Long Legged Doji

As a trader, you may have come across several candlestick patterns that help you make informed trading decisions. One of the most popular candlestick patterns is the Long-legged Doji, which is known for its unique shape and significant implications for traders.

In this blog post, we will go through all the aspects of the Long-legged Doji candlestick pattern, explain what it is, how it forms, how to trade, and some FAQs .By the end of this post, you will have a better understanding of how to identify and trade the Long-legged Doji pattern effectively.

What is a Long legged Doji?

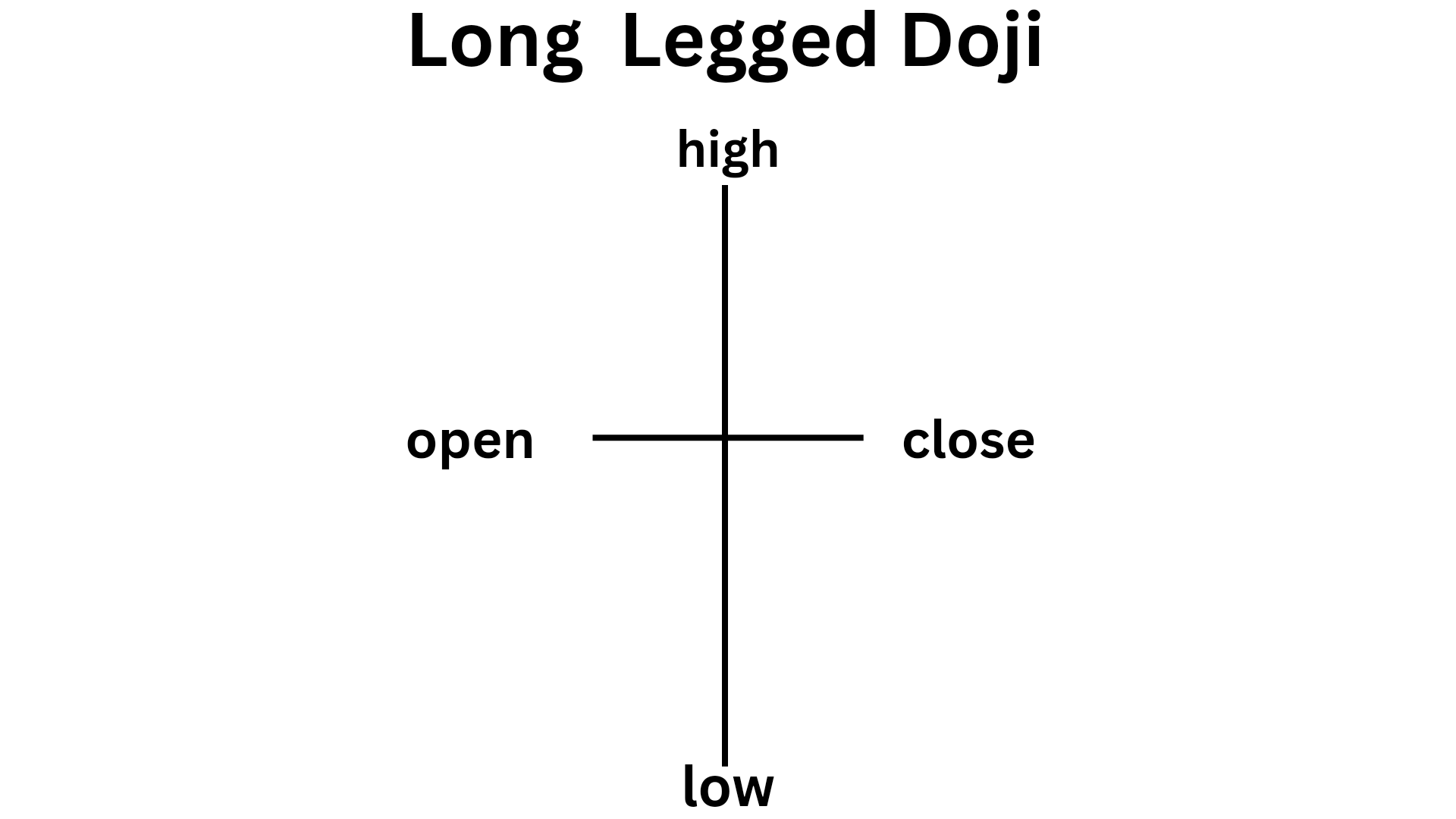

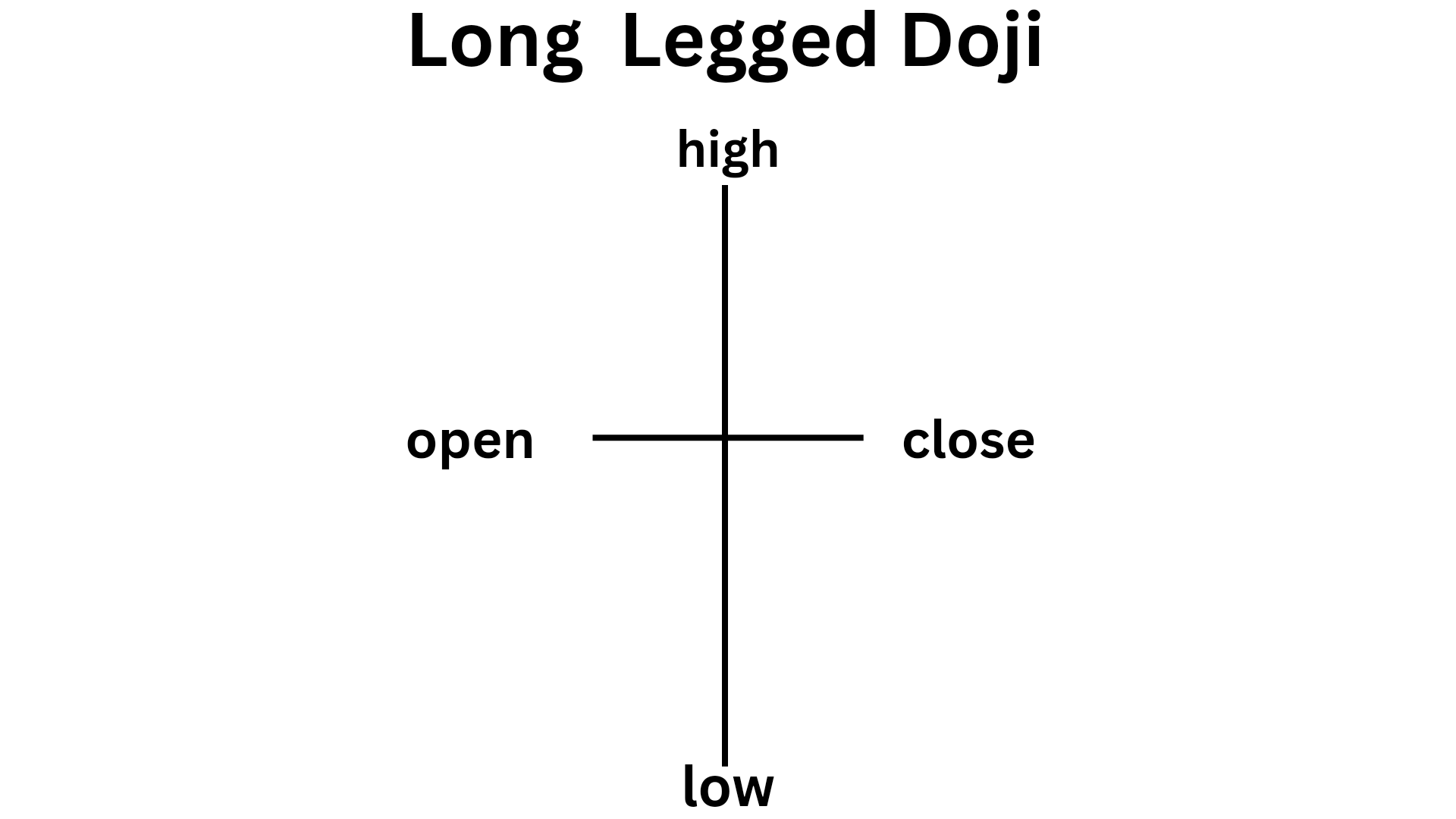

A Long-legged Doji is a single candlestick pattern that suggests indecision between buyers and sellers in the market. It has a long upper and lower shadow and a very small or no body. The wicks represent the high and low prices of the asset, while the body represents the opening and closing prices. In a Long-legged Doji, the opening and closing prices are usually around the middle of the candlestick, creating a cross-like appearance.

