Bearish engulfing candle

The bearish engulfing pattern is one of the most widely used and reliable candlestick pattern in technical analysis of price charts. If you are a trader or investor in the financial markets , there is huge possibility that you might have heard of candlestick patterns. One such pattern is the bearish engulfing candlestick pattern, which is widely used by traders to identify potential bearish trend reversals in the market.

In this post, we will go through everything you need to know about the bearish engulfing candlestick pattern. From its definition to trading strategy, we will cover it all. By the end of this guide, you will have a in depth understanding of bearish engulfing candle.

to do trading, expert trader use hardcopy of chart pattern one such bestseller book is here.

What is a Bearish Engulfing Candlestick Pattern?

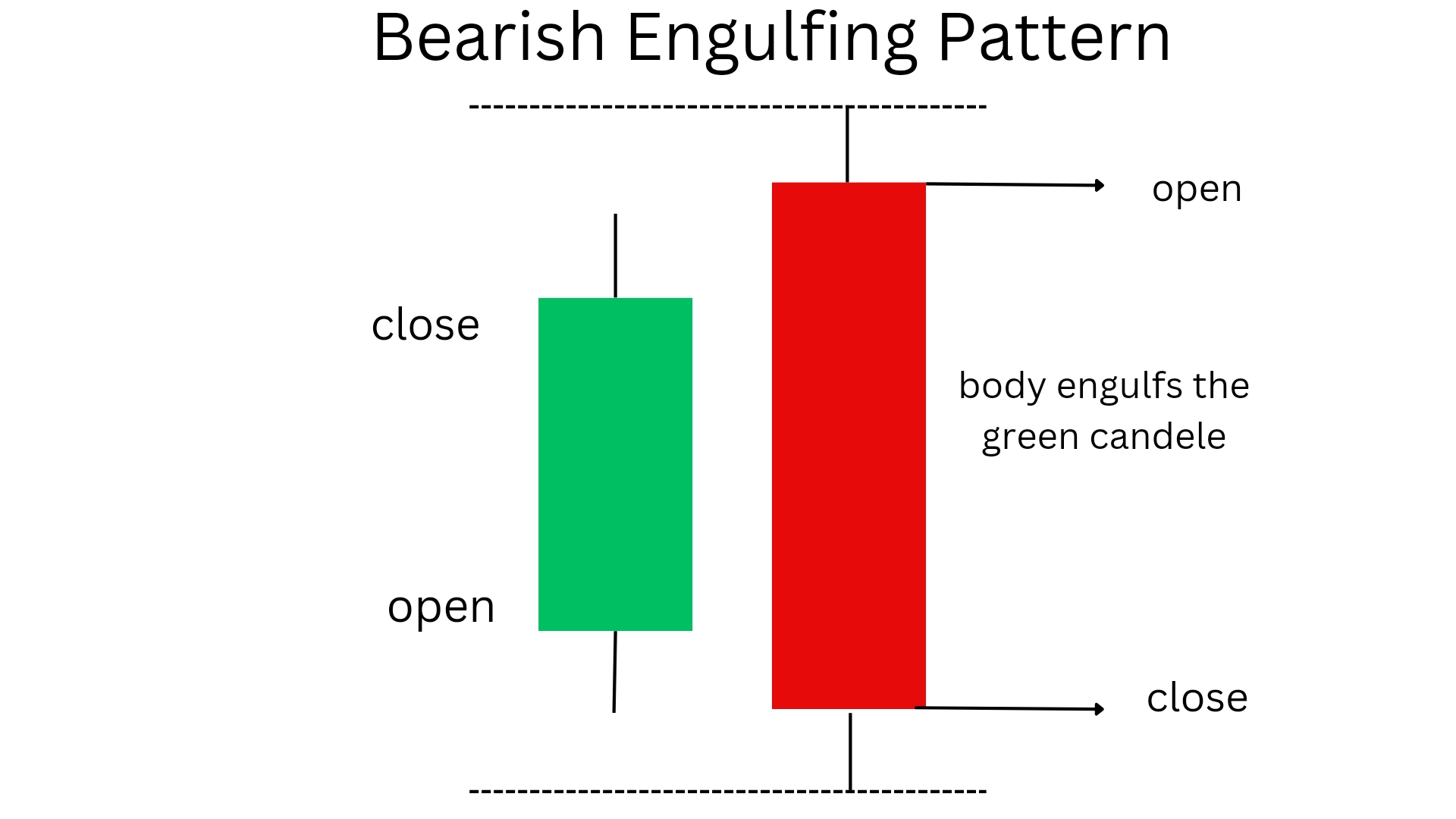

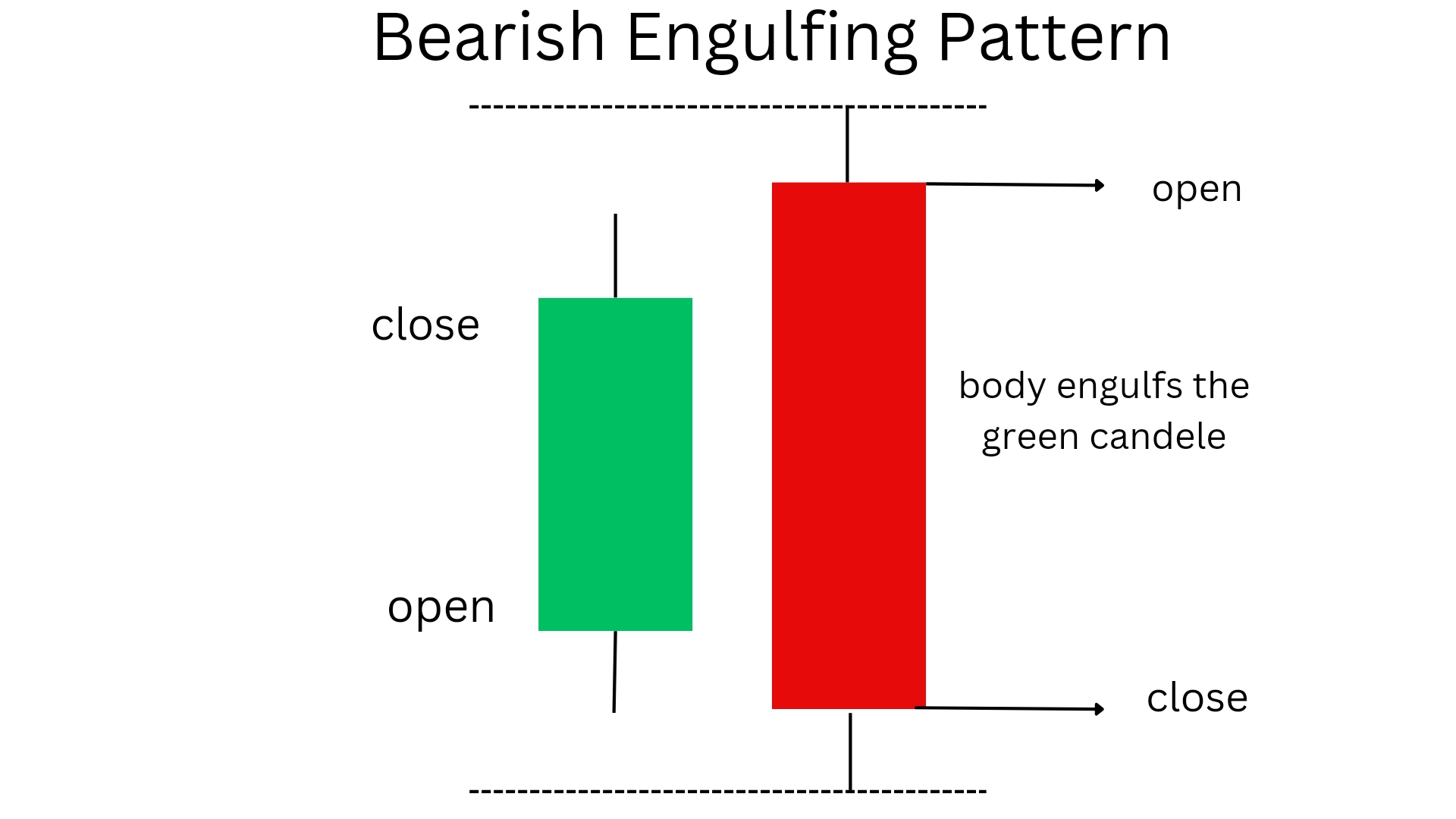

A bearish engulfing candlestick pattern is a bearish reversal pattern. It consists of two-candle that signals a potential reversal in an uptrend whenever formed at end of an uptrend. The first candle is has a small green (bullish) body followed by a large red (bearish) candle, which completely engulfs the green candle.

