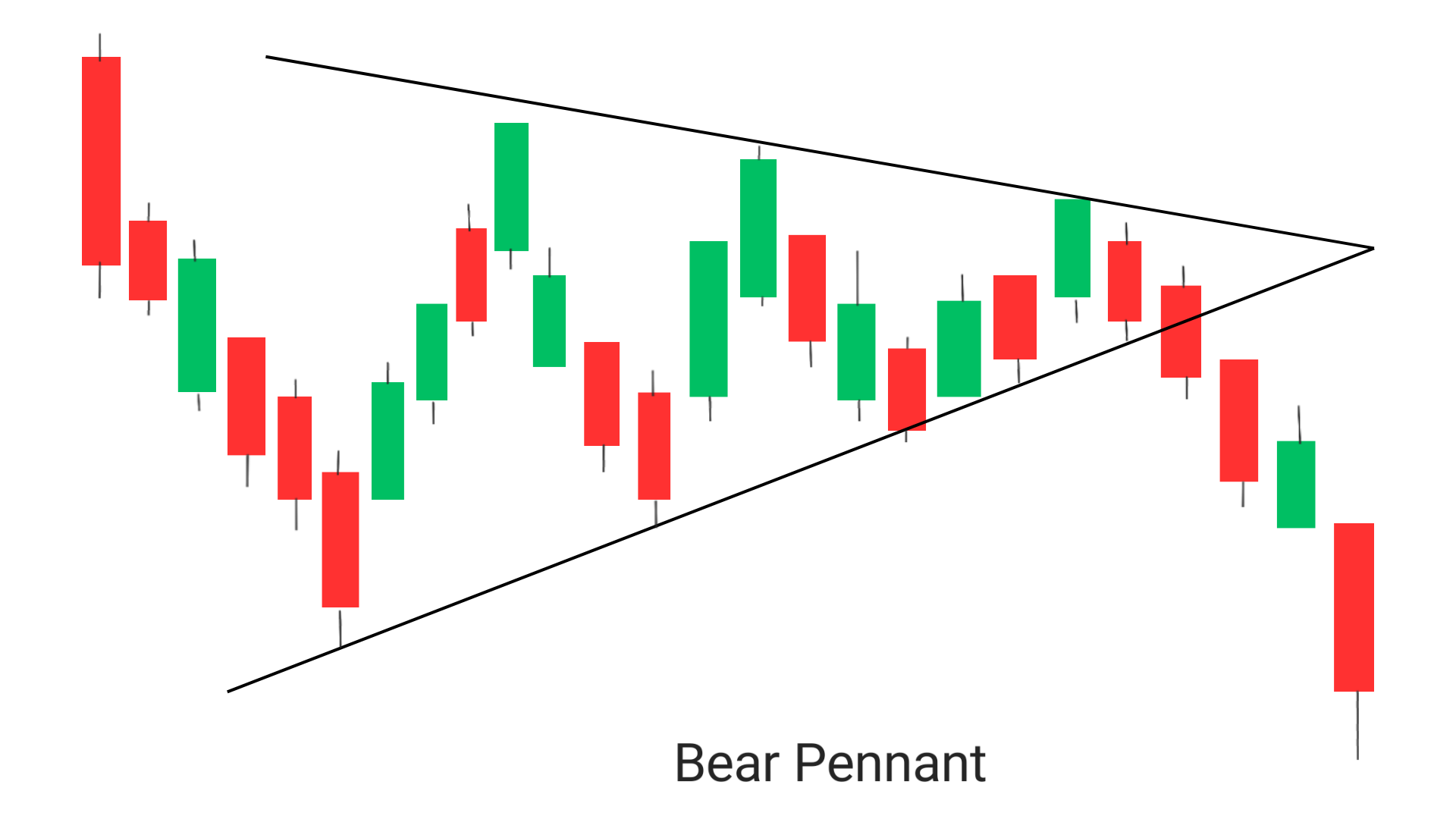

The bear pennant pattern is a bearish continuation chart pattern that forms during a downtrend. This pattern is characterized by a brief consolidation period that occurs after a strong price move. The consolidation period takes the form of a small symmetrical triangle, which is referred to as the pennant. The pennant is formed by two converging trendlines that connect the highs and lows of the consolidation period.

How to Identify Bear Pennant Pattern?

To identify the bear pennant pattern, traders should look for the following characteristics:

1.Initial price movement was in sharp downtrend (also known as Flag Pole), At its lowest point, it takes support and price goes into consolidation period.(volume at the top is greater than during the consolidation period.

