How To Trade Three white soldiers? definition, 2 FAQs

If you are a trader or investor in the financial markets, you may have come across the term “3 White Soldiers”. This is one of the widely used candlestick pattern that is often used by technical analysts to identify potential trend reversals or continuations. In this blog post, we will explore what the Three White Soldiers pattern is, how it is formed, and how it can be used to make informed trading decisions.

What is the Three White Soldiers Pattern?

The Three White Soldiers pattern is a three candlestick bullish reversal pattern that consists of three consecutive long bodied candlesticks with small to no wicks. Each candlestick opens within the body of the previous candle and closes higher than the previous candle’s close. This pattern when formed at bottom of a downtrend, is considered to be a strong indication of a potential uptrend reversal or continuation.

Appearance of Three White Soldiers Candle pattern

• The second candlestick should be bigger than the previous candles body.

• The second candle should close near the high of the first candle with no to very small wick.

• The last candle must be atleast the same size of the second candle.

How is the Three White Soldiers candlestick pattern formed?

- The First candlestick can be a small or long bullish candlestick.

- The second candle gap down opens in between the mid to closing of the first candle and closes above the high of the first candle

- The third candle gap down opens in between the mid to closing of the second candle and closes above the high of the second candle.

- The high and closing price of all candle must be of same size, which means there is very low to no shadows.

- The volume of the third candle must be higher than the 1st candle.

- there is no as such volume requirement for the 2nd candle, but if it has more volume than 1st candle then it increases the accuracy of the pattern.

- All the candles of the 3 white soldiers can be bullish marubozu candles.