The Long-legged Doji is considered a neutral pattern as it does not indicate a clear direction for the market. However, its unique shape suggests that there was significant price volatility during the trading session. The long wicks represent the market’s attempt to push prices higher or lower, but ultimately failed to sustain those levels, resulting in a close near the open.

Key features of long legged doji

- A Long-legged Doji is a single candlestick pattern with a long upper and lower shadow and a small or non-existent body.

- The opening and closing prices are usually around the middle of the candlestick, creating a cross-like appearance.

- The Long-legged Doji is considered a neutral pattern as it does not indicate a clear direction for the market.

- The pattern suggests that there was significant price volatility during the trading session, with buyers and sellers struggling to take control.

- A Long-legged Doji can signal a potential trend reversal, trend continuation, or price reversal, depending on the prevailing market conditions.

- Trading the Long-legged Doji requires careful analysis of other technical indicators, confirmation candles, and the use of stop-loss orders to limit potential losses.

How does a Long-legged Doji form?

A Long-legged Doji forms when there is an equal amount of buying and selling pressure in the market. The market may open higher or lower than the previous day’s close, but throughout the trading session, buyers and sellers struggle to take control, resulting in a close near the open.

The formation of a Long-legged Doji can occur in different market conditions, including uptrends, downtrends, and sideways markets. However, it is more common to see this pattern after a significant price move in either direction.

Bestseller mastermind book to learn trading from scratch along with examples in here.

Long-legged Doji indicates

The Long-legged Doji has significant implications for forex traders as it suggests that the market is indecisive and may be about to change direction. Here are some of the key implications of this pattern:

1. Potential trend reversal

Bullish signal

If it appears at the end of a downward trend, then it has the potential to reverse the trend from downward to upward.

Bearish signal

If this pattern appears at the top of a uptrend, then it has the potential to convert the trend from upward to downward.

NOTE: It is necessary to confirm trend reversal y applying alternate methods along with Long Legged Doji , in order to take decision more precisely.