2.In this consolidation period 2 support levels and resistance level are created.

3.Draw two lines(i) Touching the support of at both the points and (ii) Touching the resistance level . This two lines meet each other at a point, forming a pennant shaped pattern.

4. When a candle give breakout at the support level then it is considered as a valid bear pennant pattern.( Volume of candle is increases as soon as it gives breakout)

Traders can trade the bear pennant pattern by waiting for a breakout below the lower trendline of the pennant before entering a short position. They should place a stop loss above the upper trendline of the pennant to limit their potential losses and set a profit target by measuring the height of the pennant and subtracting it from the breakout point. By understanding these patterns, traders can improve their trading strategies and increase their chances of success.

How Bear Pennant Pattern is Formed?

A bear pennant pattern is formed during a downtrend when the price of an asset experiences a brief period of consolidation. The consolidation period is characterized by a small triangle or pennant formation, which is formed by two converging trendlines that connect a series of lower highs and higher lows.

The trendlines of the pennant formation should be drawn in a way that they are parallel to the trendline of the downtrend. This creates a pennant shape, with the trendline of the downtrend acting as the flagpole and the consolidation period forming the pennant.

The bear pennant pattern is considered to be a continuation pattern because it typically occurs in the middle of a downtrend. Traders look for a breakout to occur below the lower trendline of the pennant formation, which signals that the downtrend is likely to continue. They may enter short positions after the breakout, with a stop loss above the upper trendline of the pennant formation.

Bull pennant Vs Bull flag

| Bull Pennant | Bull Flag |

|---|---|

| It is a symmetrical triangle pattern. | It forms a rectangular pattern. |

| The support and resistance line meet at one point. | The support and resistance line are parallel to each other. |

| It represents a Pennant shaped pattern. | It represents a Flag shaped pattern. |

