Gravestone doji

In the world of technical analysis, candlestick patterns play a crucial role in predicting future price movements. One such candlestick is Gravestone doji. Gravestone Doji is a very basic candlestick and is similar to that of a gravestone. Its appearance in a downtrend may suggest its continuation or a move to a sideways trend.

What is a Gravestone Doji pattern?

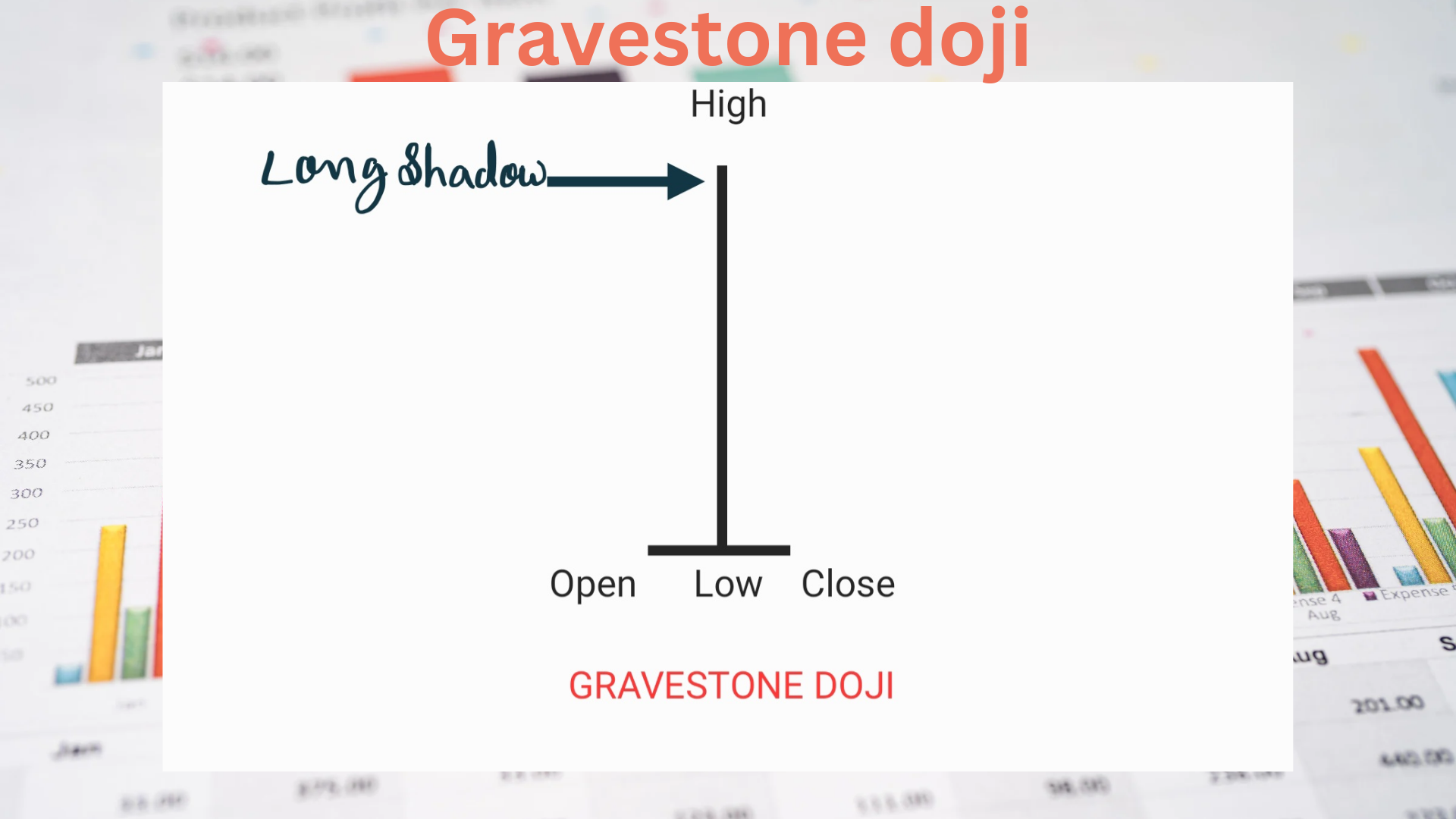

The Gravestone Doji is a single candlestick pattern that forms when the open ,high, and close prices are almost same,that creates a long upper shadow and no lower shadow. The candlestick looks like an upside-down “T” or a gravestone, hence it is called gravestone doji. This pattern suggests indecision in the market and sideways trend continuation , with buyers and sellers struggling for control.

Formation of a Gravestone Doji

To identify a Gravestone Doji, traders must look for the following characteristics:

• The opening price is roughly equal to the high of the candle.

• The closing price is approximately equal to the low of the session.

• There is no or minimal lower shadow.

• The upper shadow is significantly longer than the body of the candlestick.

Interpretation of a Gravestone Doji

The Gravestone Doji is considered as a bearish reversal trend pattern when it occurs after an uptrend. It means that buyers have lost their momentum and sellers are all set take control of the market . In the same way, when this pattern appears after a downtrend it can indicate a potential bullish reversal suggesting that sellers are losing strength and buyers might regain control.

Significance in Trading Decisions

Traders generally use the Gravestone Doji candlestick as a signal to enter or exit positions in a trade.

Entry signal

When a Gravestone doji is formed at the top of an uptrend or where the price has gained resistance and is caused by a loss of momentum from the buyers then traders may consider it as a best position to enter for selling or shorting positions as it suggests potential trend reversal.