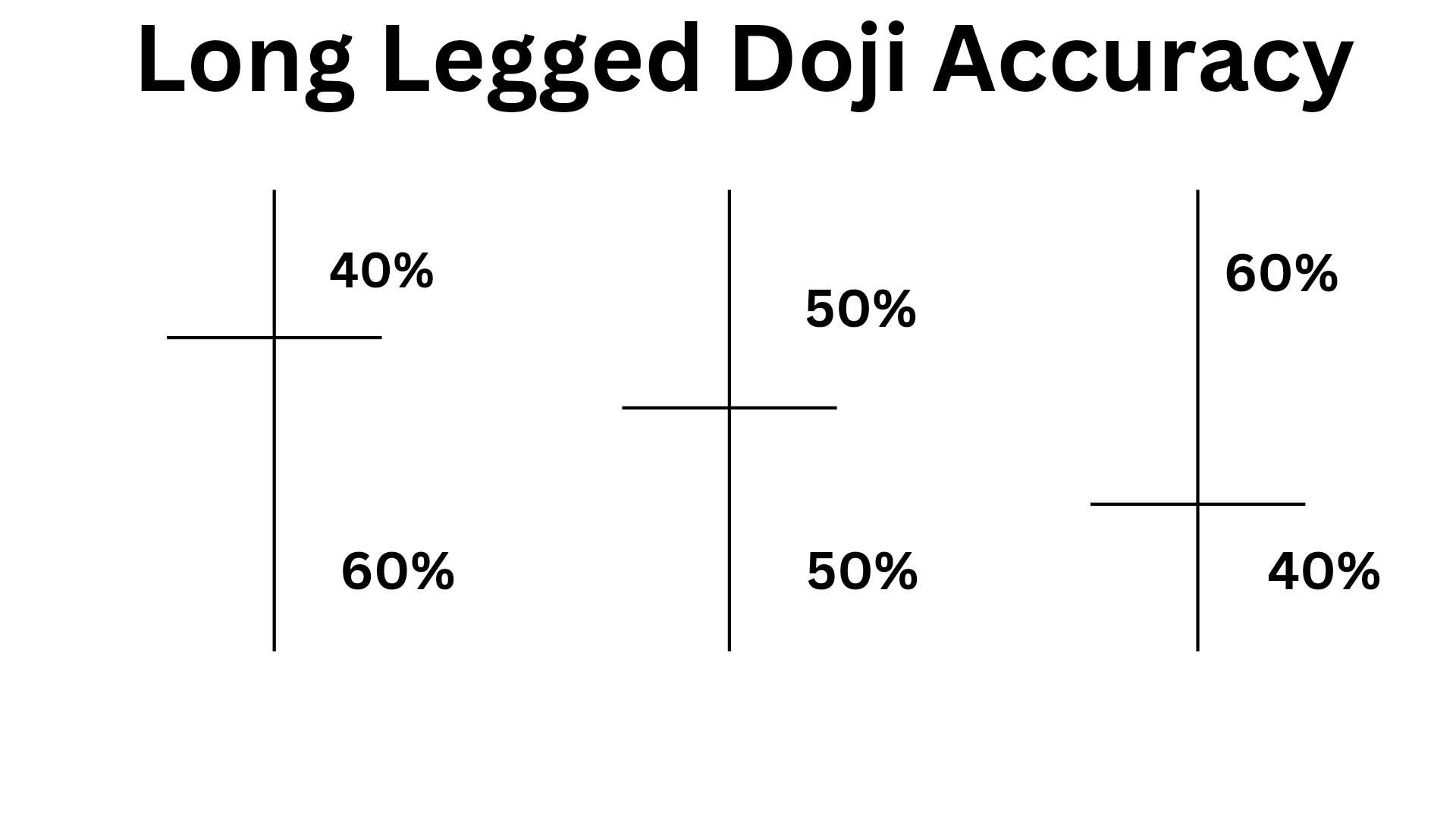

In simple words, a Long-legged Doji that forms after a prolonged uptrend or downtrend can signal a potential trend reversal. The long wicks suggest that the market attempted to push prices higher or lower but failed, indicating that the buying or selling pressure may be weakening. Traders can use this pattern as a signal to start looking for opportunities to enter short or long positions, depending on the prevailing trend.

2. Potential trend continuation

In some cases, a Long legged Doji can signal a potential trend continuation. This occurs when the pattern forms within a consolidation or sideways market. The long wicks suggest that there is significant price volatility, but the close near the open indicates that the market is still undecided. Traders can use this pattern as a signal to wait for a breakout in either direction before entering a position.

3. Potential price reversal

A Long legged Doji can also signal a potential price reversal, especially when it forms at key support or resistance levels. The long wicks suggest that the market attempted to push prices beyond these levels but failed, indicating that there may be a shift in sentiment. Traders can use this pattern as a signal to start looking for opportunities to enter short or long positions, depending on the prevailing trend.

How to trade Long-legged Doji?