How to Trade the Bull Pennant Pattern

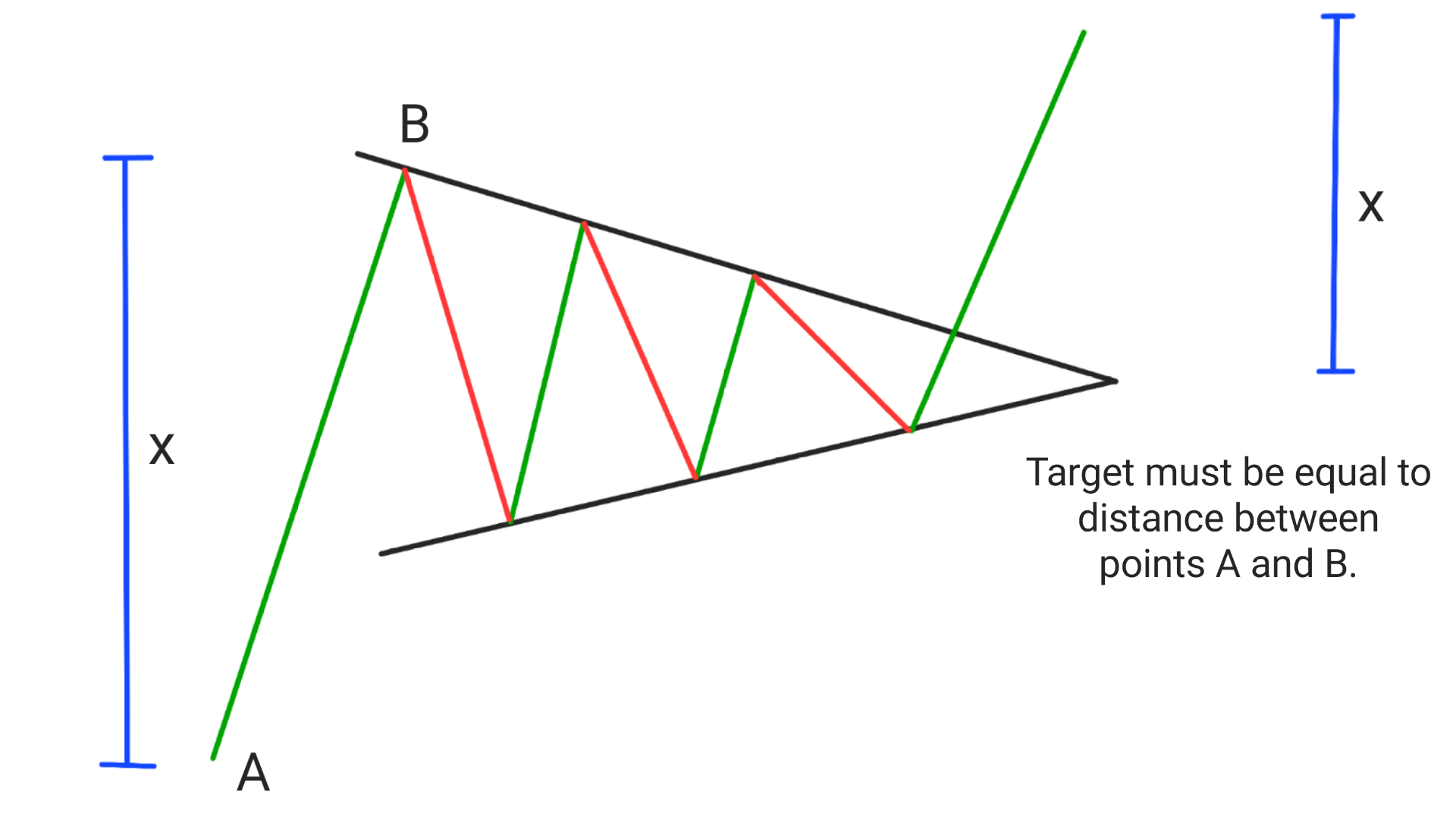

When trading the bull pennant pattern, traders look for a breakout above the upper trendline, which signals a continuation of the previous uptrend. Traders can enter a long position when the price breaks above the upper trendline, with a stop loss below the lower trendline. The profit target can be set at a distance equal to the height of the flagpole, which is measured from the start of the price increase to the beginning of the consolidation period.

The bull pennant pattern is a continuation pattern that occurs during an uptrend. Here are the steps to trade a bull pennant pattern:

1. Identify the uptrend: The first step in trading a bull pennant pattern is to identify a sharp uptrend. This can be done by looking at the price chart and identifying a series of higher highs and higher lows.

2. Look for a consolidation phase: After the uptrend, there will be a period of consolidation where the price moves sideways. This is typically characterized by lower trading volume and smaller price movements.

3. Identify the pennant formation: During the consolidation phase, the price will form a pennant shape. This is created by drawing two trendlines that converge towards each other, forming a triangle shape.

4. Wait for a breakout: The final step in trading a bull pennant pattern is to wait for a breakout. This occurs when the price breaks out of the pennant formation and continues its uptrend.

5. Enter a long position: Once the breakout occurs, traders can enter a long position with a stop loss at the low of the candle previous to the candle which gave breakout.