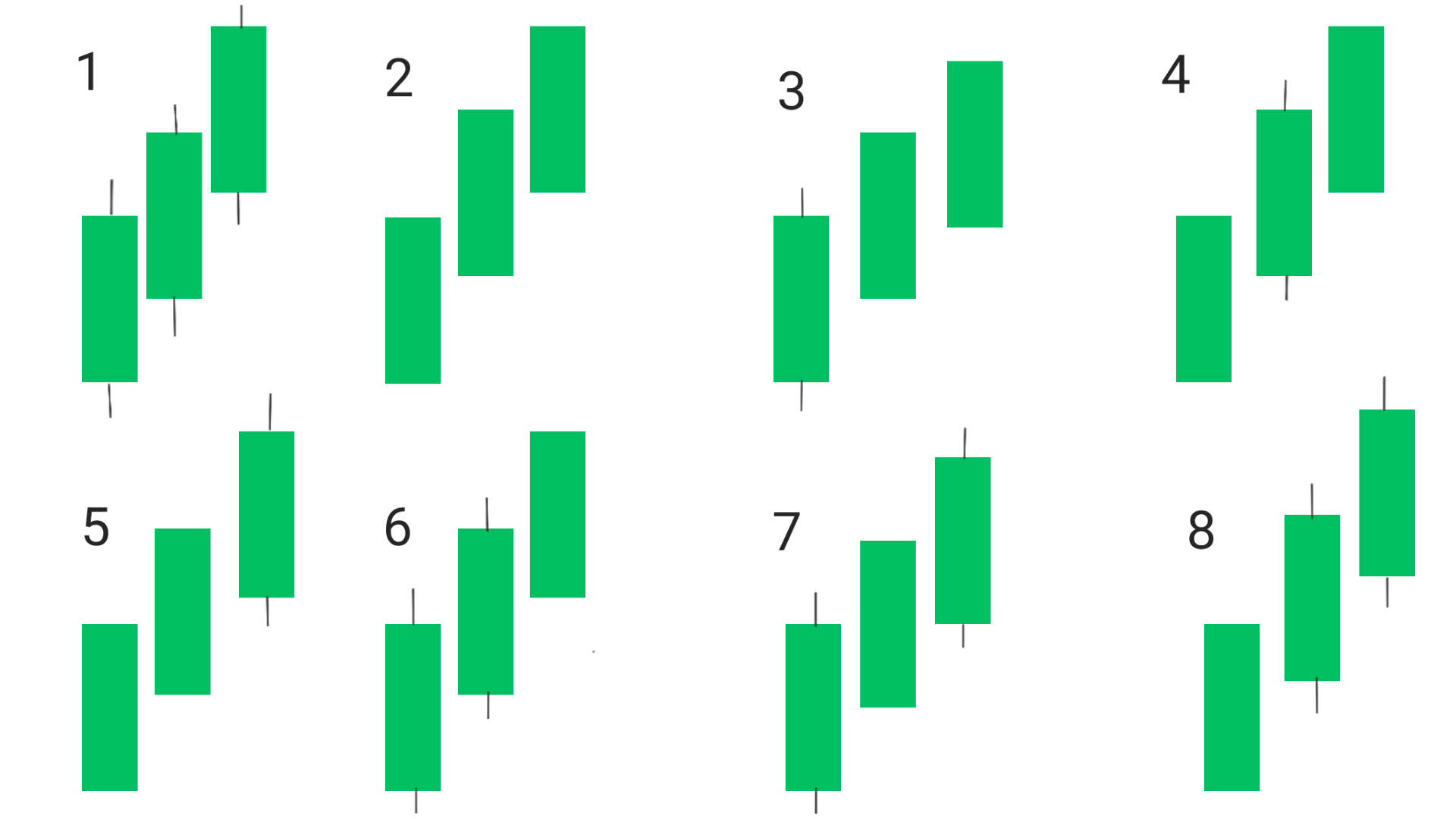

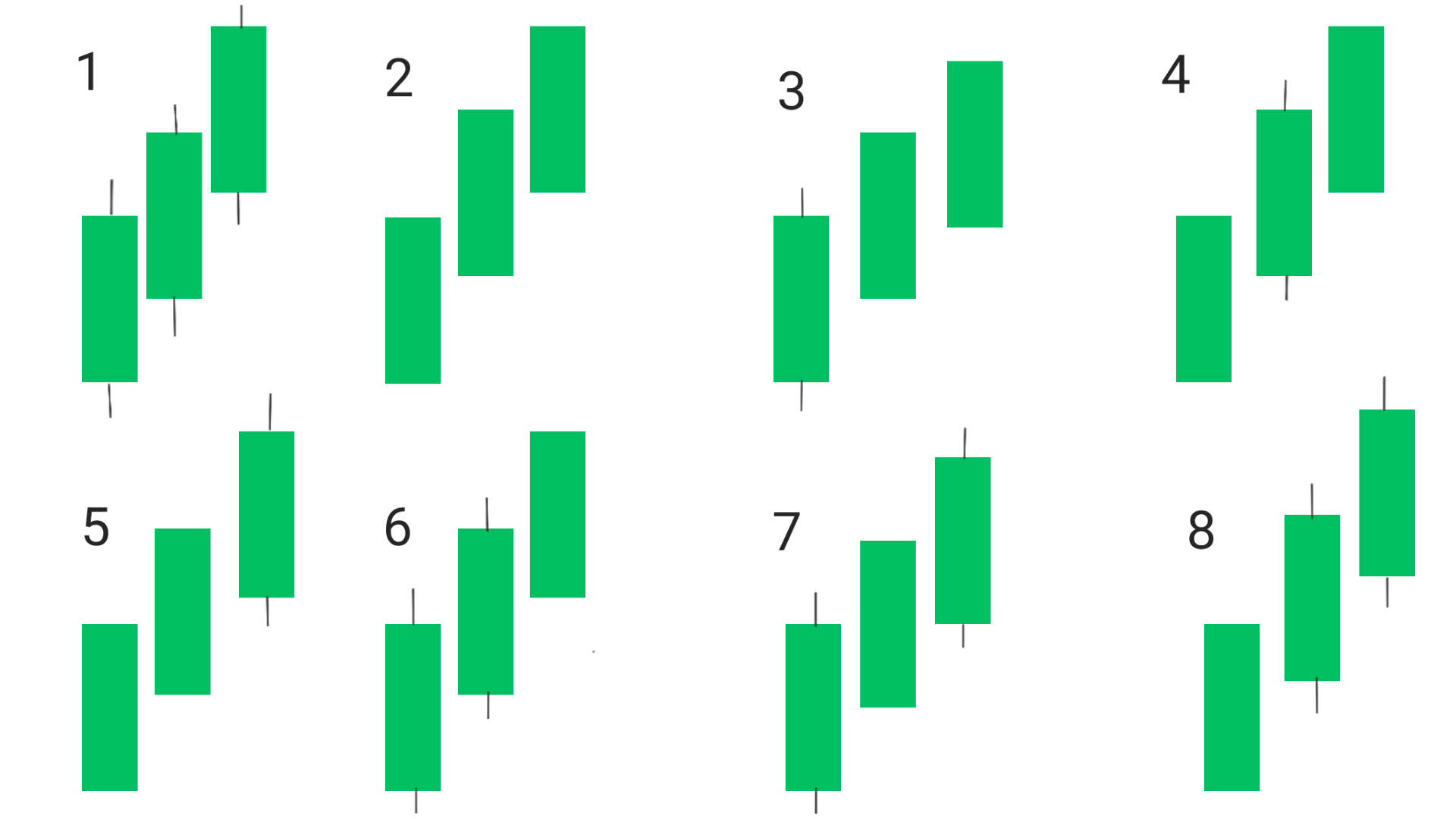

- There can be 8 types of Three White Soldiers.