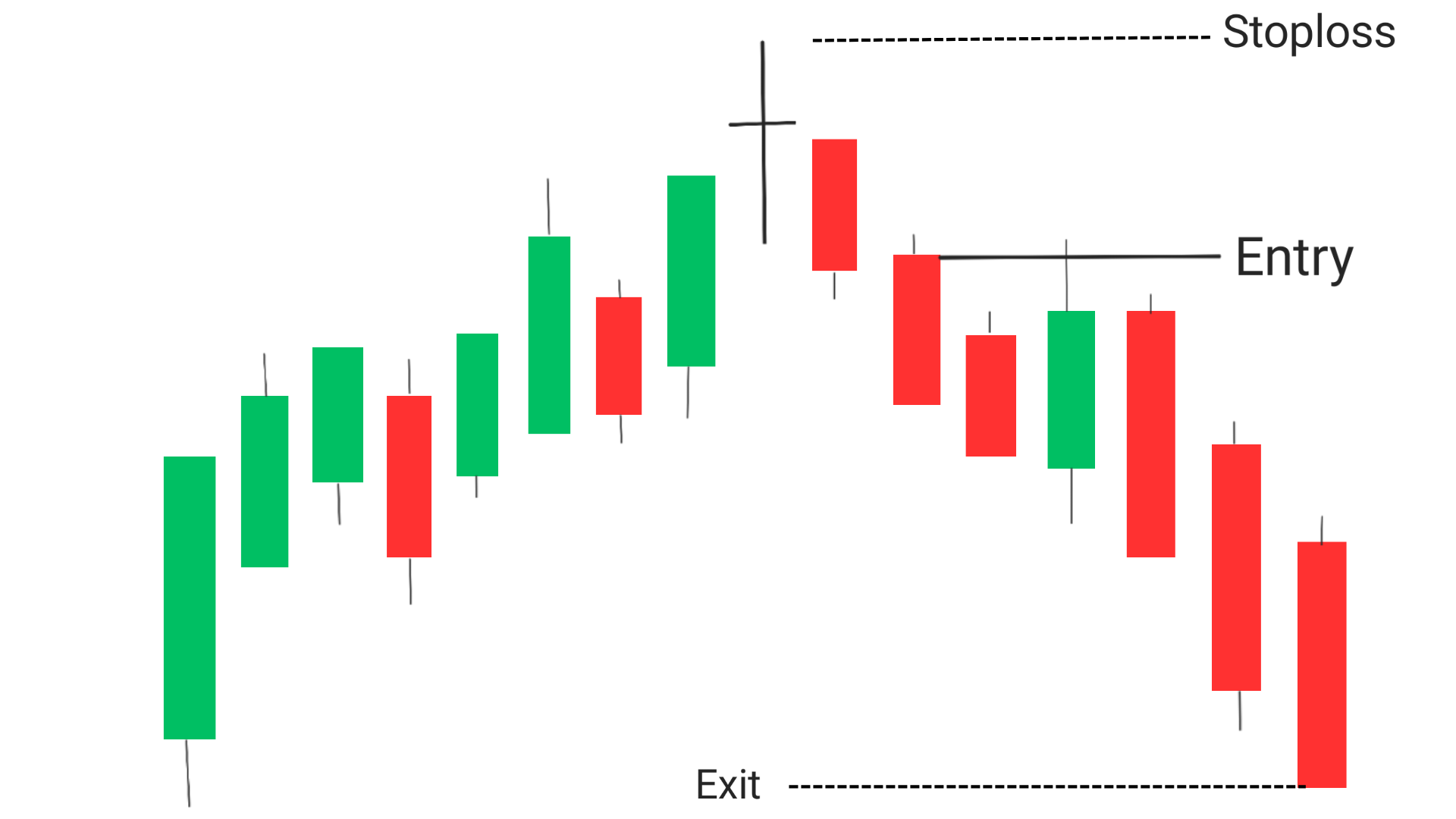

In this particular chart, following are the best entry, exit and stoploss positions :

Entry: The best entry point , when long legged doji is formed at the end of an uptrend , is when the candle next to the long legged doji closes below the low of the long legged doji.