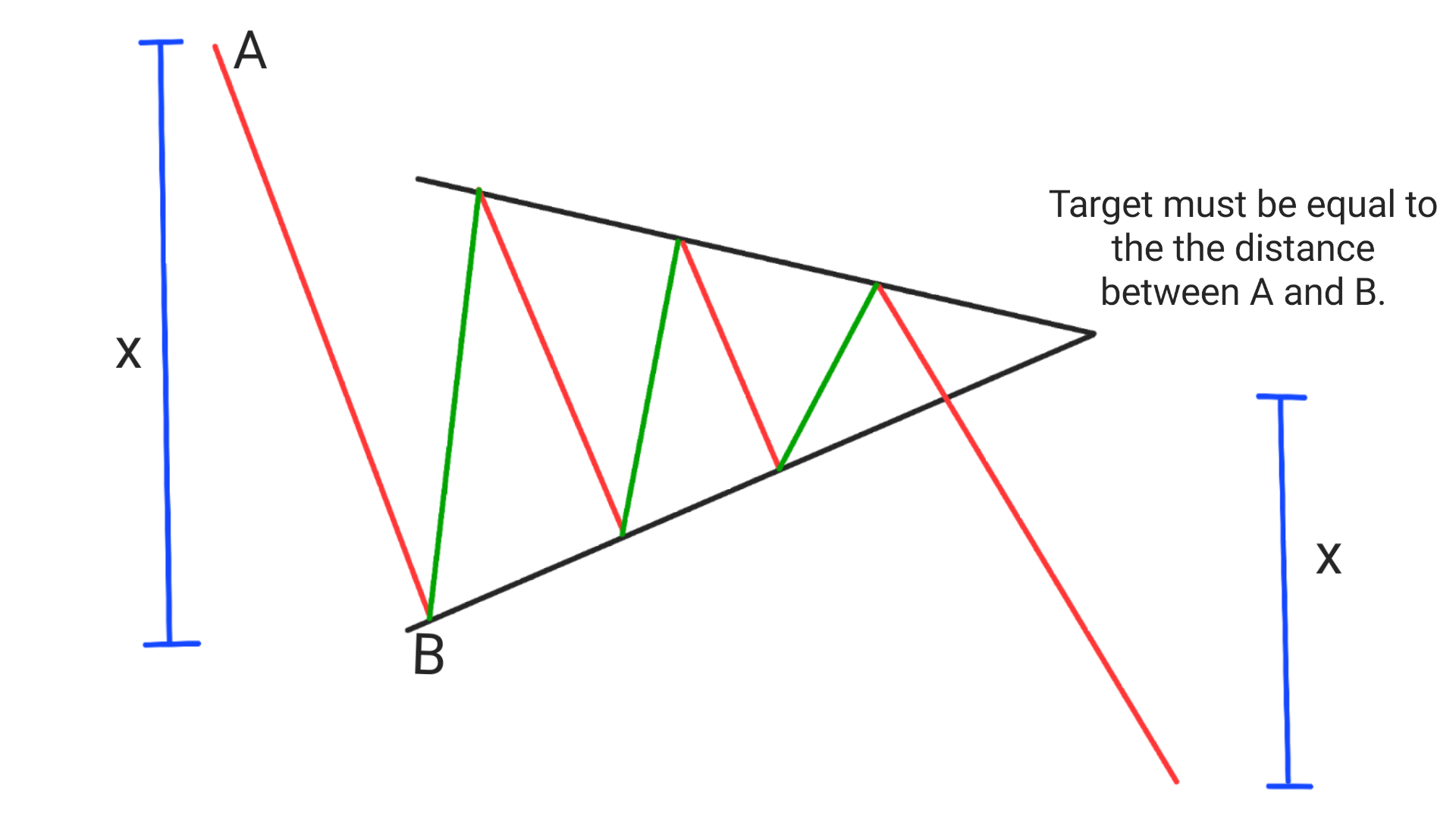

Bull Pennant Target: The target for the trade will be equal to the the points covered bu the first uptrend, from where it has taken support i.e. distance between points A and B.

Overall, trading the bull pennant pattern involves waiting for a breakout and entering a long position to profit from a continuation of the uptrend. It is important to use proper risk management techniques, such as setting stop losses and taking profits at appropriate levels.

How to Trade Bear Pennant?

The bear pennant pattern is a continuation pattern that occurs during a downtrend. Here are the steps to trade a bear pennant pattern:

1. Identify the downtrend: The first step in trading a bear pennant pattern is to identify a downtrend. This can be done by looking at the price chart and identifying a series of lower lows and lower highs.

2. Look for a consolidation phase: After the downtrend, there will be a period of consolidation where the price moves sideways. This is typically characterized by lower trading volume and smaller price movements.

3. Identify the pennant formation: During the consolidation phase, the price will form a pennant shape. This is created by drawing two trendlines that converge towards each other, forming a triangle shape.

4. Wait for a breakdown: The final step in trading a bear pennant pattern is to wait for a breakdown. This occurs when the price breaks out of the pennant formation and continues its downtrend.

5. Enter a short position: Once the breakdown occurs, traders can enter a short position with a stop loss above the pennant formation. The target for the trade can be set based on the length of the previous downtrend.

Bear Pennant Target: Once the breakout occurs, traders can enter a short position with a stop loss above the high of the candle previous to candle which gave breakout.The target for the trade will be equal to the the points covered bu the first uptrend, from where it has taken support i.e. distance between points A and B.

Overall, trading the bear pennant pattern involves waiting for a breakdown and entering a short position to profit from a continuation of the downtrend. It is important to use proper risk management techniques, such as setting stop losses and taking profits at appropriate levels.

Conclusion

The Bull Pennant and Bear Pennant pattern is a powerful tool for traders looking to utilize bullish continuation and bearish continuation patterns. By identifying these pattern and using proper risk management techniques, traders can set themselves up for profitable trades by taking long and short positions with target equal to the flag pole length in both the cases.

What is failed Bull Pennant and bear Pennant?

A failed bull pennant and a bear pennant are both chart patterns that occur during a price consolidation period, but they have different implications for traders.