Similarly, in the same way if it appears at the bottom of downtrend, then trader might look for buying as it indicates a possible bullish trend reversal

Exit Signal

If traders are holding long positions and notice a Gravestone Doji forming at the too of an uptrend, it could serve as a warning sign to exit the trade . Similarly in bearish trend or during a downtrend, traders may consider closing short positions or adjusting stop-loss levels.

Gravestone doji a unique candlestick pattern and signifies a potential sudden swing in momentum to the downside and can be powerful indicator for swing trading. This pattern can be helpful if you are a swing trader orl looking to exit a trade.

Confirmation and Risk Management

While the Gravestone Doji pattern can provide valuable insights, it is essential to understand its significance through additional technical analysis tools and indicators. Traders can combine this pattern with volume analysis, trendlines, or other candlestick patterns to increase their confidence in the potential reversal. In order to rduce chances of risk traders can learn risk management techniques such as setting appropriate stop-loss levels and position sizing should always be employed to mitigate potential losses.

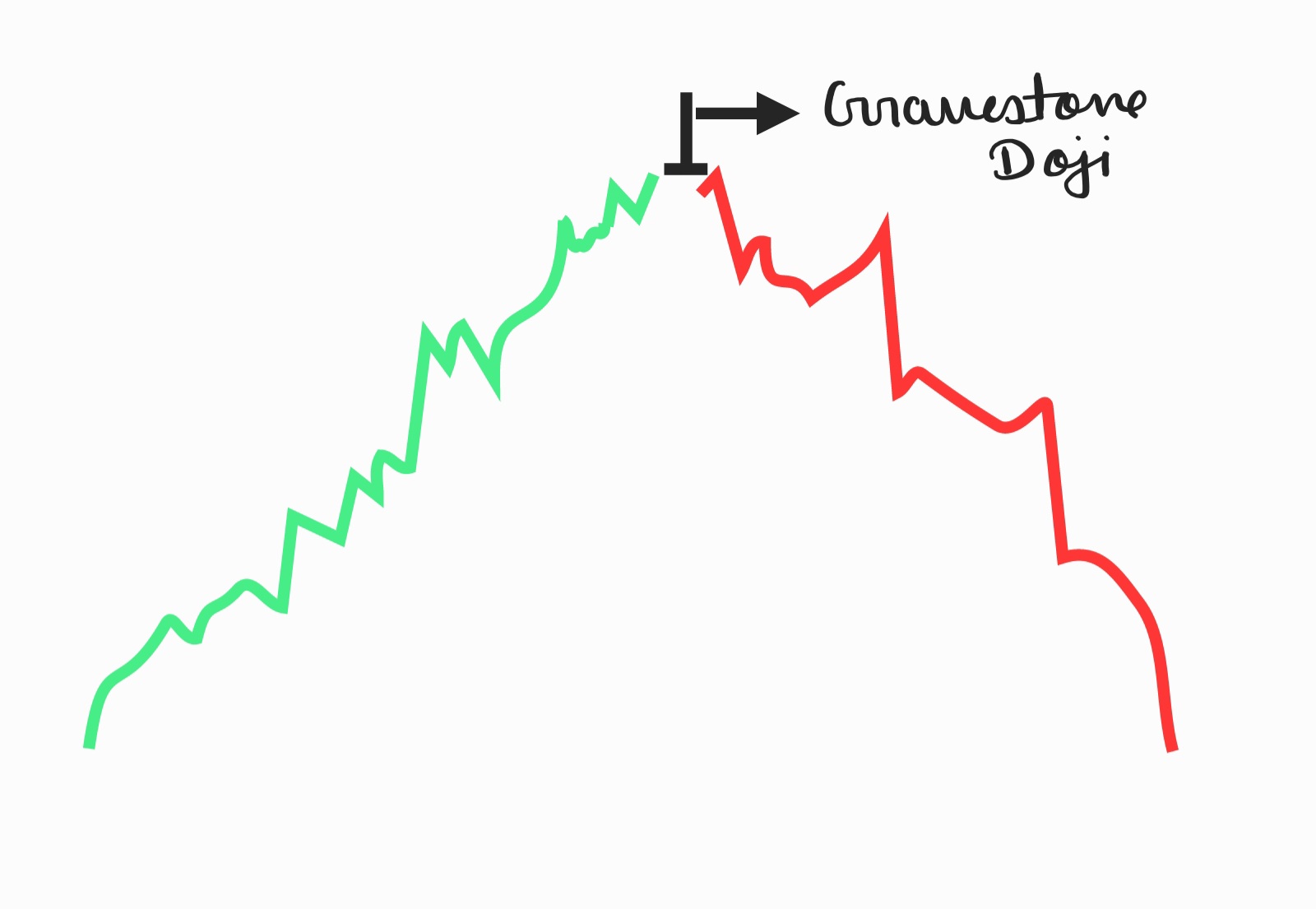

Example

Following figure describes how Gravestone doji can reverse the trend. It is just for an example to show and is not copied from anywhere.

Limitations and False Signals

Limitations and False Signals

Like any other technical analysis tool, the Gravestone Doji pattern also have some limitations. Traders must be aware of false signals and understand that not every occurrence of this pattern guarantees a significant trend reversal. It is crucial to consider other factors such as market conditions, volume, and overall trend strength before making trading decisions solely based on the Gravestone Doji pattern.

The Gravestone Doji candlestick pattern serves as a valuable tool for traders seeking to identify potential trend reversals. By understanding its formation, interpretation, and significance in trading decisions, traders can incorporate this pattern into their technical analysis toolkit. However, it is crucial to remember that no single pattern or indicator guarantees success in trading. Proper risk management, confirmation through additional analysis, and a comprehensive understanding of market dynamics are essential for making informed investment choices. for more do visit moneyinspires.