Exit: exit the trade when you achieved your goal, if you want to trade more then look for a breakout at support level , if it happens then trade for the next support level.

Stoploss: the perfect stoploss in this case will be the high of the long legged doji, this will minimize the risk of stoploss hitting.

Entry: The entry point for a Long legged Doji pattern will depend on the prevailing market conditions and the trader’s trading strategy. Traders may choose to enter a long position if the price breaks above the high of the Long-legged Doji candle, or enter a short position if the price breaks below the low of the candle. However, it is important to wait for confirmation from other technical indicators before entering a trade.

Exit: Traders can exit their position when the price reaches their profit target or when the market shows signs of a trend reversal or continuation. Traders may also choose to use trailing stop-loss orders to lock in profits and minimize potential losses.

Stop-loss: Stop-loss orders are essential when trading the Long legged Doji pattern. Traders can place a stop-loss order below the low of the Long-legged Doji candle if entering a long position, or above the high of the candle if entering a short position. This will help limit potential losses if the market moves against the trader’s position. It is important to use a stop-loss order that is appropriate for the trader’s risk tolerance and trading strategy.

Trading the Long legged Doji requires careful analysis of the prevailing market conditions and other technical indicators. Here are some tips to help you trade this pattern effectively:

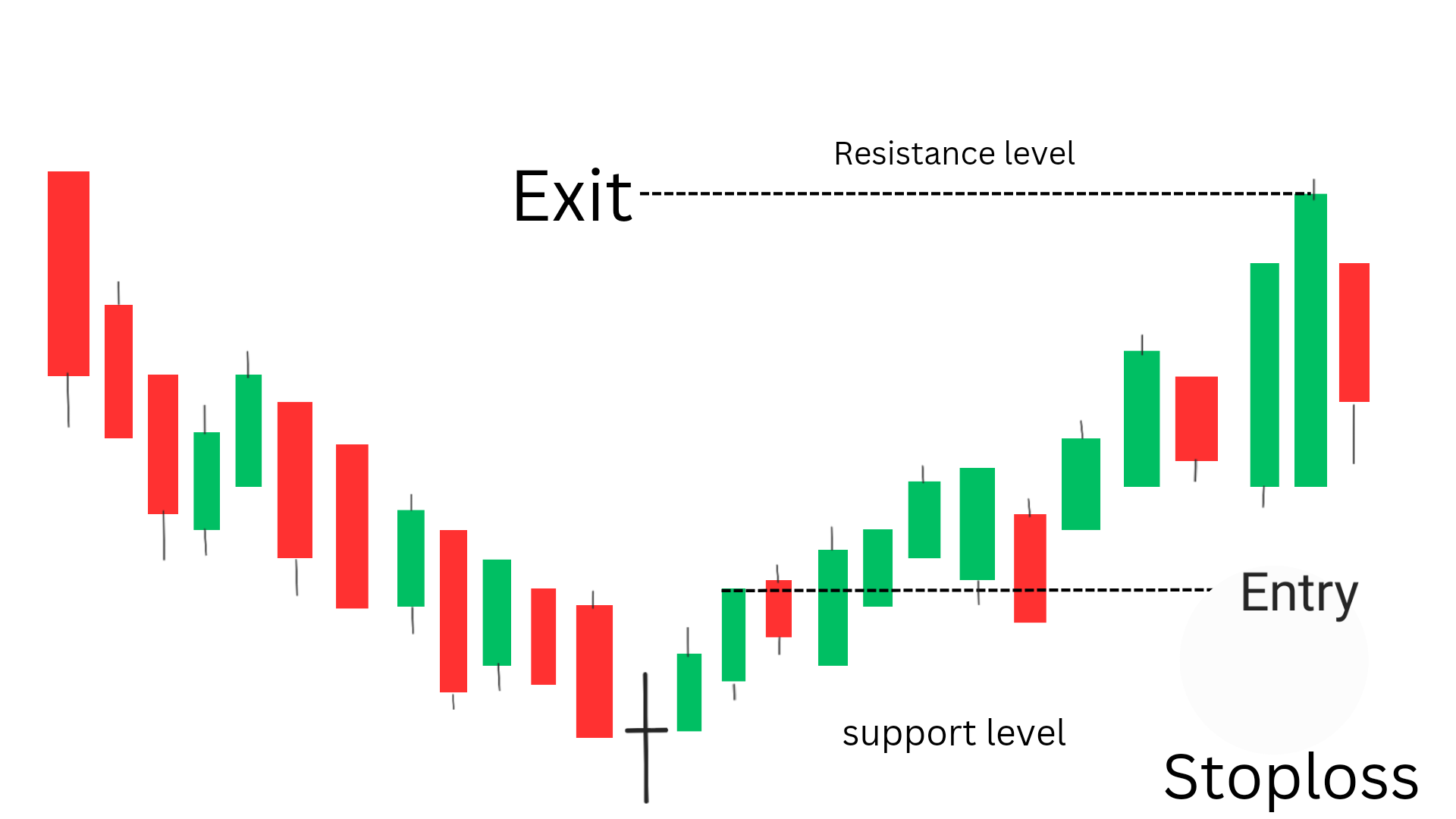

Entry: the best entry, when long legged doji is formed at the end of an downtrend is when, the candle next to the long legged doji crosses and closes above the high of the long legged doji. To reduce the risk by 90% , you must enter the trade when candles following long legged doji crosses the opening price of the candle previous to long legged doji.

Exit: exit the trade when you achieved your goal, if you want to trade more then look for a breakout at resistance level , if it happens then trade for the next resistance level.

Stoploss: the perfect stoploss in this case will be the low of the long legged doji, this will minimize the risk of stoploss hitting.

following are the general rules to be followed while doing trading

1. Confirm with other indicators