Characteristics of a Bearish Engulfing Candlestick Pattern

To identify a bearish engulfing candlestick pattern, there are specific characteristics that you should look for:

1. The first candle is a smaller bullish(green) candle, indicating that buyers are in control on day1.

2. The second candle is a larger red(bearish) candle that completely engulfs the body of the first candle.

3. The second candle opens higher than the close of the first candle and closes lower than the open of the first candle on day 2.

4. The pattern is more significant when it occurs after a prolonged uptrend, indicating a potential bearish reversal in market.

Difference between bullish engulfing pattern and bearish engulfing pattern

| Bullish Engulfing | Bearish Engulfing |

|---|---|

| The first candle is small bearish candle followed by a large bullish candle.The green candle completely engulfs red candle. | the first candle is a small bullish candle followed by a large bearish candle. The red candle engulfs the green candle. |

| It converts downtrend into uptrend. | It converts uptrend into downtrend. |

| It is formed at the end of a downtrend. | It is formed at the end of an uptrend. |

| It suggests that buyers(bulls) are ready to take charge and price is going to move upward. | It suggests that buyers(bears) are ready to take charge and price will move downtrend. |

How to Use Bearish Engulfing Candlestick Pattern in Your Trading Strategy?

Using bearish engulfing pattern you can only make money through selling (put). Sell at high price , when it at top and buy it at the support level.

Entry- your entry must be from the closing price of the red candle, look for some confirmation from other indicators and then only take trade , and you have a long you to go in this case.

Exit- Exit the trade when the trend has reached the support level, if you want to trade more look for a breakout if it breaks the line the take another trade and you can Maximise your profit.

Stoploss- your stoploss should be the the resistance level at the end of uptrend, this will minimise the risk of hitting stoploss and in this way you can you can save you from huge losses.

Now that we understand the significance of the bearish engulfing candlestick pattern, let’s explore how you can effectively incorporate it into your trading strategy:

1. Confirmation: As with any technical analysis tool, it is crucial to confirm the bearish engulfing pattern with other indicators such as moving averages, trendlines, or oscillators. This confirmation can increase the reliability of the signal and help avoid false alarms.

2. Risk Management: Before taking a trade based on the bearish engulfing pattern, it is essential to make a risk management plan. This includes setting stop-loss orders to limit potential losses and determining an appropriate position size based on your risk tolerance.

3. Timeframe analysis : Use different timeframe while trading , when using the bearish engulfing pattern. This pattern may carry more weightage on longer timeframes such as daily or weekly charts compared to shorter timeframes like intraday charts.

4. Combine with Other Patterns: To increase the effectiveness of the bearish engulfing pattern, consider combining it with other candlestick patterns or chart patterns to strengthen your trading signal or you can use indicators like moving averages , VWAP etc.

The bearish engulfing candlestick pattern is one of the best tool for traders and investors to identify potential trend reversals in the market. By understanding its characteristics, importance, and how to use it in your trading strategy, you can gain success in trading.

Frequently Asked Questions(FAQs)

1.What is a bearish engulfing?

A bearish engulfing is a candlestick is a two candlestick bearish reversal pattern that is formed at the end of a downtrend. It consists of small bullish candle is followed by a larger bearish candle that completely engulfs the previous candle’s body. This pattern is a signal that the market sentiment has turned bearish and that selling pressure may be increasing.

2.What is the bearish engulfing setup?

The bearish engulfing setup occurs when the first candle in the pattern is a small bullish candle, followed by a larger bearish candle that opens above the previous candle’s high and closes below its low. This setup indicates that buyers were initially in control but were then overpowered by sellers.

3.How accurate is bearish engulfing?

The accuracy or success rate of bearish engulfing pattern is near to 60%, which means for every 10 trades taken one can make profit in 6 out of those 10 by solely using bearish engulfing.