A failed bull pennant is a pattern that occurs during an uptrend when a pennant formation is formed, but instead of breaking out to the upside, the price breaks down below the support level of the pennant. This is a bearish signal and suggests that the uptrend may be losing momentum and that a reversal may be imminent. Traders who were waiting for a breakout to the upside would need to exit their long positions and consider entering short positions.

On the other hand, a bear pennant is a pattern that occurs during a downtrend when a pennant formation is formed. It is similar to the bull pennant, but it is a bearish continuation pattern. After the consolidation period, the price typically breaks out to the downside, indicating that the downtrend is likely to continue. Traders can enter short positions after the breakout, with a stop loss above the pennant formation.

In summary, while a bull pennant is a bullish continuation pattern, a failed bull pennant and a bear pennant are bearish continuation patterns. It is important for traders to understand these patterns and their implications to make informed trading decisions.

Bear pennant Vs Symmetrical triangle

A bear pennant and a symmetrical triangle are both chart patterns that occur during a price consolidation period, but they have different implications for traders.

A bear pennant is a bearish continuation pattern that occurs during a downtrend when a pennant formation is formed. After the consolidation period, the price typically breaks out to the downside, indicating that the downtrend is likely to continue. Traders can enter short positions after the breakout, with a stop loss above the pennant formation.

A symmetrical triangle, on the other hand, is a neutral pattern that occurs when the price consolidates within a triangle formation. The pattern is characterized by two converging trendlines that connect a series of higher lows and lower highs. Traders often wait for a breakout to occur in either direction before entering a position. A breakout to the upside suggests a bullish trend continuation, while a breakout to the downside suggests a bearish trend continuation.

In summary, while a bear pennant is a bearish continuation pattern, a symmetrical triangle is a neutral pattern that can signal either a bullish or bearish continuation depending on the direction of the breakout. It is important for traders to understand these patterns and their implications to make informed trading decisions.

Frequently Asked Questions(FAQs)

1.Is the pennant pattern bullish or bearish?

The pennant pattern can be both bullish or bearish, depending on the direction of the trend that precedes it. A bear pennant pattern is formed during a downtrend and is considered a bearish continuation pattern, while a bull pennant pattern is formed during an uptrend and is considered a bullish continuation pattern.

2.What is the difference between a triangle and a pennant?

A triangle and a pennant are similar in that they both involve a consolidation period characterized by two converging trendlines. However, the key difference is that a triangle formation has a wider range and is more symmetrical, while a pennant formation is narrower and more pointed

3.What is the difference between a flag and a pennant?

The difference between a flag and a pennant is in their shape. A flag pattern is rectangular, with parallel trendlines, while a pennant pattern is triangular, with converging trendlines.

4.What is the pennant pattern in psychology?

In psychology, the pennant pattern refers to a formation that occurs during a period of high volatility in financial markets. It is characterized by a brief consolidation period followed by a sharp price movement in one direction. This can create feelings of uncertainty and anxiety among traders.

5.Is a bull pennant bullish?

Yes, a bull pennant pattern is considered bullish as it occurs during an uptrend and signals a continuation of the upward price movement.

6.What is triple top pattern?

The triple top pattern is a bearish reversal pattern that occurs when the price of an asset makes three consecutive peaks at roughly the same price level, followed by a price decline. It indicates that the buyers are losing momentum, and the sellers are gaining control.

7.Can a pennant be bearish?

Yes, a pennant can be bearish. A bear pennant pattern is formed during a downtrend, and it signals a continuation of the downward price movement. The key difference between a bull and bear pennant is the direction of the preceding trend. A bear pennant occurs after a downtrend, while a bull pennant occurs after an uptrend.

8.How do you identify a bullish pennant pattern?

To identify a bullish pennant pattern, look for the following characteristics:

- The price of the asset is in an uptrend, with higher highs and higher lows.

- The price then consolidates into a symmetrical triangle pattern, with lower highs and higher lows.

- The volume during the consolidation period is lower than during the uptrend.

- Once the price breaks out of the triangle pattern, it usually continues its upward trend.

9.Why is it called the pennant?

The pattern is called a pennant because it looks like a small flag on top of a flagpole, similar to the shape of a pennant used in sports or as a banner. The flagpole represents the initial sharp price move, while the flag or pennant represents the consolidation period before the continuation of the trend.

1 thought on “How to trade Bull Pennant and Bear Pennant? 9 FAQs”