Before entering a trade based on a Long legged Doji, it is essential to confirm the pattern with other technical indicators such as moving averages, trendlines, and support and resistance levels. This helps to reduce false signals and increase the probability of a successful trade.

2. Use stop-loss orders

As with any trading strategy, it is crucial to use stop-loss orders to limit your potential losses. When trading the Long legged Doji, you can place your stop-loss order below the low of the candlestick if entering a long position, or above the high of the candlestick if entering a short position.

3. Look for confirmation candles

To increase the probability of a successful trade, look for confirmation candles that support the Long legged Doji pattern. For example, if you see a Long-legged Doji followed by a bearish candle, this could be a signal to enter a short position.

Conclusion

The Long legged Doji is a unique candlestick pattern that has plays significant role in technical analysis of price charts. While it does not indicate a clear direction for the market, its shape suggests that there was significant price volatility during the trading session. Traders can use this pattern as a signal to start looking for opportunities to enter short or long positions, depending on the prevailing trend. However, it is crucial to confirm the pattern with other technical indicators and use stop-loss orders to limit potential losses. With practice and experience, you can learn to trade the Long-legged Doji effectively and improve your trading results.

Frequently Asked Questions(FAQs)

1.What does a long-legged doji indicate?

A long legged doji indicates indecision in the market, with buyers and sellers unable to establish control.

2.Is a doji bullish or bearish?

Yes, A doji can be both bullish or bearish, depending on the context in which it appears. If it appears at the bootom of chart then it is bullish, and if it appears at the top of the chart then it is bearish.

3 Is Dragonfly doji bullish?

Yes, a Dragonfly doji is typically considered bullish as it suggests that buying pressure has overcome selling pressure, leading to a potential reversal in the trend.

4.Is a long-legged doji bullish?

No, A long legged doji is not bullish. It does not have a clear bullish or bearish bias on its own, as it simply indicates market indecision. If it appears at the bottom of the chart , it is bullish and if it appears the top of the chart it is bearish.

1 thought on “Long Legged Doji: 4 FAQs”