- The Three White Soldiers pattern is formed when there is a significant shift in market sentiment from bearish to bullish. The first candlestick in the pattern opens lower than the previous close but quickly rallies to close near the high of the session. The second and third candlesticks continue the bullish momentum, opening within the body of the previous candle and closing higher. This pattern indicates that buyers are in control and are pushing the price higher.

To learn all the candlestick pattern at one place do check this besteller guide for stock market.

How to trade using Three White Soldiers Pattern?

The 3 White Soldiers pattern is a bullish reversal pattern that indicates a potential trend reversal from a bearish to a bullish trend. Here are the suggested entry, exit, and stop-loss points for this pattern:

You can easily observe 3 white soldiers pattern on Intraday Chart, Daily Chart, Weekly Chart, Monthly Chart. But, It is mainly observed on intraday and daily charts. Whenever this pattern is formed on chart, there is high probability that price will rise or gap up opens on the the very next day.

Type Of Trading Timeframe

1. Intraday Trading 5-15 minute and hourly chart pattern

1. Positional Trading Daily and Weekly chart time frame

Entry: The best entry point for a 3 White Soldier pattern is at the close of the third candle in the pattern. This confirms that the bullish trend is strong and buyers are in control.

Exit: Traders may choose to exit their position when the price reaches a resistance level or when there are signs of a potential reversal. If you want to trade more , then you can look for a real breakout at resistance, if it happens then you can trade untill the price reaches the next resistance level.

Stop-loss: The stop-loss point for this pattern should be placed below the low of the third candle in the pattern. This ensures that traders minimize their losses in case the pattern fails to play out as expected.

The Three White Soldiers pattern can be used by traders and investors to make informed decisions about entering or exiting positions. When this pattern forms after a downtrend, it can be a signal that the trend is about to reverse and that a new uptrend may be beginning. Traders can use this information to enter long positions or to close out short positions.

On the other hand, if the Three White Soldiers pattern forms during an uptrend, it can be a signal that the trend is likely to continue. Traders can use this information to add to existing long positions or to enter new long positions with more confidence.

NOTE: No trading strategy is accurate, and the 3 White Soldiers pattern should be used along with other technical indicators and analysis tools to confirm its validity.

Success rate

The success rate of the “three white soldiers” candlestick pattern is generally considered to be high. According to stockpathsala , the Three White Soldiers success rate is around 80%, which means for every 5 trade taken you will gain profit in 4 of them.This pattern is a bullish reversal pattern that often indicates a strong buying pressure and a potential upward trend in the market. However, like any technical analysis tool, it is not foolproof and should be used in conjunction with other indicators and analysis methods. The success rate can vary depending on the specific market conditions and timeframe in which it appears.

Key features of 3 White soldiers

1. 3 white soldiers stock is a bullish candlestick pattern that consists of three consecutive long green (or white) candles with small or no wicks, indicating a strong upward momentum in the market.

2. 3 white soldiers often occurs after a period of downward movement and is considered a strong reversal signal, suggesting that the bullish trend is likely to continue.

3. Traders often look for 3 white soldiers as a potential entry point for buying positions, as it indicates a shift in market sentiment from bearish to bullish. However, it is important to consider other technical indicators and confirm the pattern with other signals before making trading decisions.

Conclusion

The 3 White Soldiers pattern is a powerful candlestick pattern that can be used by traders and investors to identify potential trend reversals or continuations.This pattern is formed when there is a significant shift in market sentiment from bearish to bullish, and it can be a strong indication of a potential uptrend reversal or continuation.

Traders and investors can use this pattern to make informed decisions about entering or exiting positions, but it should be used in conjunction with other technical indicators and analysis tools for confirmation. With proper understanding and application, the Three White Soldiers pattern can be a valuable tool in a trader’s arsenal.

Frequently Asked Questions (FAQs)

1. Three white soldiers entry?

Three White Soldiers is a bullish candlestick pattern that occurs when three consecutive long white candles are formed after a downtrend, indicating a potential reversal in the market.

2. 3 green soldiers candlesticks?

3 Green Soldiers is a bullish candlestick pattern that occurs when three consecutive long green candles are formed, indicating a strong upward trend in the market.